See also

24.04.2025 12:59 AM

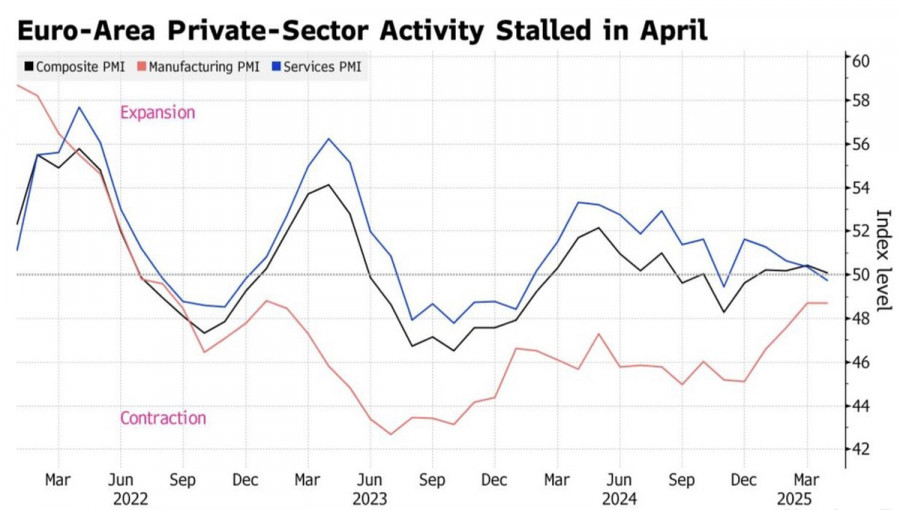

24.04.2025 12:59 AMThere will be no winners in trade wars. The U.S. will suffer due to a loss of trust in the dollar and other American assets, while Europe will suffer from an economic slowdown—which is already starting to show. The Eurozone composite Purchasing Managers' Index (PMI) fell to 50.9 in April, failing to meet Bloomberg experts' expectations. The two largest economies in the currency bloc, Germany and France, both fell below the critical level of 50, which separates expansion from contraction.

The biggest negative surprise came from Germany's PMIs, which fell below the critical threshold for the first time in four months. According to Bundesbank President Joachim Nagel, tariffs and the EU's trade war with the U.S. will lead to a recession in Germany. While fiscal stimulus from Friedrich Merz and monetary expansion from the European Central Bank may eventually pull the country out of the abyss, difficult times lie ahead.

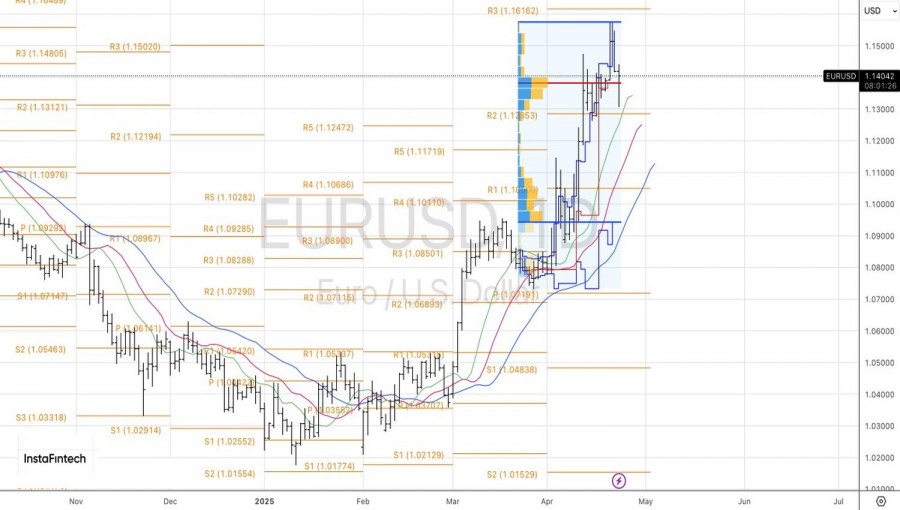

Credit Agricole agrees, stating that investors have overestimated the loss of confidence in the U.S. dollar. The bank considers the eurozone and Japan to be the main casualties of trade wars due to their export-oriented economies. It forecasts a decline in EUR/USD to 1.08 by the end of the year.

ING, by contrast, warns that renewed threats from Donald Trump directed at Jerome Powell could push the pair toward 1.20 — although, at present, this appears to be more of a peak in dollar skepticism. In the short term, EUR/USD bears may trigger a correction, but in the second half of the year, a slowdown in the U.S. economy and a renewed easing cycle by the Federal Reserve may further weaken the dollar and lift the euro toward 1.15.

I believe markets are beginning to sense Donald Trump's interest in rising U.S. stock indices. This is evident in the 47th president's conciliatory tone. He has no intention of removing Powell from his post as Fed Chair and promises to be "very nice" to China. Without the recent S&P 500 crash, it's unlikely a Republican would be speaking this way.

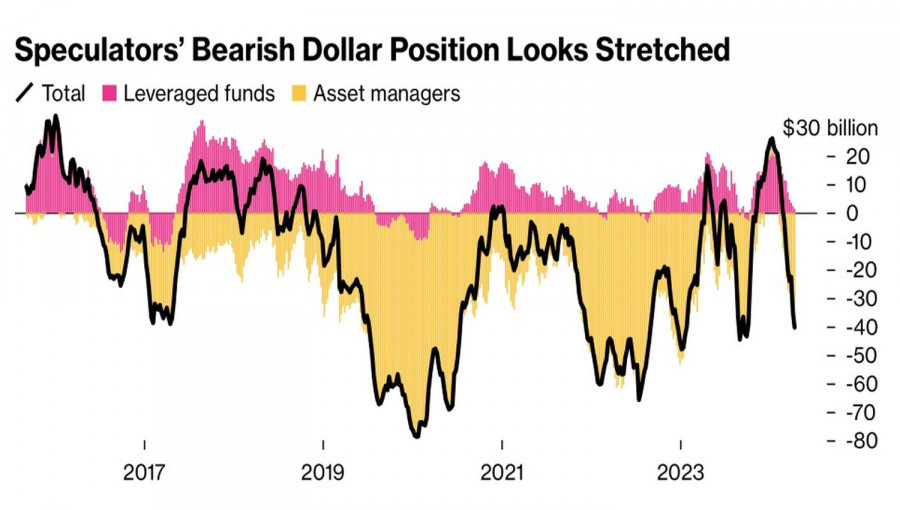

A lifeline from the White House could help stabilize the broad stock index, which may cause traders to question the continuation of the dollar's sell-off. This is especially true since speculative long positions on the U.S. dollar have been declining rapidly, pushing the USD index into bear territory. Before moving further south, the market may need to shed some weight.

Overall, eurozone economic weakness could raise doubts about the sustainability of the euro's rally against the U.S. dollar, increasing the risks of consolidation.

Technically, a pin bar with a long lower shadow is forming on the daily EUR/USD chart. This indicates weakness among bears and provides a basis for renewed buying if resistance at 1.1425 is broken.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The GBP/USD currency pair saw a slight downward correction after Monday's rise, which came out of nowhere. However, it's difficult to call this minor move a "dollar recovery." The U.S

Markets have once again paused amid uncertainty over whether a trade agreement between the U.S. and China will be reached anytime soon. The cloud of uncertainty that Donald Trump

Very few macroeconomic events are scheduled for Tuesday, and none are significant. If we set aside all the tertiary reports, such as the GfK Consumer Confidence Index in Germany

On Monday, the GBP/USD currency pair also traded with low volatility and mainly moved sideways, although the British pound maintained a slight upward bias. Despite the lack of market-relevant news

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.