#PEP (PepsiCo Inc.). Exchange rate and online charts.

Currency converter

04 Jun 2025 22:59

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

PepsiCo Inc. (#PEP) is a world’s leading multinational food and beverage corporation. The company was founded in 1965 in the US. It is the second largest corporation in the global food business in terms of net revenue.

PepsiCo produces and sells fizzy and still drinks, snacks, and other products in the US and around the world. The company owns several popular brands such as Pepsi, 7Up, Gatorade, Tropicana, Lay’s, Cheetos and others. At present, the company is committed to healthy nutrition, thus reducing dubious ingredients in its products.

In the 2008 fiscal year, PepsiCo revenues surged 9.6% to $43,251 billion whereas net profits on the contrary slumped 9.1% to $5,142 billion. Nowadays, its market capitalization equals $9,773.06 billion.

PepsiCo is included in the S&P 500 index. The company’s shares are traded on the NYSE under the #PEP ticker. In 2017, 99.57% of PepsiCo shares have been in free circulation.

The global producer of soft drinks and snacks suggests lucrative investment opportunities. According to expert estimates, PepsiCo’s shares gain 1.54% on average per month.

See Also

- Technical analysis / Video analytics

Forex forecast 04/06/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

12:05 2025-06-04 UTC+2

2743

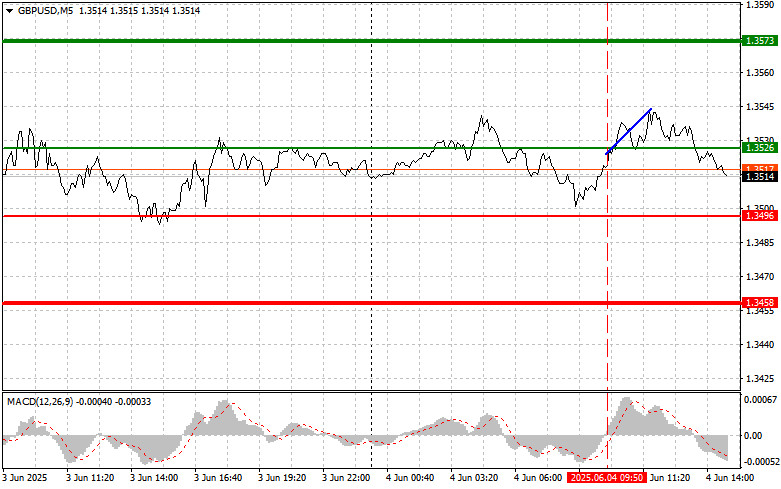

GBP/USD: Simple Trading Tips for Beginner Traders on June 4th (U.S. Session)Author: Jakub Novak

14:27 2025-06-04 UTC+2

1828

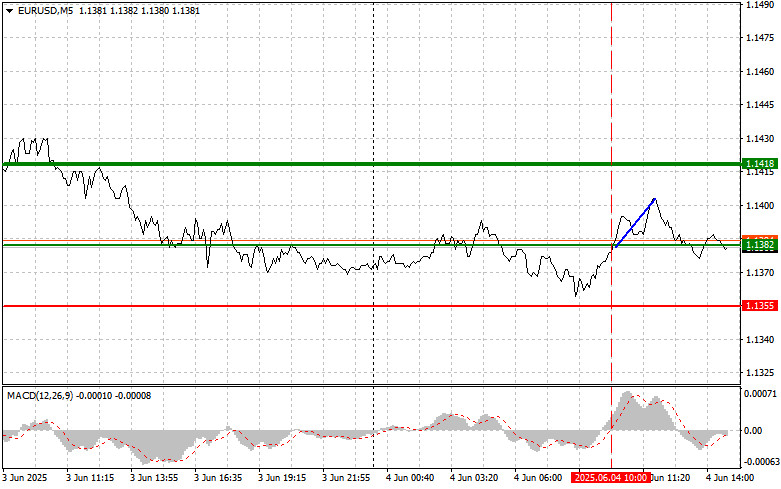

EUR/USD: Simple Trading Tips for Beginner Traders on June 4th (U.S. Session)Author: Jakub Novak

14:23 2025-06-04 UTC+2

1618

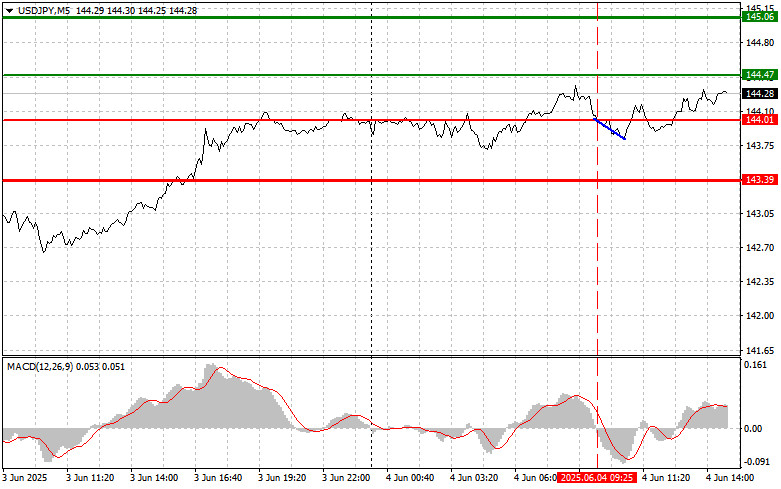

- USD/JPY: Simple Trading Tips for Beginner Traders on June 4th (U.S. Session)

Author: Jakub Novak

14:30 2025-06-04 UTC+2

1543

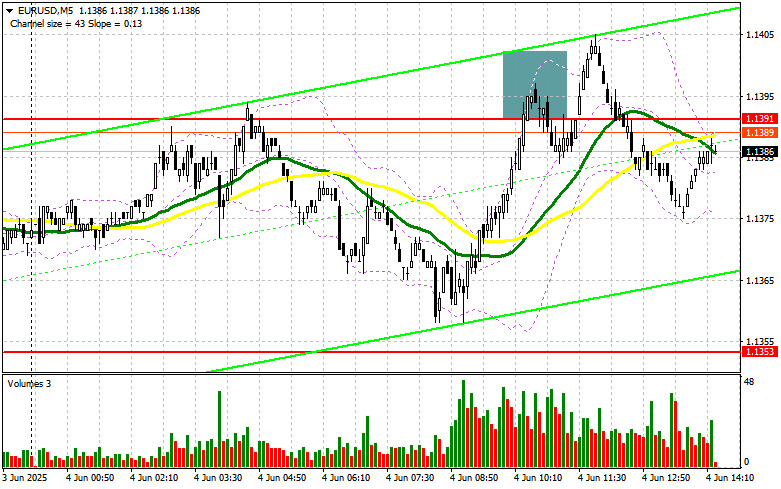

EUR/USD: Trading Plan for the U.S. Session on June 4th (Review of Morning Trades)Author: Miroslaw Bawulski

14:16 2025-06-04 UTC+2

1513

Stock Market on June 4: S&P 500 and NASDAQ Showed Strong Daily GrowthAuthor: Jakub Novak

09:34 2025-06-04 UTC+2

1468

- Amid ongoing trade disputes and mounting fiscal concerns, US investors continue to adhere to a "buy-the-dip" strategy

Author: Ekaterina Kiseleva

12:42 2025-06-04 UTC+2

1363

USD/CAD. Analysis and ForecastAuthor: Irina Yanina

09:57 2025-06-04 UTC+2

1333

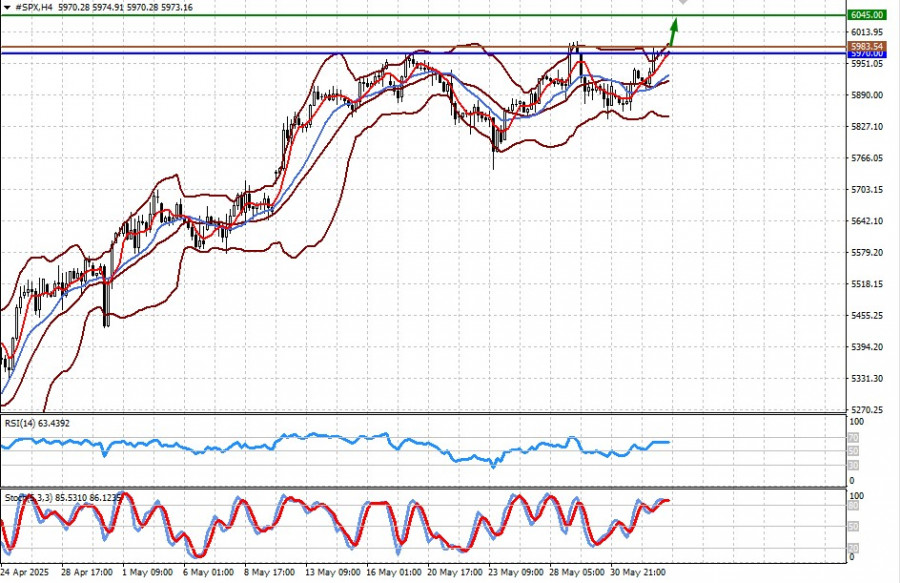

Fundamental analysisThe Stock Market Believes Trump's Tariff Game Won't Have a Major Impact (Growth in #NDX and #SPX CFDs May Continue)

After a sharp, almost catastrophic drop in March and April, the major U.S. stock indices recovered in May, fully offsetting the decline. Confidence is growing among market participantsAuthor: Pati Gani

09:53 2025-06-04 UTC+2

1303

- Technical analysis / Video analytics

Forex forecast 04/06/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

12:05 2025-06-04 UTC+2

2743

- GBP/USD: Simple Trading Tips for Beginner Traders on June 4th (U.S. Session)

Author: Jakub Novak

14:27 2025-06-04 UTC+2

1828

- EUR/USD: Simple Trading Tips for Beginner Traders on June 4th (U.S. Session)

Author: Jakub Novak

14:23 2025-06-04 UTC+2

1618

- USD/JPY: Simple Trading Tips for Beginner Traders on June 4th (U.S. Session)

Author: Jakub Novak

14:30 2025-06-04 UTC+2

1543

- EUR/USD: Trading Plan for the U.S. Session on June 4th (Review of Morning Trades)

Author: Miroslaw Bawulski

14:16 2025-06-04 UTC+2

1513

- Stock Market on June 4: S&P 500 and NASDAQ Showed Strong Daily Growth

Author: Jakub Novak

09:34 2025-06-04 UTC+2

1468

- Amid ongoing trade disputes and mounting fiscal concerns, US investors continue to adhere to a "buy-the-dip" strategy

Author: Ekaterina Kiseleva

12:42 2025-06-04 UTC+2

1363

- USD/CAD. Analysis and Forecast

Author: Irina Yanina

09:57 2025-06-04 UTC+2

1333

- Fundamental analysis

The Stock Market Believes Trump's Tariff Game Won't Have a Major Impact (Growth in #NDX and #SPX CFDs May Continue)

After a sharp, almost catastrophic drop in March and April, the major U.S. stock indices recovered in May, fully offsetting the decline. Confidence is growing among market participantsAuthor: Pati Gani

09:53 2025-06-04 UTC+2

1303