AUDMXN (Australian Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

28 Apr 2025 14:09

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/MXN is not a very popular currency pair on Forex. AUD/MXN represents the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present in this currency pair, it still has a significant influence on it. Thus, by combining AUD/USD and USD/MXN price charts, you can get and approximate AUD/MXN chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator and many others. Is necessary to note that AUD and MXN could respond differently towards changes in the U.S. economy, therefore, the AUD/MXN currency pair may be a specific indicator reflecting changes within the two currencies.

To date, Mexico is one of the most developed countries in Latin America. The country ranks first among Latin American countries in terms of per capita income. The Mexican economy is largely composed of private sector, due to mass privatization of state enterprises mostly in the 80s of last century to overcome the economic crisis. For the most part the former state-owned enterprises in Mexico are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, this country has an active trade with its rich neighbors - the United States and Canada, which is a significant part of government revenue in Mexico.

Mexico is the largest exporter of oil in its region. Currently most of the country’s revenues are generated in the oil sector. However, despite this, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. This makes the government to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to the forecasts, with such a policy, Mexico will soon be forced to import oil from abroad, to meet the needs of its economy. All these circumstances have a significant impact on the currency of Mexico, which is largely dependent on world oil prices, which are formed in global financial markets. In addition, the Mexican peso exchange rate is highly dependent on international ranking of the country, which is based on complex economic formulas calculated by major rating agencies.

This trading instrument is relatively illiquid compared it with major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this financial instrument, focus primarily on those currency pairs that include a U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for this currency pair than for more popular ones, so before you start working with the cross rates, learn carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

- Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1153

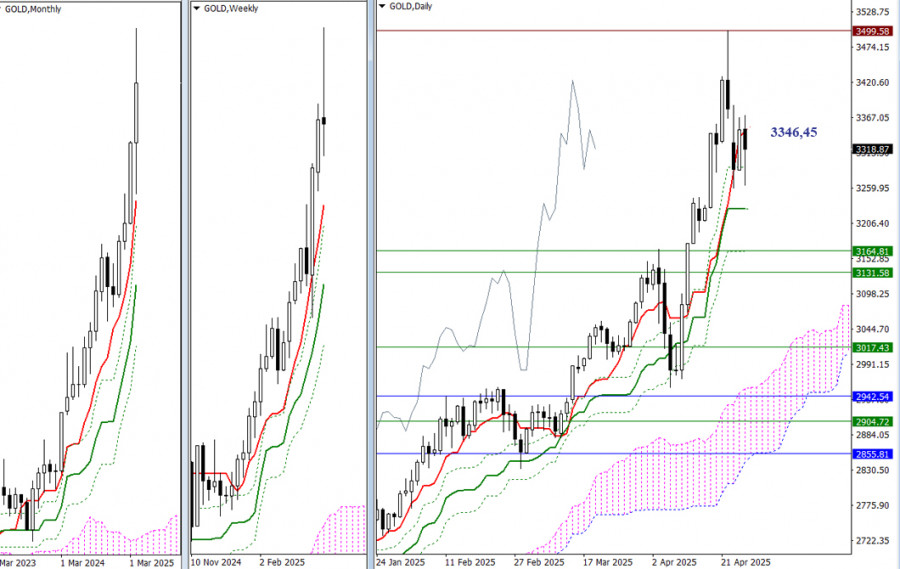

Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1138

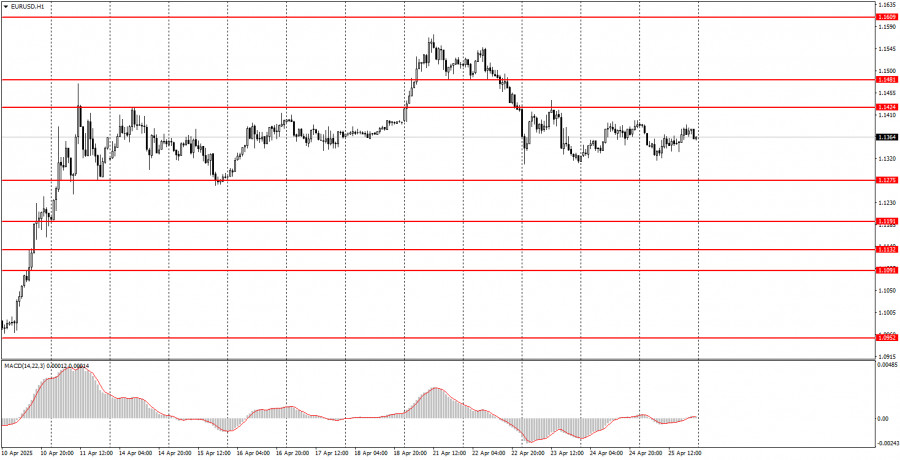

The EUR/USD currency pair continued trading sideways throughout FridayAuthor: Paolo Greco

04:13 2025-04-28 UTC+2

973

- Fundamental analysis

EUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

943

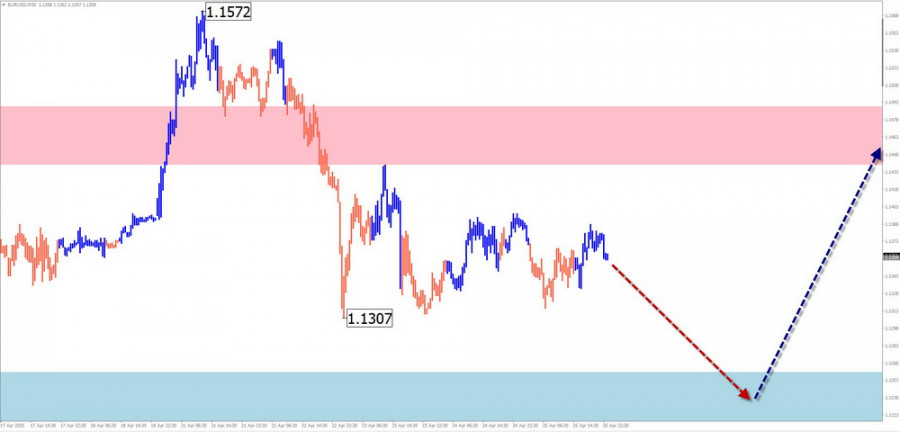

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

913

Trading planTrading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highsAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

898

- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

883

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838

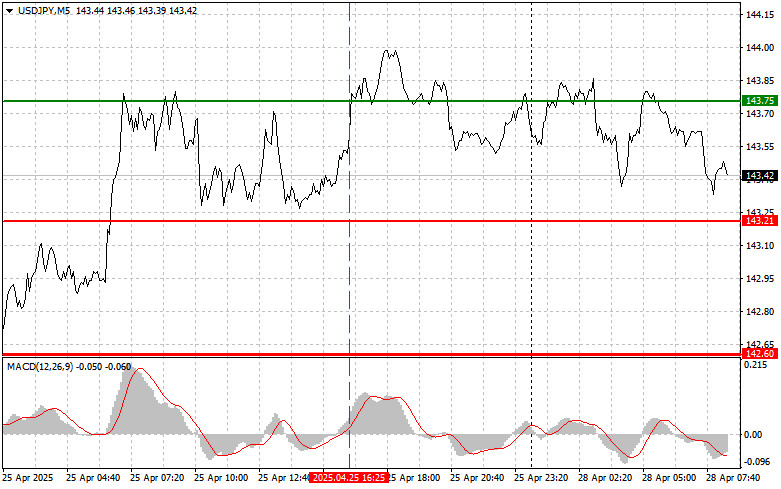

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838

- Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1153

- Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.

Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1138

- The EUR/USD currency pair continued trading sideways throughout Friday

Author: Paolo Greco

04:13 2025-04-28 UTC+2

973

- Fundamental analysis

EUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

943

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

913

- Trading plan

Trading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highsAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

898

- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

883

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838