See also

04.04.2024 02:38 PM

04.04.2024 02:38 PMOn Thursday, the market observes somewhat contradictory dynamics of the dollar. It weakens in the DXY index, which primarily consists of the euro, but strengthens against safe-haven assets—the yen, franc, and gold.

At the same time, market participants who are in active short positions on the dollar may want to pay attention to the dynamics of U.S. government bond yields, which continue to rise.

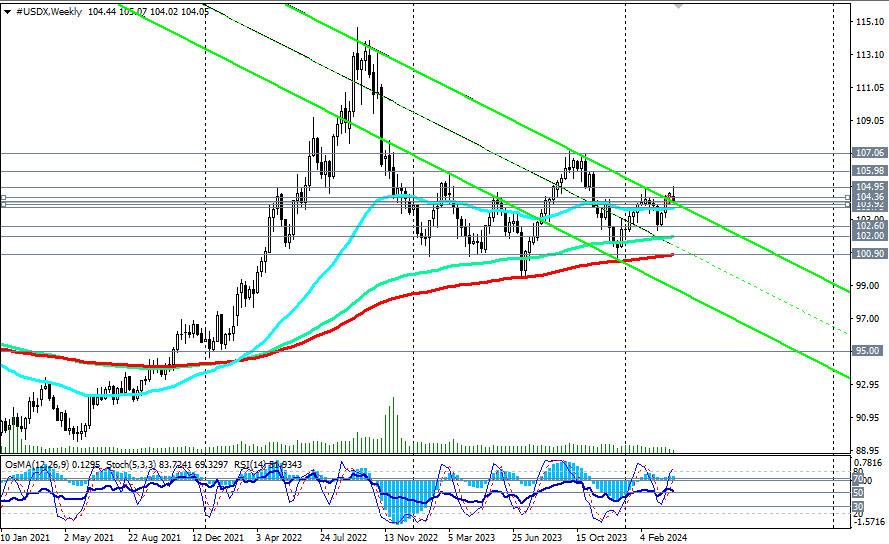

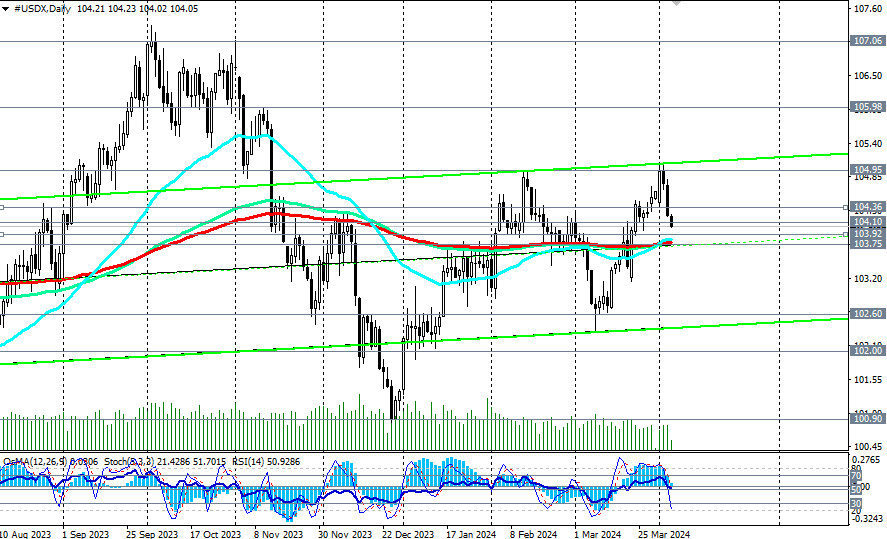

From a technical point of view, the dollar index (CFD #USDX in the MT4 terminal) remains in a bullish market zone, medium-term—above the support level of 103.75 (200 EMA on the daily chart), long-term—above the key support level of 100.90 (200 EMA on the weekly chart).

Therefore, long positions on the dollar index remain preferable for now.

A signal for new purchases could be the breakout of the important short-term resistance level of 104.36 (200 EMA on the 1-hour chart).

In case of a decrease to the support levels of 103.92 (200 EMA on the 4-hour chart) and 103.75 (200 EMA, 144 EMA on the daily chart), it is possible to place pending limit orders for purchase with stops below the 103.60 mark.

In an alternative scenario, after the confirmed breakout of the support level at 103.75, the price may deepen into the downward channel on the weekly chart, with targets at support levels of 102.60 and 102.00 (144 EMA on the weekly chart).

The breakout of the key support level of 100.90 (200 EMA on the weekly chart) will bring the DXY into the long-term bear market zone. The bullish trend of the dollar will be broken.

This scenario may gain momentum if tomorrow's U.S. Labor Department report turns out to be significantly weaker than forecasted. Further dynamics of the dollar and its DXY index will largely depend on the fundamental background and the actions of the Federal Reserve.

Support levels: 104.10, 104.00, 103.92, 103.75, 103.00, 102.60, 102.00, 101.00, 100.90, 100.00

Resistance levels: 104.36, 104.95, 105.00, 106.00, 106.80, 107.00, 107.30

Trading Scenarios

Main scenario: BuyStop 104.40. Stop-Loss 103.60. Targets 104.95, 105.00, 106.00, 106.80, 107.00, 107.30

Alternative scenario: SellStop 103.60. Stop-Loss 104.10. Targets 103.00, 102.60, 102.00, 101.00, 100.90, 100.00

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but they can serve as a guideline for planning and placing your trading positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair didn't even attempt a correction on Thursday. While the euro faced bearish pressure from weak business activity indices

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair corrected to the nearest support level on the hourly timeframe, which was at 1.1267. Multiple factors

The GBP/USD currency pair broke out of its sideways channel through the upper boundary, but it is in no hurry to continue rising. Traders appear to be gathering momentum

On Thursday, the EUR/USD currency pair traded lower, which can be considered an exception to the general trend. Nearly all macroeconomic reports during the day were unfavorable for the euro

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair maintained its upward trend on Wednesday, a movement that has developed over the past two weeks. Recall that

Analysis of Wednesday's Trades 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair continued its upward movement calmly and steadily. The price broke through the 1.1267 level, which

The GBP/USD currency pair also resumed its upward movement on Wednesday. The rise of the British pound, which in reality still reflects the fall of the US dollar, began overnight

The EUR/USD currency pair resumed its upward movement on Wednesday, and it is now safe to say that the uptrend is present not only in the hourly timeframe but also

Analysis of Tuesday's Trades 1H Chart of GBP/USD The GBP/USD pair mainly traded sideways on Tuesday, but early Wednesday morning it surged upward. On the 4-hour timeframe, it's clear that

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair traded sideways, but it resumed its upward movement early Wednesday morning. This indicates that the ongoing

InstaTrade video

analytics

Daily analytical reviews

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.