See also

24.04.2025 12:59 AM

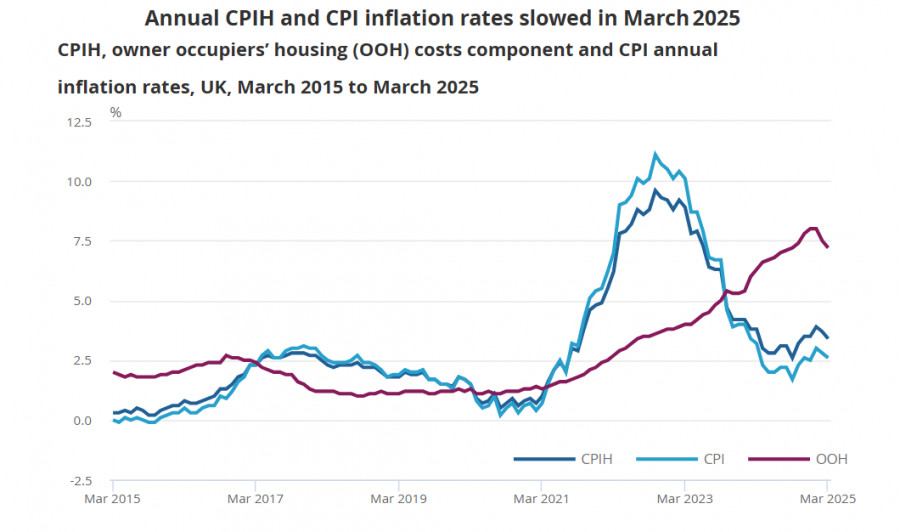

24.04.2025 12:59 AMInflationary pressure in the UK is gradually easing but remains elevated. In March, the core index fell from 3.5% to 3.4% year-over-year, while the headline CPI dropped from 2.8% to 2.6%. Meanwhile, the labor market remains tight, and average wage growth is not slowing.

The next Bank of England meeting is scheduled for May 8, and recent labor market and inflation data will play a key role in shaping the decision. At its previous meeting, the BoE kept the interest rate unchanged at 4.5%, citing a negative inflation outlook and heightened economic uncertainty. The latest data, however, can be considered positive—UK GDP grew by 0.5% in February, and the prospects of signing a trade agreement with the US without significant damage are now seen as fairly achievable.

Markets expect the BoE to cut rates by 25 basis points but not more than that. Moreover, the anticipated cut is not seen as the beginning of a complete normalization cycle. In February, the Bank projected inflation at 3.7% in Q3, as energy prices are expected to rise—so a swift rate-cutting path looks unlikely. This can be seen as a potentially bullish factor for the pound, but its weight remains fragile due to high uncertainty. The market is unlikely to price in such long-term expectations. Inflation may pick up again—or the opposite may happen, where a weakening economy eventually dampens price growth. Both scenarios are entirely plausible.

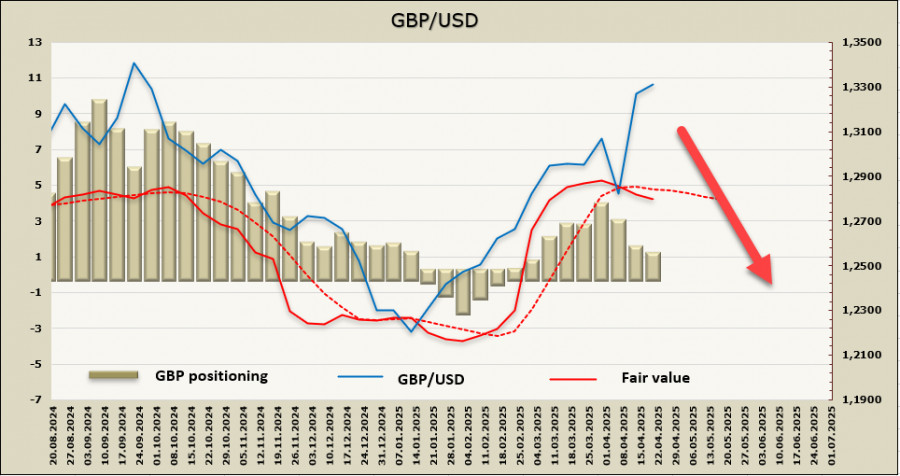

The net long speculative position on GBP decreased by $983 million over the reporting week to $538 million—essentially to a neutral level. The fair value is below the long-term average and shows a tendency for further decline.

Last week, we suggested that the pound's bullish impulse was nearing exhaustion. However, GBP still managed to reach the strong resistance level at 1.3433, driven by a broad sell-off in the dollar—so it pushed higher along with the market. At the same time, the fair value continues to decline, which makes the pound's rally look like a temporary reaction to another unexpected move from Trump rather than something grounded in fundamentals.

We expect a decline to begin from current levels, with the nearest target at the technical level of 1.3107, followed by a potential attempt to break below 1.3013.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The GBP/USD currency pair saw a slight downward correction after Monday's rise, which came out of nowhere. However, it's difficult to call this minor move a "dollar recovery." The U.S

Markets have once again paused amid uncertainty over whether a trade agreement between the U.S. and China will be reached anytime soon. The cloud of uncertainty that Donald Trump

Very few macroeconomic events are scheduled for Tuesday, and none are significant. If we set aside all the tertiary reports, such as the GfK Consumer Confidence Index in Germany

On Monday, the GBP/USD currency pair also traded with low volatility and mainly moved sideways, although the British pound maintained a slight upward bias. Despite the lack of market-relevant news

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.