CADHUF (Canadian Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

28 Apr 2025 14:09

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/HUF pair is quite popular among some Forex traders. This trading instrument is a cross rate against the US dollar, which has a significant impact on the pair. So, when comparing the CAD/USD and USD/HUF charts, we can get an almost clear picture of CAD/HUF movements.

Features of CAD/HUF

The Canadian dollar is highly correlated with global oil prices. Canada is one of the largest oil-exporting countries. For this reason, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. Therefore, the CAD/HUF pair is dependent on the world price of this fuel.

Although Hungary is part of the European Union, it has its own national currency, the forint.

The Hungarian economy depends strongly on the organizations and countries that do business in its territory. The state is characterized by a high share of foreign capital in the economy.

A large part of Hungary's income is generated by tourism. In addition, such sectors of the economy as engineering, metallurgy, chemical industry, and agriculture are also flourishing in the country. Most of the production is exported abroad. Hungary's main trading partners are the EU countries and Russia. Therefore, when assessing the future exchange rate of the Hungarian forint, special attention should be paid to the economic indicators of these regions.

How to trade CAD/HUF

When trading cross rates, remember that brokers usually set a higher spread on such pairs than on more popular currency pairs. Therefore, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

The CAD/HUF pair is a cross rate. Therefore, the US dollar has a significant impact on each of the currencies in this trading instrument. For this reason, when predicting the movement of the pair, it is necessary to take into account the major US economic indicators. These include the refinancing rate, GDP growth, unemployment, number of new jobs, and many others. Notably, the currencies mentioned above may react differently to changes taking place in the US economy. Therefore, CAD/HUF could be an indicator of fluctuations in these currencies.

See Also

- Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1153

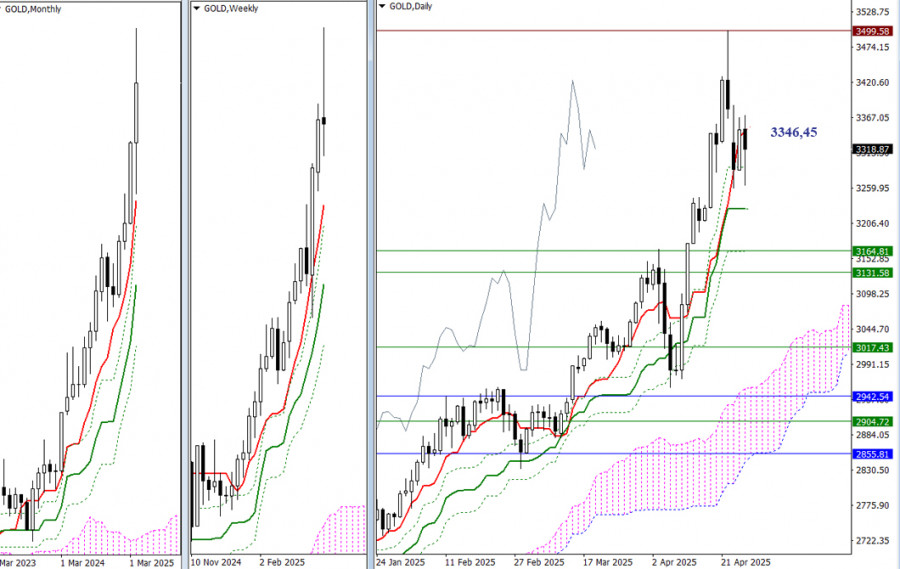

Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1138

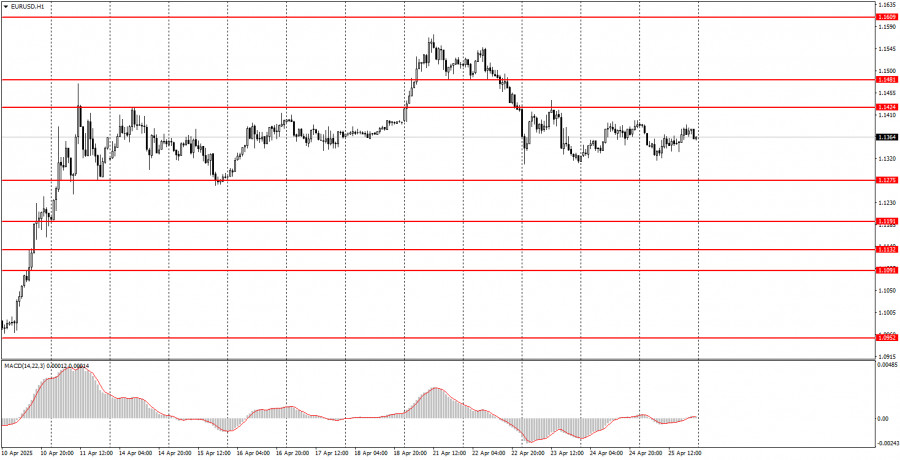

The EUR/USD currency pair continued trading sideways throughout FridayAuthor: Paolo Greco

04:13 2025-04-28 UTC+2

973

- Fundamental analysis

EUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

943

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

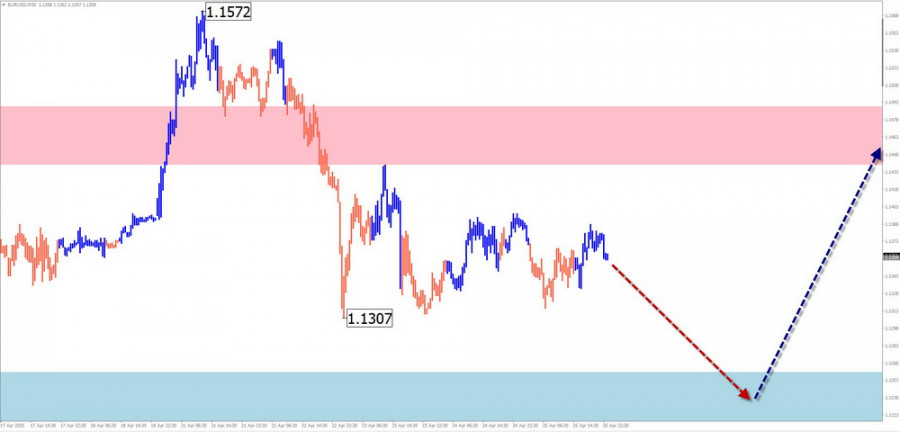

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

913

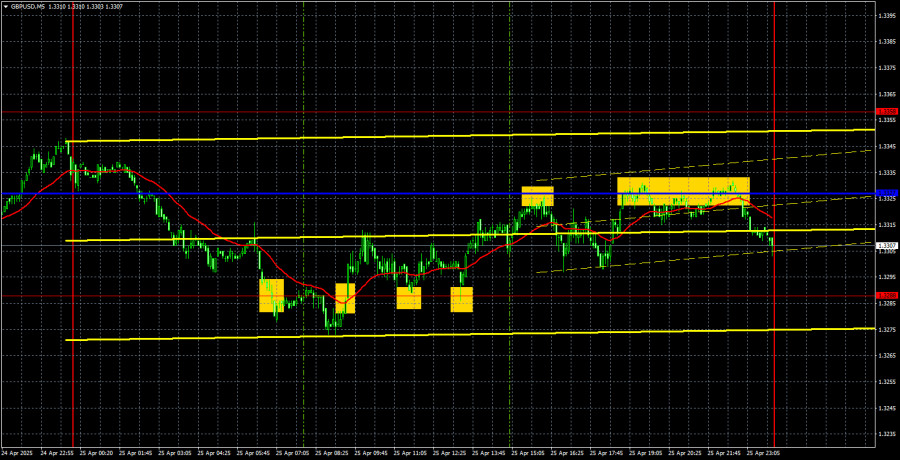

Trading planTrading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highsAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

898

- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

883

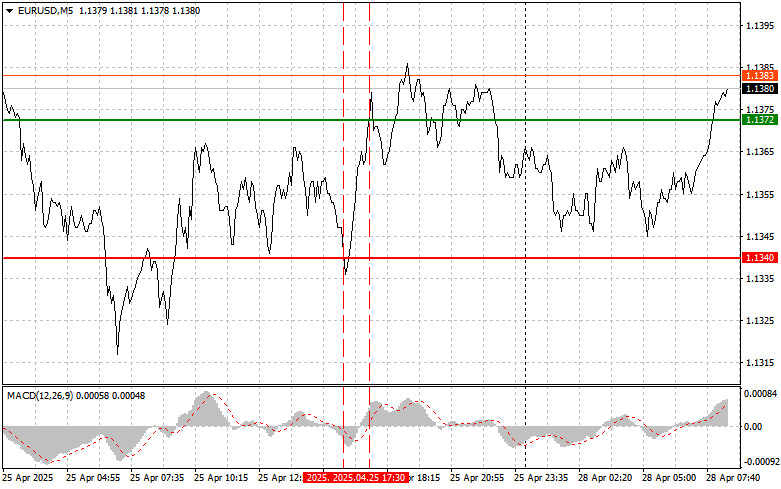

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838

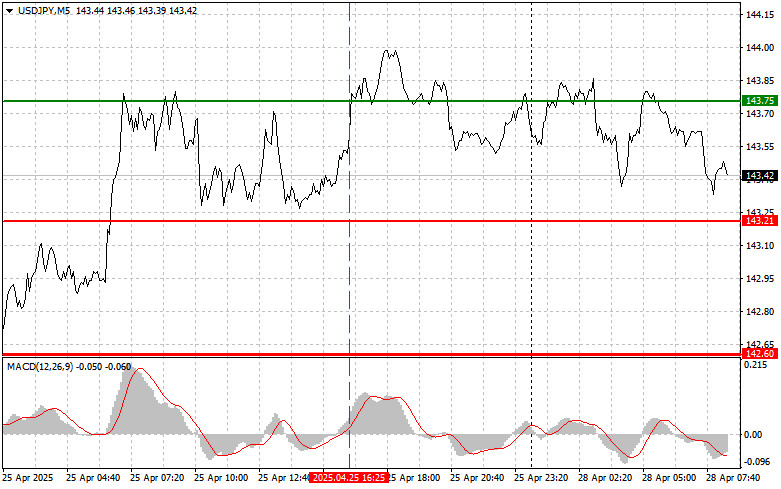

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838

- Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1153

- Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.

Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1138

- The EUR/USD currency pair continued trading sideways throughout Friday

Author: Paolo Greco

04:13 2025-04-28 UTC+2

973

- Fundamental analysis

EUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

943

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

913

- Trading plan

Trading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highsAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

898

- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

883

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

838