CHFMXN (Franc Swiss vs Peso Meksiko). Nilai tukar dan grafik online.

Konverter mata uang

17 Apr 2025 07:34

(0%)

Harga penutupan, hari sebelumnya.

Harga pembukaan.

Harga tertinggi pada hari transaksi terakhir.

Harga terendah pada hari transaksi terakhir

Nilai total perusahaan dalam pasar saham. Umumnya dihitung dengan menggandakan saham-saham yang beredang dengan harga saham saat itu.

Jumlah saham yang dipegang oleh para investor dan insider perusahaan, diluar sekuritas dilutif (dilutive securities) seperti non-vested RSU dan unexercised options.

CHF/MXP is the exchange rate of the Swiss franc against the Mexican peso and it is not popular among Forex traders. The US dollar significantly affects this currency pair even though it is not a part of it. It is easy to follow up: one only needs to merge USD/CHF and USD/MXN movements to get the chart for the CHF/MXN pair.

As the US dollar has a considerable influence on the Swiss franc and the Mexican peso, the main indiсes of the US economy should be taken into account when forecasting the most accurate prices of the currency trading instrument. These indexes include central bank interest rates, the GDP, unemployment rate, new jobs, etc. Remember that the represented currencies may react differently to changes in the US economy.

For several centuries, the Swiss economy has remained one of the highly developed economies in the world. That is why the Swiss franc is deemed the most stable currency as well as the safest one to keep funds. In times of economic crisis when capital flows to Switzerland зпт the franc advances sharply against other currencies. Take that aspect of the Swiss economy into account while trading the CHF/MXN pair.

Mexico has the highest per capita income in Latin America that lets it rank among the most developed countries in the region. The major part of state enterprises in Mexico were privatized in the 80 according to government measures against the economic crisis. Foreign companies take control of most organizations that used to be state-owned. Mexico trades with the US and Canada under the North American Free Trade Agreement. The profit from trading with these countries represents one of the government's main sources of revenue.

Besides, Mexico is the leading oil exporter in Latin America and money earned from selling oil makes an important contribution to the country’s budget. However, the key source of revenue comes from the services sector.

In spite of the large amount of oil and gas fields located on the territory of Mexico, natural hydrocarbon deposits are contracting gradually. To avoid new economic problems, the government has taken measures to decrease gas and oil production. Analysts believe that the ongoing restrictive policy is likely to make Mexico purchase raw materials to cope with its domestic demand. Besides movements in oil prices, the Mexican peso is influenced by different ratings from the most reliable international rating agencies, based on analysis of various factors.

CHF/MXN is less liquid compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. You should consider the pairs that the Swiss franc and the Mexican peso form with the US dollar, preparing forecasts about the CHF/MXN pair.

Please do not forget that spreads for cross rate transactions are often wider than spreads for transaction which involve major currencies. That is why you need to examine your broker’s terms for cross currency pairs before you start trading this financial instrument.

Lihat juga

- Rekomendasi Trading untuk Pasar Cryptocurrency pada 16 April.

Penulis: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

868

Emas terus menarik perhatian investor, terutama di saat ketidakpastian di pasar keuangan meningkat.Penulis: Irina Yanina

11:50 2025-04-16 UTC+2

808

USD/CHF. Analisis dan Prediksi.Penulis: Irina Yanina

11:41 2025-04-16 UTC+2

778

- Wall Street mengakhiri sesi dengan penurunan. Saham raksasa Boeing dan Johnson & Johnson mengalami penurunan terbesar karena ketidakpastian seputar kebijakan tarif terus membebani sentimen investor. Sementara sektor perbankan mencatatkan keuntungan, didorong oleh pendapatan kuat dari pemain.

Penulis: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

703

Fundamental analysisKonfrontasi Antara AS dan Tiongkok Akan Berdampak Negatif pada Pasar (Potensi Penurunan Kembali di #NDX dan Litecoin)

Konfrontasi Antara AS dan Tiongkok Akan Berdampak Negatif pada Pasar (Potensi Penurunan Kembali di #NDX dan Litecoin).Penulis: Pati Gani

11:34 2025-04-16 UTC+2

643

Pasar saham AS pada 16 April: S&P 500 dan NASDAQ melanjutkan penurunannya.Penulis: Jakub Novak

12:22 2025-04-16 UTC+2

628

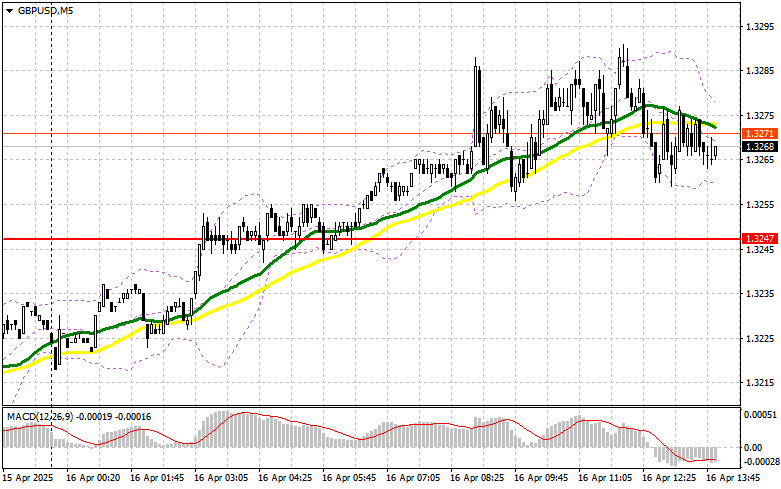

- GBP/USD: Rencana Trading untuk Sesi AS pada 16 April (Tinjauan Trading Pagi)

Penulis: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

598

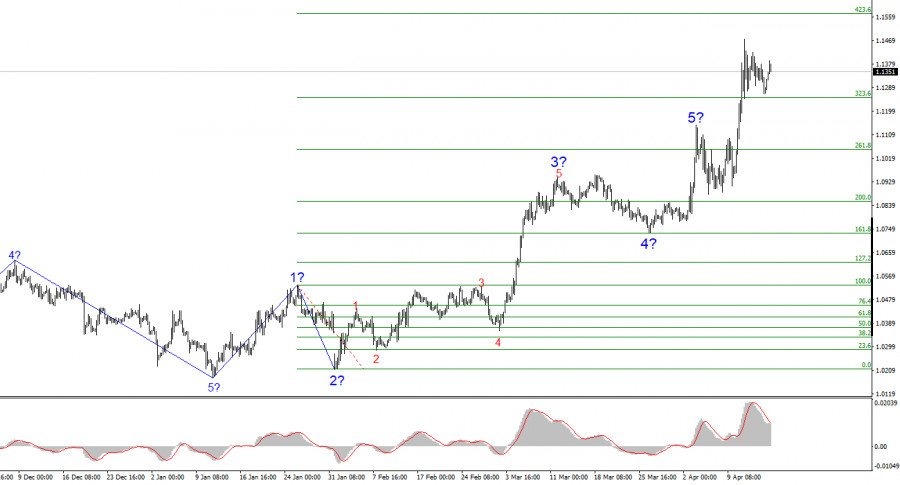

Pada sesi Rabu, pasangan EUR/USD naik beberapa puluh poin.Penulis: Chin Zhao

18:56 2025-04-16 UTC+2

598

Technical analysisSinyal Trading untuk EMAS (XAU/USD) pada 16-18 April 2025: jual di bawah $3,320 (jenuh beli - 21 SMA)

Indikator eagle mencapai kondisi jenuh beli yang ekstrem. Jadi, pada level harga saat ini di bawah rekor tertingginya, akan memungkinkan untuk menjual dengan target di 3,281.Penulis: Dimitrios Zappas

18:20 2025-04-16 UTC+2

583

- Rekomendasi Trading untuk Pasar Cryptocurrency pada 16 April.

Penulis: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

868

- Emas terus menarik perhatian investor, terutama di saat ketidakpastian di pasar keuangan meningkat.

Penulis: Irina Yanina

11:50 2025-04-16 UTC+2

808

- USD/CHF. Analisis dan Prediksi.

Penulis: Irina Yanina

11:41 2025-04-16 UTC+2

778

- Wall Street mengakhiri sesi dengan penurunan. Saham raksasa Boeing dan Johnson & Johnson mengalami penurunan terbesar karena ketidakpastian seputar kebijakan tarif terus membebani sentimen investor. Sementara sektor perbankan mencatatkan keuntungan, didorong oleh pendapatan kuat dari pemain.

Penulis: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

703

- Fundamental analysis

Konfrontasi Antara AS dan Tiongkok Akan Berdampak Negatif pada Pasar (Potensi Penurunan Kembali di #NDX dan Litecoin)

Konfrontasi Antara AS dan Tiongkok Akan Berdampak Negatif pada Pasar (Potensi Penurunan Kembali di #NDX dan Litecoin).Penulis: Pati Gani

11:34 2025-04-16 UTC+2

643

- Pasar saham AS pada 16 April: S&P 500 dan NASDAQ melanjutkan penurunannya.

Penulis: Jakub Novak

12:22 2025-04-16 UTC+2

628

- GBP/USD: Rencana Trading untuk Sesi AS pada 16 April (Tinjauan Trading Pagi)

Penulis: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

598

- Pada sesi Rabu, pasangan EUR/USD naik beberapa puluh poin.

Penulis: Chin Zhao

18:56 2025-04-16 UTC+2

598

- Technical analysis

Sinyal Trading untuk EMAS (XAU/USD) pada 16-18 April 2025: jual di bawah $3,320 (jenuh beli - 21 SMA)

Indikator eagle mencapai kondisi jenuh beli yang ekstrem. Jadi, pada level harga saat ini di bawah rekor tertingginya, akan memungkinkan untuk menjual dengan target di 3,281.Penulis: Dimitrios Zappas

18:20 2025-04-16 UTC+2

583