USDHUF (US Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

17 Apr 2025 08:55

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/HUF (United States Dollar vs Hungarian Forint)

USD/HUF is not actively traded on Forex. The exchange rate of this instrument was pegged to the euro since its introduction in most countries of the European Union. However, in 2008 the country launched the floating forint rate.

Hungary is a country with high proportion of foreign capital, for this reason, its economy is highly dependent on those organizations that operate within the territory of this Central European state.

Hungary is an advanced industrial country of Central Europe. The Hungary's economy is represented mostly by engineering, metallurgy, and chemical industries. Moreover, agricultural sector, especially gardening and wine making sectors, is also robust. The greater part of the products are exported abroad. Tourism is pivotal to Hungarian economy. Millions of foreigners visit this country annually, attracted by its nature, ancient traditions, and architecture. Hungary's main trading partners are the EU countries and Russia. For this reason, when you try to predict the further course of the Hungarian forint, you should pay the utmost attention to the economic indicators of these regions.

If you trade USD/HUF, you need to consider the dynamics of EUR/USD, GBP/USD, and USD/JPY currency pairs as they can influence the forint greatly indicating the future course of the Hungarian national currency. In addition, monitor the global prices for oil and other minerals vital for the country's economy as they can change the USD/HUF rate.

See Also

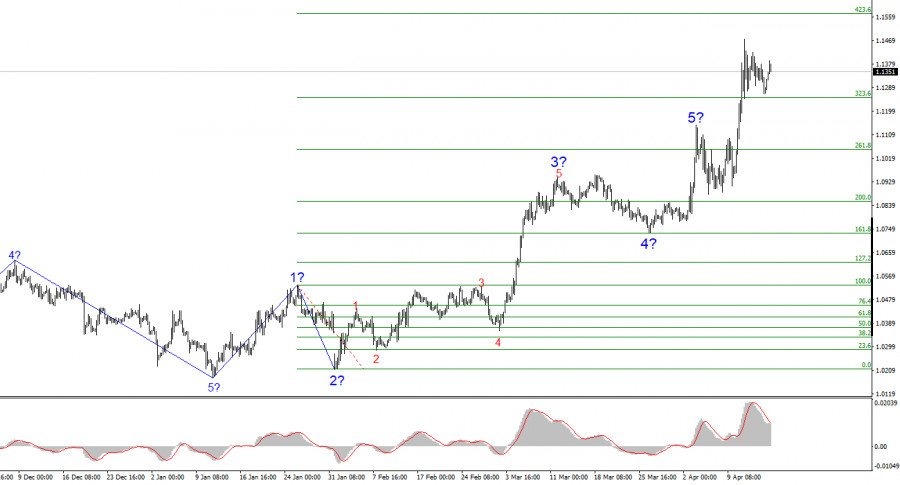

- The EUR/USD pair rose by several dozen points during Wednesday's session.

Author: Chin Zhao

18:56 2025-04-16 UTC+2

1363

Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.Author: Irina Yanina

11:50 2025-04-16 UTC+2

1333

Technical analysis / Video analyticsForex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1123

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

1003

Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

943

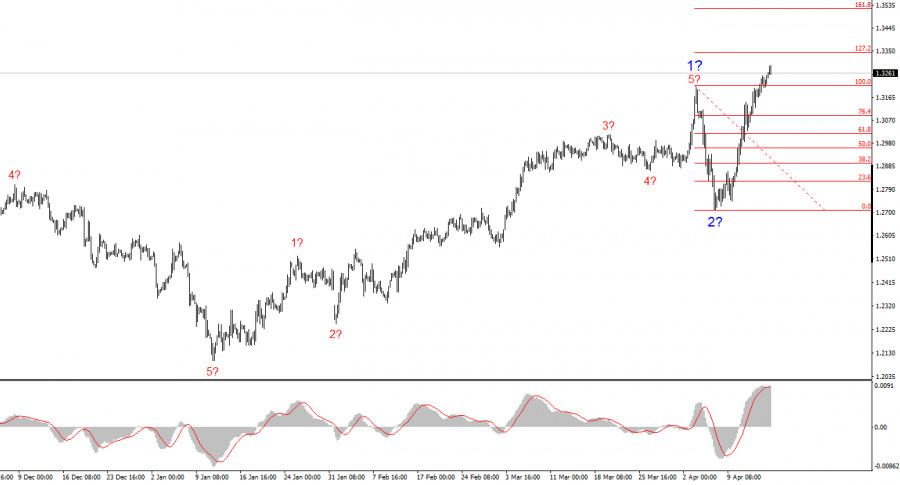

The GBP/USD pair rose by another 30 basis points on Wednesday.Author: Chin Zhao

18:53 2025-04-16 UTC+2

913

- Trading plan

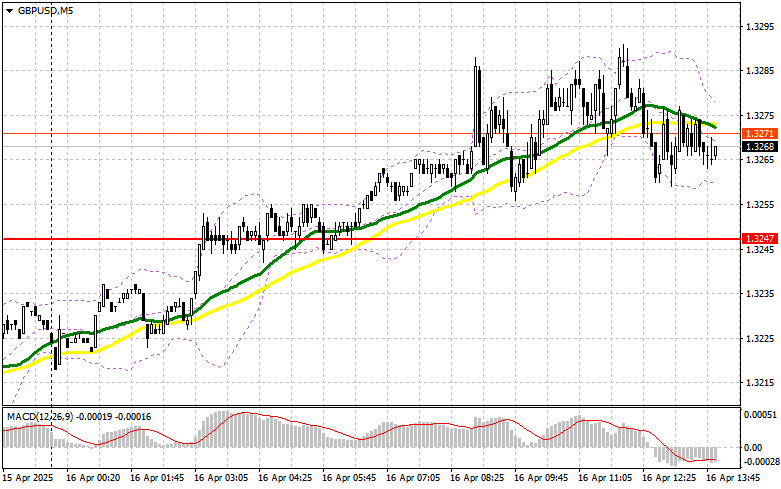

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

913

Fundamental analysisConfrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

913

US stock market on April 16: the S&P 500 and NASDAQ resume their slideAuthor: Jakub Novak

12:22 2025-04-16 UTC+2

868

- The EUR/USD pair rose by several dozen points during Wednesday's session.

Author: Chin Zhao

18:56 2025-04-16 UTC+2

1363

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1333

- Technical analysis / Video analytics

Forex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1123

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

1003

- Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.

Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

943

- The GBP/USD pair rose by another 30 basis points on Wednesday.

Author: Chin Zhao

18:53 2025-04-16 UTC+2

913

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

913

- Fundamental analysis

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

913

- US stock market on April 16: the S&P 500 and NASDAQ resume their slide

Author: Jakub Novak

12:22 2025-04-16 UTC+2

868