See also

24.03.2025 11:01 AM

24.03.2025 11:01 AMThe BTC/USD pair has managed to halt its recent decline. The current wave pattern now suggests a potential short-term upside for the world's leading cryptocurrency.

Wave structure signals a correction phase

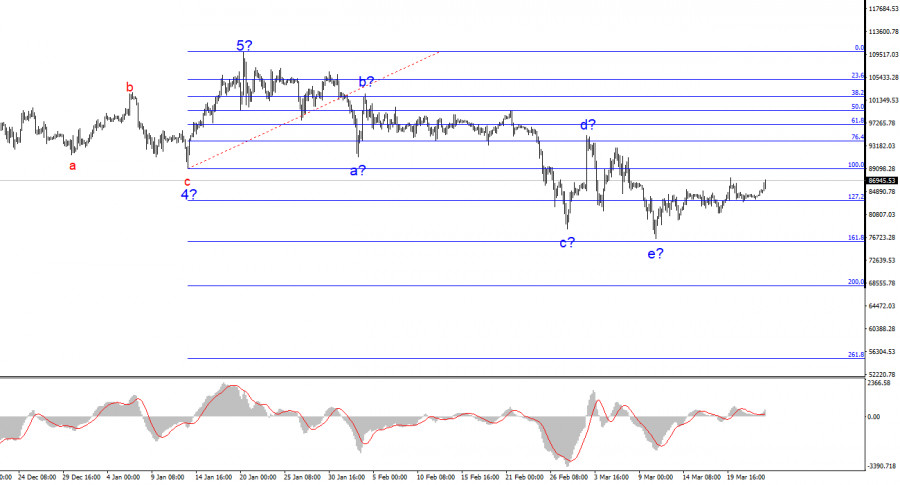

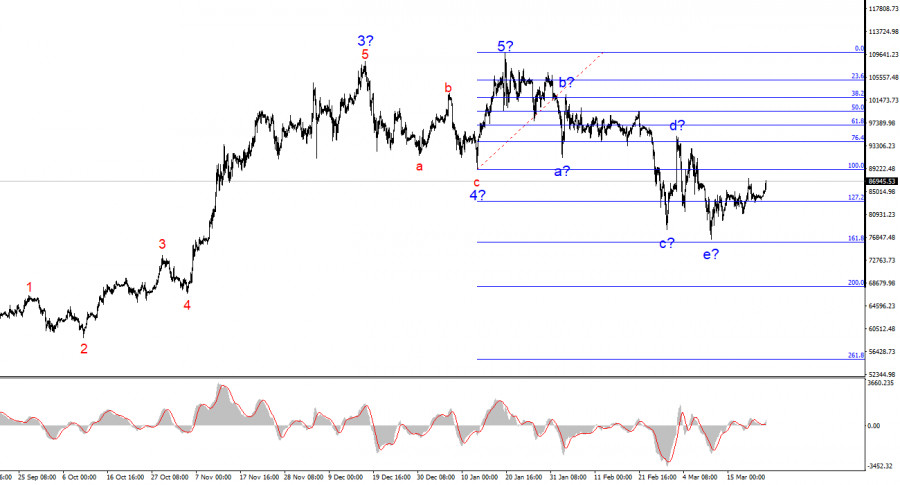

The 4-hour wave analysis for BTC/USD is quite clear. After completing a five-wave bullish trend, a downward corrective phase began. At present, this downtrend appears corrective rather than impulsive, which aligns with my earlier forecasts. Based on this wave setup, I do not expect Bitcoin to exceed $110,000–$115,000 in the coming months.

Previously, Bitcoin's rally was supported by a wave of positive news — including institutional investments, government endorsements, and even pension fund allocations. However, Trump's policy shifts have caused a shift in sentiment. Investors are pulling out, and it's a reminder that markets can't rally forever.

The wave originating on January 20 doesn't resemble a clean impulse wave. It seems to be forming a complex correction, which could take months to fully develop. Within this first wave, a detailed a-b-c-d-e structure can be identified. If the current wave count is accurate, we are now in a bullish corrective wave, likely forming a classic three-wave a-b-c pattern.

BTC/USD has stabilized for now, and the wave structure supports a short-term rise. However, I emphasize that this forecast is purely technical, as the fundamental backdrop remains hostile to Bitcoin, stocks, and other risk assets.

While new tariff announcements have been scarce lately, reciprocal tariffs between the US and EU are expected to go into effect in early April. It's hard to believe that Donald Trump will abandon his quest to turn America's trade deficit into a surplus. In my view, more tariffs are inevitable, which means Bitcoin remains a risky investment in the current environment.

Some analysts argue that Bitcoin could benefit from a weakening US economy, as investors seek alternatives during a potential recession. But I disagree. Bitcoin's circulating supply is relatively small, with a vast portion stored in cold wallets. This makes the asset prone to manipulation by large holders.

At this point, Bitcoin isn't functioning as a true currency — the liquidity in the market is too low. This makes it more of a speculative asset, and one where wave analysis provides the most reliable guidance for short- and medium-term outlooks.

Based on the current wave analysis, Bitcoin's recent rally appears to be over. We are likely entering a complex, multi-month correction. That's why I have consistently advised against buying the cryptocurrency — and now, even more so.

A drop below the low of wave 4 would signal a full transition into a bearish trend phase, albeit likely a corrective one. This makes the search for shorting opportunities more appealing.

In the near term, we could see a bullish corrective wave, which may provide another chance to open short positions, targeting $68,000 and potentially lower — down to $55,000.

On the larger time scale, the upward five-wave structure has already played out. Now, the market appears to be building either a downward corrective phase or possibly a fully developed bearish trend.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has climbed above $100,000, while Ethereum is trying to consolidate above $2,000. After yesterday's sharp rally, which continued during today's Asian session, Bitcoin is now trading at $103,000, having

On the 4-hour chart of the Bitcoin cryptocurrency, the Stochastic Oscillator indicator can be seen to be in Overbought conditions and is now preparing to Cross SELL and break below

While stock indices remain stagnant, gold consolidates near its highs, and Bitcoin is once again capturing attention. The crypto market's flagship has approached the psychologically important $100,000 level

Bitcoin's price is hovering near a psychologically significant threshold, with market participants bracing for another upward surge or a sudden reversal that could erase short-term bullish expectations. More chart

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.