See also

01.03.2024 10:36 AM

01.03.2024 10:36 AMOn Thursday, the US Labor Department published a weekly update on unemployment benefits. The data turned out to be worse than analysts' expectations. The number of continued unemployment claims increased from 1,860 million to 1,905 million. Besides, the number of initial applications for benefits rose from 202K to 215K. Despite the signs of weakness in the labor market, the US dollar asserted its strength across the board. Perhaps the reason for the greenback's growth was expectations of a decline in inflation in the Eurozone. The inflation report will be available on Friday.

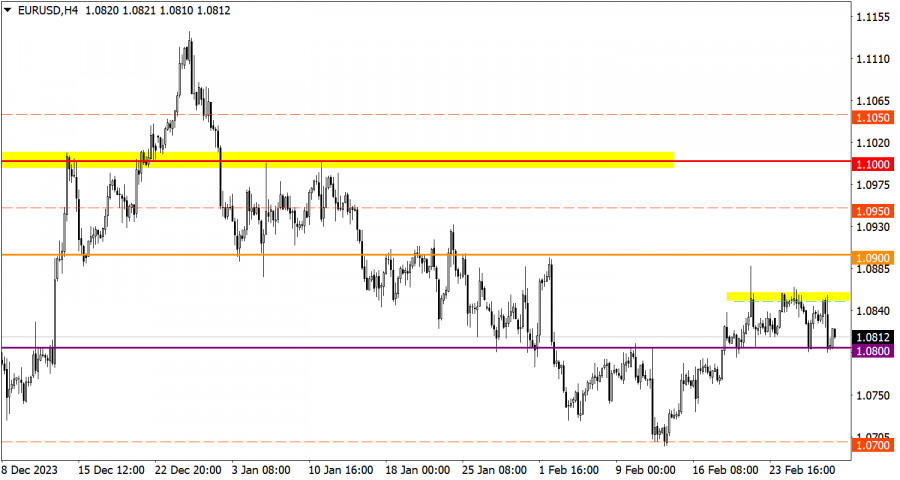

The EUR/USD pair again reached the level of 1.0800, where traders cut on short positions was observed. Judging by the speculative price swings, the instrument will soon quit the range between 1.0800 and 1.0850.

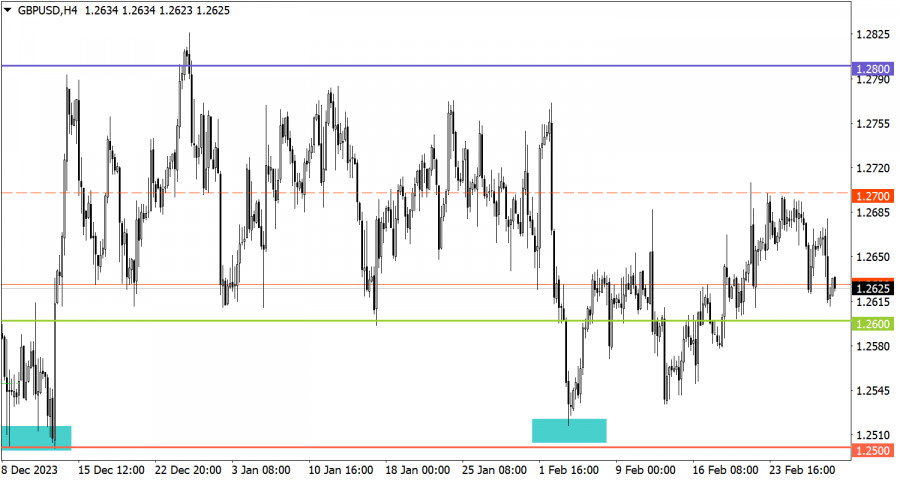

The GBP/USD pair has been following a downtrend from the resistance level of 1.2700. As a result, the instrument is approaching the support level of 1.2600.

Today, the preliminary inflation data for the EU will be released. The annual CPI is expected to slip to 2.5% in February from 2.8% in January. This may contribute to the US dollar's advance.

If EUR/USD settles below 1.0800, traders will add more short positions. Consequently, the instrument will trade lower. Until then, the realistic scenario is a climb to 1.0850.

To enable a further increase in short positions, GBP/USD needs to settle below 1.2600. Otherwise, this level will be viewed by traders as support. In turn, this will encourage a gradual recovery in the pound sterling.

The candlestick chart type consists of graphic rectangles in white and black with lines at the top and bottom. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time period: opening price, closing price, maximum and minimum price.

Horizontal levels are price coordinates relative to which a price may stop or revered its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price developed. This color highlighting indicates horizontal lines that may put pressure on the price in the future.

Up/down arrows are guidelines for a possible direction in the future.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are no macroeconomic events scheduled for Friday. Fundamental developments will also be limited, but it's entirely unclear which factors influence price formation. The pound and the euro had reasons

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair continued its choppy decline within the sideways channel and failed to break out, unlike the EUR/USD pair

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair unexpectedly exited the sideways channel where it had been trading for three weeks. This occurred during

On Thursday, the GBP/USD currency pair continued trading within the sideways channel, visible in the hourly timeframe. Two central bank meetings — each of which could be considered favorable

The EUR/USD currency pair exhibited a particularly interesting trend on Thursday. As a reminder, the FOMC meeting results were announced Wednesday evening, and we once again considered them hawkish. It's

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair showed no notable movements on Wednesday. After Jerome Powell stated the need for more time to assess the full

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.