See also

24.04.2025 08:26 AM

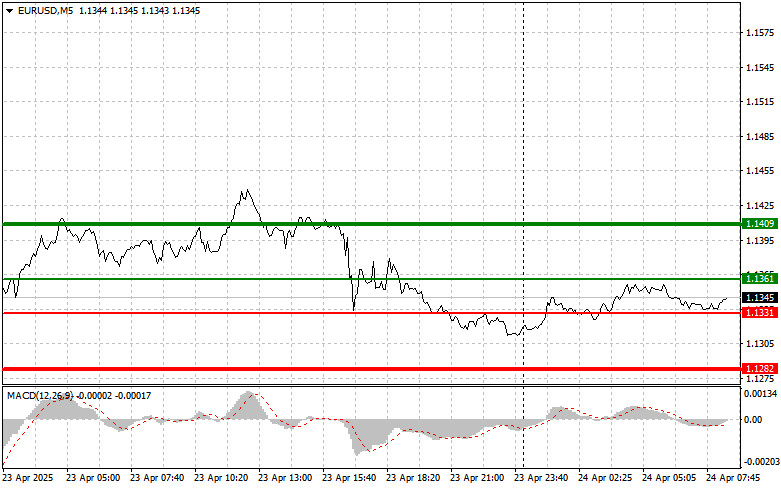

24.04.2025 08:26 AMThe price test at 1.1382 in the second half of the day coincided with the MACD indicator beginning a downward move from the zero line, confirming a correct entry point for selling the euro. As a result, the pair declined by 50 pips.

Yesterday's positive data on U.S. business activity indices and increased new home sales fueled demand for the dollar and led to a decline in the euro. The improvement in U.S. economic indicators inspired investors, who began actively shifting capital into dollar-denominated assets, intensifying pressure on the euro. However, the fundamental factors shaping long-term trends remain critical for market participants. Inflation levels in the eurozone, U.S. trade tariffs, and European Central Bank interest rates will continue to be key components of trading strategy.

Today, several important economic reports from Germany will be released, including the IFO Business Climate Index, Current Economic Assessment, and Economic Expectations indicators. These are forecast to decline, which could weigh on the euro as early as the first half of the trading session. Economists closely monitor these indicators as they serve as a barometer of sentiment in German business. A drop in the IFO Business Climate Index is often seen as a sign of an impending slowdown in Germany's economic growth—the largest economy in the eurozone. This, in turn, could negatively affect the entire European economy and, therefore, the euro.

The Current Economic Assessment reflects how business leaders view present-day conditions. A decline signals that companies are struggling now—whether due to falling demand, rising costs, or other issues. Meanwhile, the Economic Expectations Index shows how companies view the near future. A drop in this measure indicates pessimism and may lead to cutbacks in investment and hiring.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the euro today if the price reaches 1.1361 (green line on the chart) with a target of 1.1409. At 1.1409, I plan to exit the long position and open a short in the opposite direction, expecting a 30–35-pip pullback from the entry. A euro rise in the first half of the day can only be expected after strong data.

Important: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1331 level when the MACD indicator is in the oversold zone. This will limit the downside potential and trigger a reversal. A rise to the opposite levels of 1.1361 and 1.1409 can be expected.

Scenario #1: I plan to sell the euro after it reaches 1.1331 (red line on the chart). The target is 1.1282, where I will exit the short position and open a long in the opposite direction (expecting a 20–25-pip rebound from the level). Selling pressure may return at any moment today.

Important: Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1361 level when the MACD indicator is in the overbought zone. This will limit the upside potential and trigger a reversal. A decline to the opposite levels of 1.1331 and 1.1282 can be expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 143.21 price level coincided with the MACD indicator just beginning to move downward from the zero line, confirming a correct entry point for selling the dollar

The test of the 1.3352 price level occurred when the MACD indicator had already moved significantly above the zero line, limiting the pair's upside potential. For this reason

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.