See also

08.04.2025 07:45 PM

08.04.2025 07:45 PMThe NZD/USD pair is attempting to regain positive momentum, supported by renewed US dollar selling. However, given the underlying fundamentals, bullish traders are advised to proceed with caution.

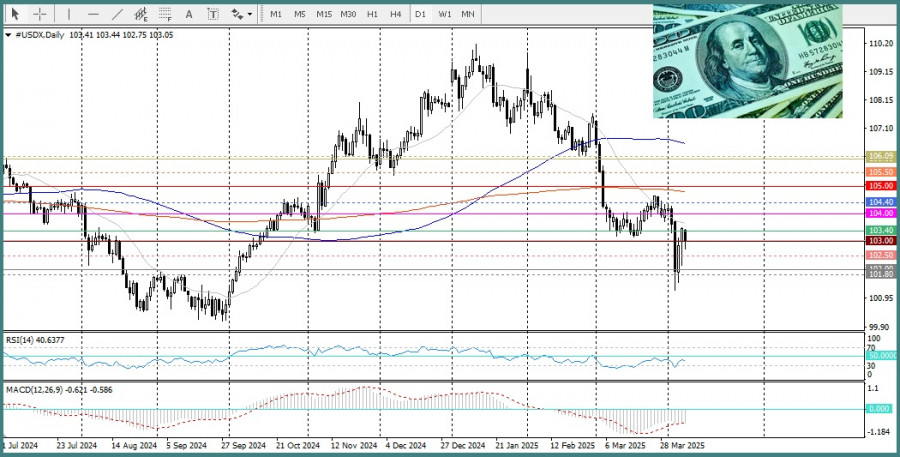

Investors appear confident that the US economic slowdown, driven by tariffs, will soon force the Federal Reserve to resume its rate-cutting cycle. Markets are already pricing in at least four rate cuts by the end of the year. This, combined with an improved global risk sentiment, is preventing the safe-haven US dollar from benefiting from its recent recovery, which in turn supports the risk-sensitive New Zealand dollar.

Additionally, reports that China is considering preemptive stimulus measures to soften the impact of tariffs are also helping antipodean currencies, including the kiwi. For now, the NZD/USD pair has ended a two-day losing streak, pausing near the psychological 0.5500 level. However, the pair's upside remains limited amid the escalating US-China trade war.

Trump has imposed reciprocal tariffs of at least 10% on all imported goods, which led to 54% levies from China. He has also threatened additional 50% tariffs if China does not lift its retaliatory duties. This creates an environment where it is prudent to wait for stronger follow-through buying before confirming that the NZD/USD pair has bottomed and is ready for a short-term rally.

From a technical standpoint, the pair has so far failed to overcome the 0.5595 hurdle. Moreover, oscillators on the daily chart remain firmly in negative territory, indicating that the path of least resistance remains to the downside.

Traders are also advised to refrain from placing aggressive bets ahead of the FOMC meeting minutes due Wednesday. Furthermore, the Consumer Price Index (CPI) and the Producer Price Index (PPI), scheduled for release on Thursday and Friday respectively, will be key indicators for assessing the Fed's next steps and will likely have a significant impact on short-term US dollar price dynamics—and, consequently, on the NZD/USD pair.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdrop

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentally

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.