See also

31.01.2025 01:38 PM

31.01.2025 01:38 PMFutures on U.S. and European indices increased amid optimism fueled by strong earnings reports from giants such as Apple Inc. and Intel Corp. These companies not only exceeded analysts' expectations but also demonstrated solid growth prospects, providing additional support to the markets. Apple, benefiting from strong sales of new iPhone models and an increase in service subscribers, showcased stable revenue, attracting investors' attention.

Intel, in turn, presented a plan to regain its market position in the semiconductor industry, which also served as a positive signal for market participants. These factors contributed to stock price increases in both the U.S. and Europe, as investors became more willing to increase allocations to the technology sector.

Euro Stoxx 50 futures rose by 0.1%, while S&P 500 and Nasdaq 100 futures gained between 0.2% and 0.3%. As mentioned earlier, this growth was supported by higher-than-expected earnings from U.S. mega-cap companies.

As Trump prepares to impose the first wave of tariffs this Saturday, U.S. Treasury bonds suffered losses, while oil prices surged. Analysts at Goldman Sachs Group Inc. noted that markets may be underestimating the likelihood that sanctions on Canadian imports could include critical commodities such as crude oil. Given the rising geopolitical tensions, underestimating the potential impact of these sanctions on Canadian imports could have serious consequences for the global energy market. Goldman Sachs analysts emphasize that crude oil plays a key role in supply chains, and any restrictions on its imports could lead to significant price volatility. In this context, investors should closely monitor developments.

In Asia, SK Hynix Inc. and Samsung Electronics Co. declined in a delayed reaction to AI stock sell-offs, as South Korean markets reopened after the Lunar New Year holidays. Meanwhile, markets in mainland China, Hong Kong, and Taiwan remain closed. Many market participants expect that the AI theme is far from over and that the market is heading for a much larger recalibration. For now, the growth of major tech company earnings is providing some support. However, earnings reports are under increased scrutiny after investors began offloading AI-related stocks earlier this month. While Nvidia shares rose on Thursday, they remain on track for their worst week since September.

On the currency market, the Mexican peso and Canadian dollar declined on Thursday following Trump's tariff warnings. Meanwhile, gold is trading near its record high at around $2,795 per ounce.

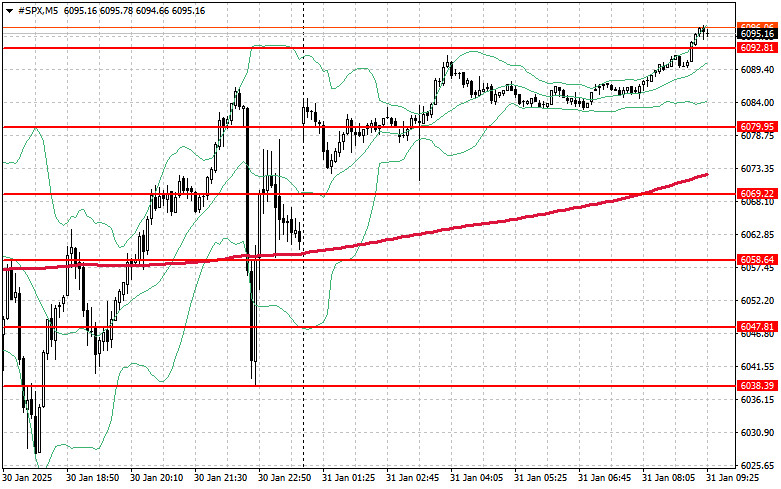

Demand for the S&P 500 remains strong. The primary objective for buyers today will be to break through the nearest resistance at $6,092. A successful breakout would reinforce the ongoing uptrend and open the way for a rally toward $6,107. An equally important task for the bulls will be maintaining control above $6,121, which would further strengthen their positions.

In the event of a downside move due to reduced risk appetite, buyers must assert themselves around $6,079. A break below this level could quickly push the index down to $6,069, opening the path to $6,058.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.