See also

19.12.2023 06:24 AM

19.12.2023 06:24 AMOn Monday, the price of oil rose almost 2% due to investor concerns about disruptions in maritime trade and increased delivery costs following an attack by the Houthi group on ships. A Norwegian vessel was attacked, and BP announced a temporary suspension of water transit. Other companies also declared their avoidance of this route.

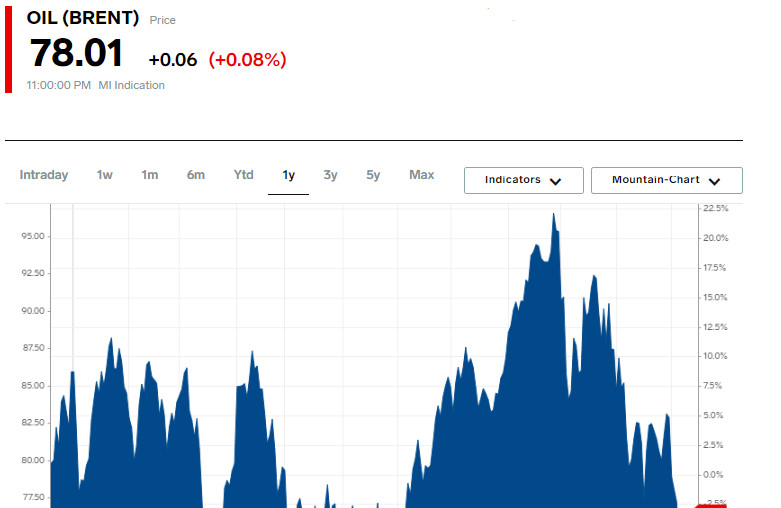

The price of Brent crude futures increased by 17 cents (0.2%) to $78.12 per barrel. The futures contract for West Texas Intermediate crude rose by 14 cents to $72.61 per barrel, and the more active contract for the following month went up by 9 cents (0.1%) to $72.91.

Favad Razaqzada, an analyst at StoneX, noted the need to account for increased delivery costs, as many oil tankers cease voyages through the Red Sea. Approximately 15% of global shipping passes through the Suez Canal. On Monday, the London marine insurance market expanded the high-risk area in the Red Sea, leading to increased insurance premiums.

Last week, there was a slight increase in contract prices after a seven-week decline. This was linked to the meeting of the Federal Reserve System of the USA, which raised expectations of an end to interest rate hikes and a forthcoming decrease.

However, ample oil supplies limited price increases on Monday. Brent crude and US immediate delivery oil traded at a discount to future deliveries, indicating a healthy supply in the physical market.

Prices for US oil for January delivery traded 40 cents lower than February delivery prices, marking the largest spread since November 2020.

Meanwhile, Saudi Arabia's crude oil exports in October reached a four-month high, according to data from the Joint Organizations Data Initiative.

Analysts believe that some short position closures may have occurred in the markets. Financial managers reduced net long positions in US oil futures and options for the eleventh consecutive week until December 12, as reported by the US Commodity Futures Trading Commission.

According to the US Energy Information Administration (EIA), oil production in the largest US shale regions will decrease for the third consecutive month in January, while production in the Upper Permian Basin will reach a record high for the eighth consecutive month.

"Considering the current rally and positive dynamics of the past week, there is a likelihood that oil has reached its bottom," said Razaqzada of StoneX.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Indices Rising: Dow 1.78%, S&P 500 2.05%, Nasdaq 2.47% Consumer Confidence Recovers in May Temu Parent PDD Holdings Falls on Quarterly Revenue Slip Chinese Xiaomi Shares Set to Rise 2.3%

To be at the center of global attention and to "shape the planet's destiny" — that's what Donald Trump enjoys most. For him, it's essential to constantly generate headlines

Stock markets showed mixed dynamics on Tuesday after Donald Trump unexpectedly postponed the introduction of the promised 50% tariffs on goods from the European Union. The move only increased uncertainty

The gold market has recently been highly volatile, with dramatic movements in both directions. After breaking above $3,000 per ounce, the metal entered a phase of heightened volatility—testing resistance

The world's first cryptocurrency finds itself in limbo. After a recent rally, it pulled back and then settled. At the moment, Bitcoin is at a crossroads, with market participants closely

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.