CADNOK (Canadian Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

17 Apr 2025 08:42

(0.03%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CAD/NOK is quite popular currency pair on Forex. CAD/NOK represents the cross rate against the U.S. dollar. Although the greenback cannot be observed within this pair, it still has a great impact on it. If the CAD/USD and USD/NOK price charts are combined, the CAD/NOK chart is received.

The U.S. dollar has a significant influence on both the Canadian dollar and the Norway kroner. Thus, it is necessary to consider the U.S. major economic indicators to predict the future CAD/NOK moves correctly. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator, and many others. However, the mentioned above currencies could respond differently to the changes in the U.S. economy. Thus, CAD/NOK may be a specific indicator of change at these currencies.

Canadian dollar is very dependent on world oil prices. Canada is one of the world largest exporters of oil. For this reason, with increasing oil price, the Canadian dollar is also increasing. On the other hand, if oil prices fall, the cost the Canadian dollar is falling, too. In such a way, CAD/NOK depends mainly on oil world prices.

Norway is one of the leading industrial-agrarian countries. The country takes the leading positions in the quality of life and personal income level. Norway is the third largest producer and exporter of oil and gas. The main source of income of this Scandinavian country is the export of energy resources. In addition, Norway is among top countries in electrometallurgy, electrical engineering, mechanical engineering, etc. In addition, the Norwegian industry is a leading manufacturer of offshore drilling platforms for oil and gas. Also, Norway’s fishing and aquaculture industry supplies seafood, which is in high demand worldwide, especially in the European countries.

This trading instrument is relatively illiquid compared with EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you analyze CAD/NOK, you should primarily focus on those currency pairs that include the U.S. dollar.

It is necessary to remember that brokers usually set a higher spread for cross rates, so before trading them, read and understand the conditions offered by the broker carefully.

See Also

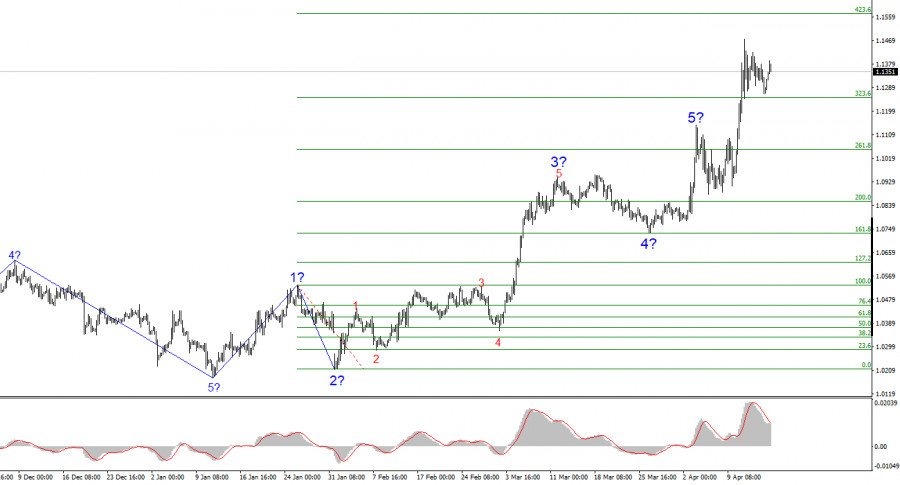

- The EUR/USD pair rose by several dozen points during Wednesday's session.

Author: Chin Zhao

18:56 2025-04-16 UTC+2

1363

Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.Author: Irina Yanina

11:50 2025-04-16 UTC+2

1333

Technical analysis / Video analyticsForex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1123

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

1003

Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

943

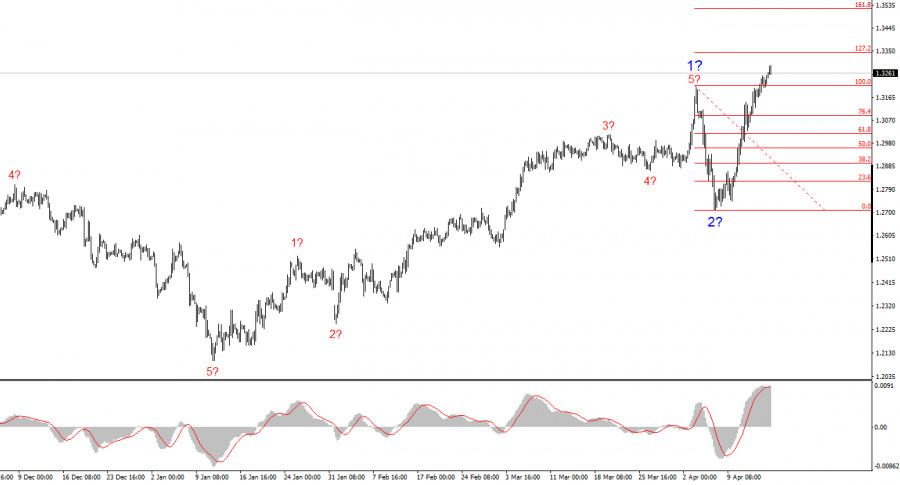

The GBP/USD pair rose by another 30 basis points on Wednesday.Author: Chin Zhao

18:53 2025-04-16 UTC+2

913

- Trading plan

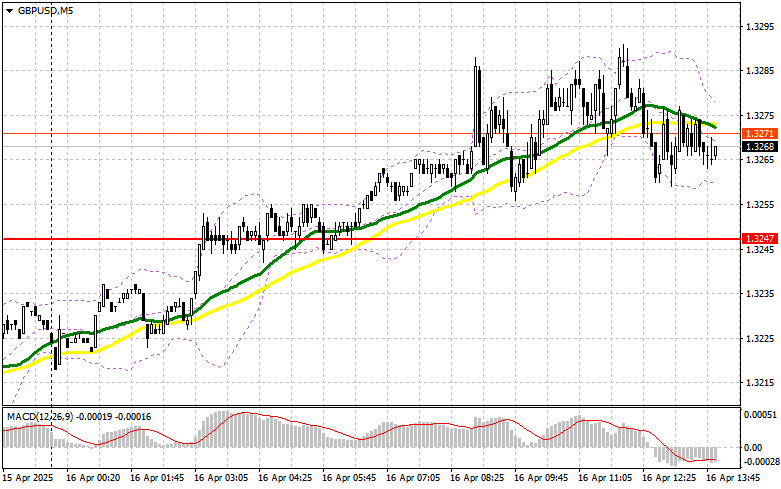

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

913

Fundamental analysisConfrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

913

US stock market on April 16: the S&P 500 and NASDAQ resume their slideAuthor: Jakub Novak

12:22 2025-04-16 UTC+2

868

- The EUR/USD pair rose by several dozen points during Wednesday's session.

Author: Chin Zhao

18:56 2025-04-16 UTC+2

1363

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1333

- Technical analysis / Video analytics

Forex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1123

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

1003

- Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.

Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

943

- The GBP/USD pair rose by another 30 basis points on Wednesday.

Author: Chin Zhao

18:53 2025-04-16 UTC+2

913

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

913

- Fundamental analysis

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

913

- US stock market on April 16: the S&P 500 and NASDAQ resume their slide

Author: Jakub Novak

12:22 2025-04-16 UTC+2

868