AUDCZK (澳大利亚元 vs 捷克克朗). 汇率和在线图表。

货币转换器

11 Apr 2025 02:55

(0%)

前一天收盘价

开盘价。

最后一个交易日的最高价。

最后一个交易日的最低价。

在过去52周的价格区间高点

在过去52周的价格区间低点

The AUD/CZK pair is not in high demand among forex traders. This is a cross-rate pair. Thus, a trader buys USD for CZK at the current USD/CZK exchange rate, and buys AUD for dollars at the current AUD/USD exchange rate.

The US dollar has a significant impact on both currencies. So, when trading this instrument, speculators should take into account important US macroeconomic indicators such as GDP, the interest rate, unemployment rate, and labor market figures, etc. Notably, the Australian dollar and Czech koruna react to the release of US economic data at a different speed. This is why the AUD/CZK pair can serve as an indicator of the swings in the rate of both currencies.

Main features. How to trade AUD/CZK

The Czech Republic is one of the most industrially developed countries in Europe as well as one of the most prosperous and stable countries in the euro area. Besides, the country can boast of robust economic growth. This is why its population has a high per capita income.

The Czech Republic is on the list of the world's top car manufacturers. Most of the produced cars are exported. In addition, the country is the main exporter of beer and shoes. The Czech Republic is one of the leaders when it comes to the production of electronics. The country generates electricity in various ways: at nuclear power plants, thermal power plants, hydroelectric power plants as well as with the help of solar and wind power plants.

The AUD/CHF pair has rather low liquidity compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this instrument, it is necessary to focus on the pairs traded against the US dollar.

If you want to start trading cross-rates, please carefully read the trading conditions of your broker. Usually, spreads for these instruments are higher than for the main currency pairs.

See Also

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

Technical analysisTrading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

733

The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

718

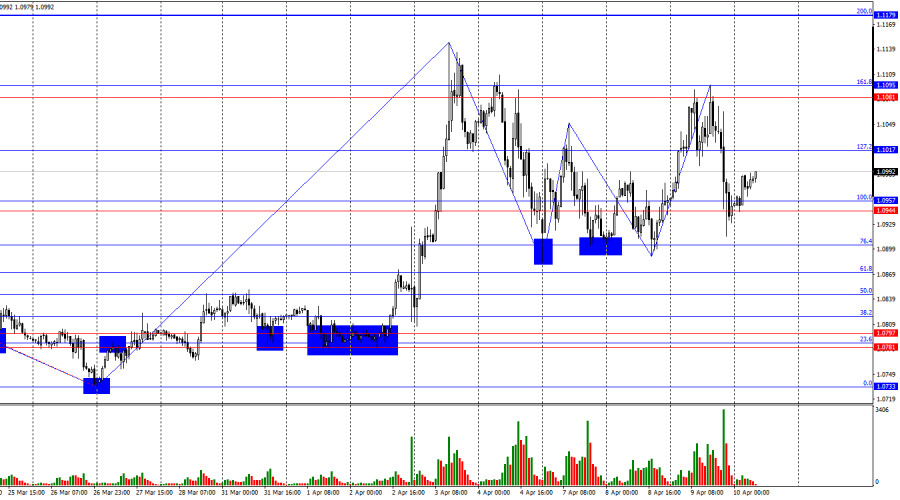

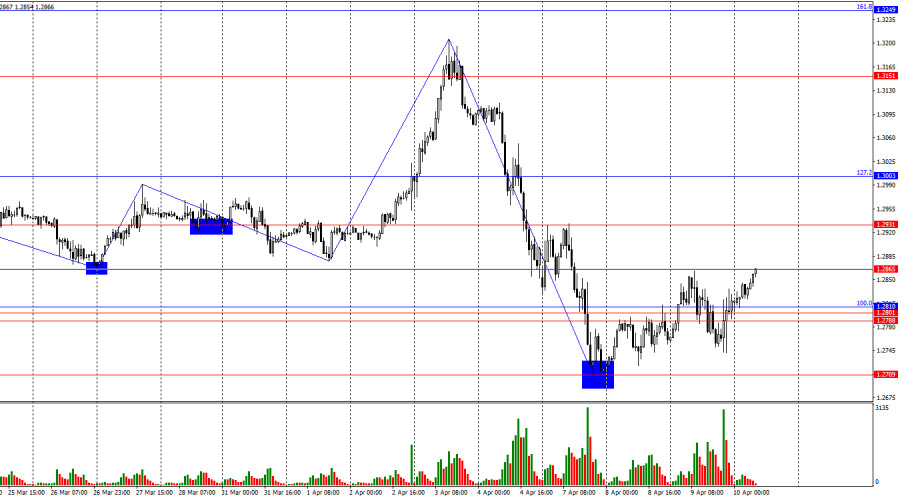

Forecast for GBP/USD on April 10, 2025Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

U.S. Inflation Data: What to Know and What to ExpectAuthor: Jakub Novak

12:09 2025-04-10 UTC+2

703

- Technical analysis / Video analytics

Forex forecast 10/04/2025: EUR/USD, SP500, NASDAQ, Dow Jones, USDX and Bitcoin

Technical analysis of EUR/USD, SP500, NASDAQ, Dow Jones, USDX and BitcoinAuthor: Sebastian Seliga

11:35 2025-04-10 UTC+2

703

Trump Suspends Tariffs for 90 Days but Raises Rates on China Even FurtherAuthor: Jakub Novak

11:57 2025-04-10 UTC+2

673

S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higherAuthor: Irina Maksimova

12:58 2025-04-10 UTC+2

673

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

838

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

733

- The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.

Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

718

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

718

- Forecast for GBP/USD on April 10, 2025

Author: Samir Klishi

12:12 2025-04-10 UTC+2

718

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

703

- Technical analysis / Video analytics

Forex forecast 10/04/2025: EUR/USD, SP500, NASDAQ, Dow Jones, USDX and Bitcoin

Technical analysis of EUR/USD, SP500, NASDAQ, Dow Jones, USDX and BitcoinAuthor: Sebastian Seliga

11:35 2025-04-10 UTC+2

703

- Trump Suspends Tariffs for 90 Days but Raises Rates on China Even Further

Author: Jakub Novak

11:57 2025-04-10 UTC+2

673

- S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higher

Author: Irina Maksimova

12:58 2025-04-10 UTC+2

673