See also

14.04.2025 12:31 PM

14.04.2025 12:31 PMThe Japanese yen continues to strengthen, remaining near its highest levels of 2024. This is driven by growing demand for traditional safe-haven assets amid a weakening U.S. dollar caused by the escalation of the trade war between the U.S. and China. Optimism over a potential trade deal between the U.S. and Japan, along with expectations of further interest rate hikes by the Bank of Japan in 2025 due to signs of rising inflation in Japan, also supports the yen.

The Bank of Japan's hawkish outlook contrasts sharply with expectations of more aggressive policy easing by the Federal Reserve, keeping the U.S. dollar near its lows from 2022.

This creates the groundwork for a continued downward trend in the USD/JPY pair.

On Friday, China announced an increase in tariffs on U.S. goods to 125%, while President Trump raised tariffs on Chinese imports to 145%. These actions have sparked concerns over the economic fallout, pushing investors toward safer assets like the Japanese yen.

Investor sentiment is optimistic about a positive outcome from U.S.–Japan trade talks. Trump stated that "strict but fair parameters" are being set for negotiations, while U.S. Treasury Secretary Scott Bessent noted that Japan could become a top priority in tariff discussions—further boosting hopes for a trade deal.

Japanese Prime Minister Shigeru Ishiba warned that "U.S. tariffs could disrupt the global economic order," while Finance Minister Shunichi Kato added that excessive exchange rate volatility is undesirable. These comments highlight the importance of currency stability for both countries.

According to the Bank of Japan, annual wholesale inflation accelerated to 4.2% in March, giving the central bank room to continue raising interest rates. Conversely, U.S. consumer price index data points to slowing inflation, likely prompting the Fed to cut rates.

Diverging policy expectations between the Bank of Japan and the Federal Reserve are adding further support for the yen. With the U.S. dollar remaining weak, the USD/JPY pair is being dragged toward multi-month lows.

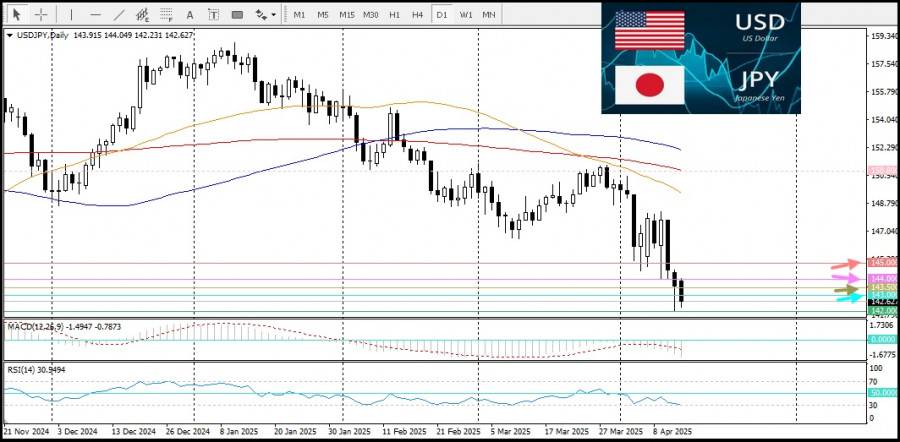

Technical analysis shows the daily Relative Strength Index (RSI) is approaching the oversold zone, which may require caution from sellers.

A short-term consolidation or modest pullback is likely necessary before the downtrend resumes. The 142.00 level serves as key support, with a break below it exposing intermediate support at 141.60, followed by the psychological 141.00 mark. Continued selling could push the pair down toward the 140.30 level, exposing the low from the September 2024 swing.

On the other hand, a recovery above 143.00 will face resistance in the 143.50–143.55 range. Further gains could lead to a test of the 144.00 level and beyond. A decisive breakout above this area would trigger short-covering rally momentum toward the psychological 145.00 level.You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The turbulence of recent months, driven by Donald Trump's actions and the release of fresh U.S. economic data, has done little to help investors understand the true direction of asset

The new week promises to be informative for EUR/USD traders. Most notably, the next Federal Reserve meeting, scheduled for May 6–7, will determine the central bank's future course of action

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.