EURDKK (Euro vs Danish Krone). Exchange rate and online charts.

Currency converter

13 Jun 2025 06:14

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/DKK is popular currency pair in the Forex market. Denmark is actively trading with the European Union. The European Union is the largest business partner of the country. For this reason, the trading instrument EURDKK is very popular among experienced traders who choose this trade instrument for reasons of high stability and predictability of the economies of the euro area and Denmark. The most intense bidding on a specific financial instrument observed during the work time of European stock exchanges.

EURDKK is the cross rate against the U.S. dollar. Although the U.S. Dollar obviously is not present at this currency pair, it still has a significant influence on it. This can be seen, if you combine two charts: EURUSD, USDDKK. By combining these two charts in the same price chart, you can get an approximate EURDKK chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator and many others. Is necessary to note that discussed currencies could respond with different speed on changes in the U.S. economy, therefore, EURDKK currency pair may be a specific indicator of change at these currencies.

Denmark is highly developed industrial-agrarian country with one of the high economic indicators in the world. Denmark has large oil reserves in the southern part of Jutland, as well as on the shelves of the North Sea, but it is poor in other mineral, that makes it on dependent position of exporting. The given country has strong economic connections with all the developed countries of the world and leads them to an active trade in machinery, electronics, agriculture, mining, etc. Denmark's main trading partners are EU countries.

Denmark has one of the strongest economies in the world that allows its currency to be stable in pairs with other major currencies on the Forex market. The strong points of the economy in Denmark are low inflation and low unemployment, the presence of major oil and gas reserves in the North Sea shelf and in the south of Jutland, the high level of development in high technology and the presence of competent professionals in all areas of the economy.

Although Denmark has one of the highest levels of the economy, the weaknesses of its economy are high taxes, as well as decrease its competitiveness in world markets. If you trade with this trading instrument, you should focus on economic indicators of Denmark, as well as the price of oil and other minerals needed to sustain Denmark produced goods.

If you trade cross rates, it is necessary to remember that brokers are usually set a higher spread than the more popular currency pairs, so before you start working with the cross-rates, it should be carefully acquainted with the conditions offered by the broker to trade with specified trade instrument.

See Also

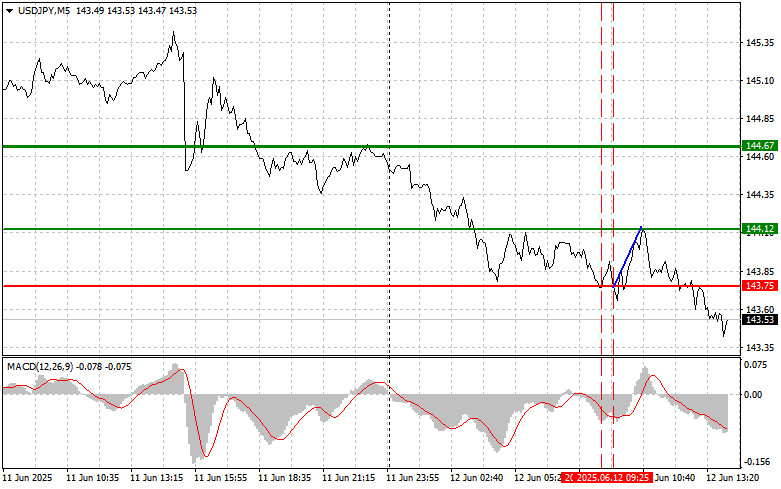

- USD/JPY: Simple Trading Tips for Beginner Traders on June 12 (U.S. Session)

Author: Jakub Novak

13:32 2025-06-12 UTC+2

1918

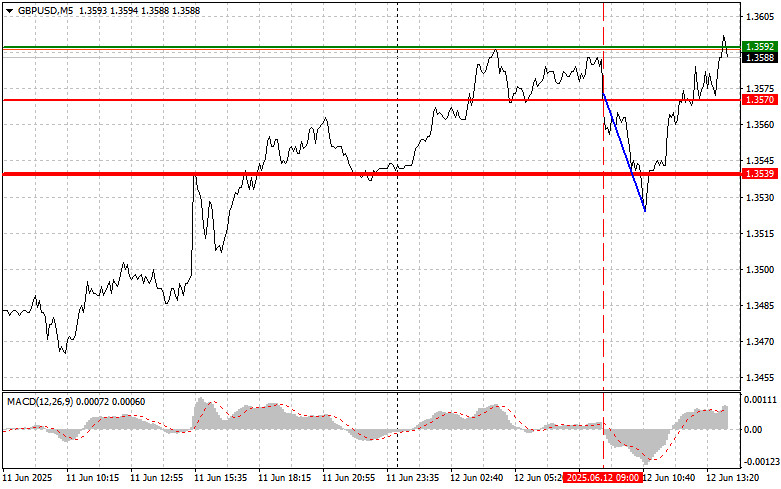

GBP/USD: Simple Trading Tips for Beginner Traders on June 12 (U.S. Session)Author: Jakub Novak

13:31 2025-06-12 UTC+2

1798

Trump Threatens Tariffs Again – Markets ReactAuthor: Jakub Novak

09:10 2025-06-12 UTC+2

1588

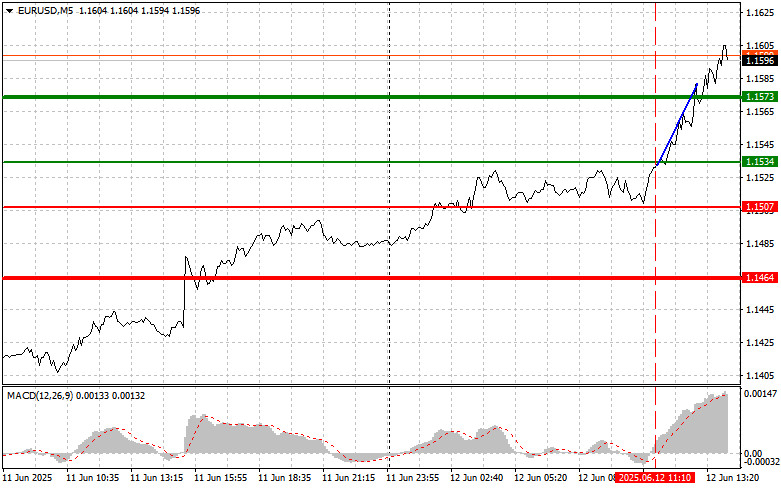

- EUR/USD: Simple Trading Tips for Beginner Traders on June 12 (U.S. Session)

Author: Jakub Novak

13:31 2025-06-12 UTC+2

1573

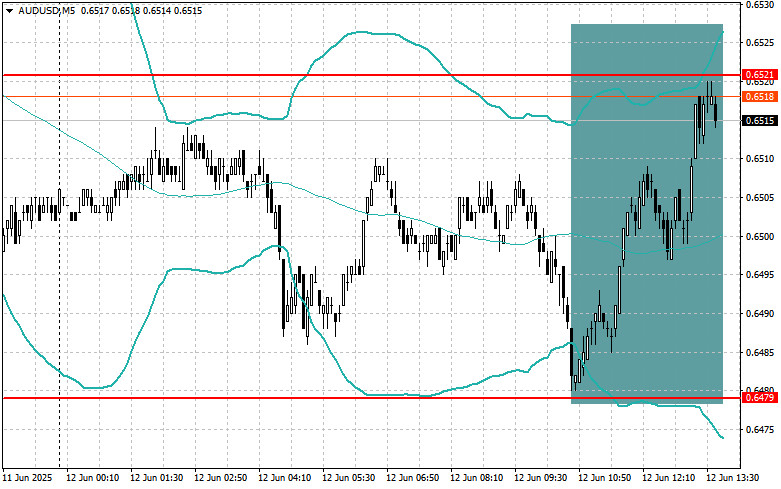

Adjustment of Levels and Targets for the U.S. Session on June 12Author: Miroslaw Bawulski

13:20 2025-06-12 UTC+2

1438

Trading Recommendations for the Cryptocurrency Market on June 12Author: Miroslaw Bawulski

09:10 2025-06-12 UTC+2

1438

- It has been less than two weeks since Donald Trump raised import tariffs on steel and aluminum for all countries except the UK

Author: Chin Zhao

00:21 2025-06-13 UTC+2

1288

Bears Still Can't Find SupportAuthor: Samir Klishi

10:15 2025-06-12 UTC+2

1228

Recession fears in the U.S. turn EUR/USD bears into easy targetsAuthor: Marek Petkovich

00:20 2025-06-13 UTC+2

1153

- USD/JPY: Simple Trading Tips for Beginner Traders on June 12 (U.S. Session)

Author: Jakub Novak

13:32 2025-06-12 UTC+2

1918

- GBP/USD: Simple Trading Tips for Beginner Traders on June 12 (U.S. Session)

Author: Jakub Novak

13:31 2025-06-12 UTC+2

1798

- Trump Threatens Tariffs Again – Markets React

Author: Jakub Novak

09:10 2025-06-12 UTC+2

1588

- EUR/USD: Simple Trading Tips for Beginner Traders on June 12 (U.S. Session)

Author: Jakub Novak

13:31 2025-06-12 UTC+2

1573

- Adjustment of Levels and Targets for the U.S. Session on June 12

Author: Miroslaw Bawulski

13:20 2025-06-12 UTC+2

1438

- Trading Recommendations for the Cryptocurrency Market on June 12

Author: Miroslaw Bawulski

09:10 2025-06-12 UTC+2

1438

- It has been less than two weeks since Donald Trump raised import tariffs on steel and aluminum for all countries except the UK

Author: Chin Zhao

00:21 2025-06-13 UTC+2

1288

- Bears Still Can't Find Support

Author: Samir Klishi

10:15 2025-06-12 UTC+2

1228

- Recession fears in the U.S. turn EUR/USD bears into easy targets

Author: Marek Petkovich

00:20 2025-06-13 UTC+2

1153