Lihat juga

27.03.2025 04:16 PM

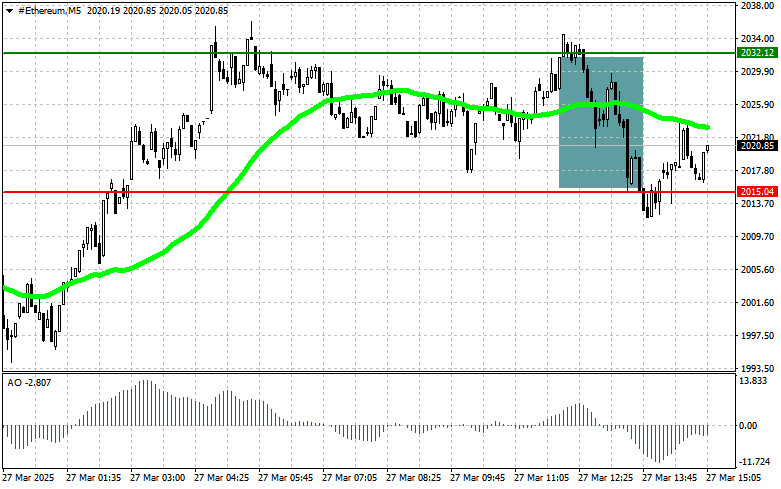

27.03.2025 04:16 PMBitcoin didn't show anything interesting in the first half of the day. Only Ethereum could be traded a bit within its sideways channel, in which it is still trapped.

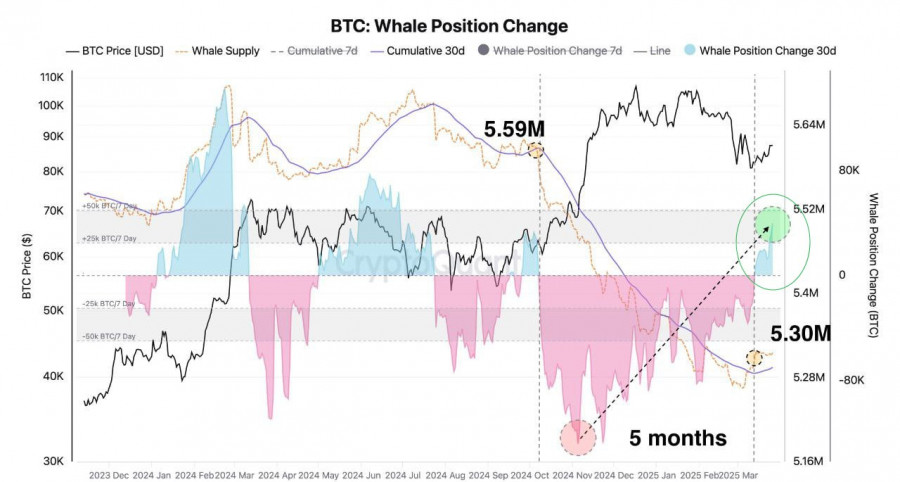

Meanwhile, according to the data, BTC supply on exchanges continues to decline, and whales with wallets of 1000 BTC or more have once again started actively buying after the 5-month sell-off that was previously observed. This doesn't mean the market may experience a sharp rise in the short term, but the fact that large players are making purchases and accumulating their assets suggests that the medium-term outlook for Bitcoin remains bullish.

The decline in BTC supply on exchanges is an important indicator of investor sentiment. When Bitcoins move from exchanges to private wallets, it usually signals an intention to hold the assets in the long term, mitigating the selling pressure on the market. A new wave of purchases by whales with significant BTC reserves reinforces this trend. Their actions are often seen as leading indicators since institutional investors have the resources to conduct in-depth market analysis, and they are likely making decisions based on long-term prospects.

Regarding the intraday strategy in the cryptocurrency market, I will continue trading based on any significant dips in Bitcoin and Ethereum, expecting the bullish market in the medium term. Well, I'm still sticking to this forecast.

As for short-term trading, the strategy and conditions are described below.

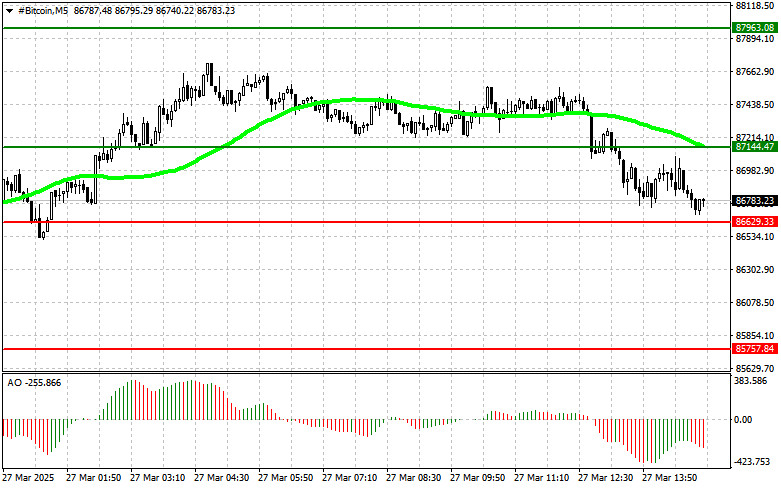

Bitcoin

Buy scenario

Scenario #1: I will buy Bitcoin today when it reaches the entry point around $87,200, targeting a rise to $88,000. Around $88,000, I will exit the buy positions and immediately sell on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price, and the Awesome Oscillator is above zero.

Scenario #2: Bitcoin can be bought from the lower border of $86,600 if there is no market reaction to its breakout back to the levels of $87,200 and $88,000.

Sell scenario

Scenario #1: I will sell Bitcoin today when it reaches the entry point around $86,600, targeting a decline to $85,700. Around $85,700, I will exit the short positions and immediately buy on the dip. Before selling on a breakout, make sure that the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario #2: Bitcoin can be sold from the upper border of $87,200 if there is no market reaction to its breakout back to the levels of $86,600 and $85,700.

Ethereum

Buy scenario

Scenario #1: I will buy Ethereum today when it reaches the entry point around $2,026, targeting a rise to $2,065. Around $2,065, I will exit the long positions and immediately sell on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price, and the Awesome Oscillator is above zero.

Scenario #2: Ethereum can be bought from the lower border of $2,009 if there is no market reaction to its breakout back to the levels of $2,026 and $2,065.

Sell Scenario

Scenario #1: I will sell Ethereum today when it reaches the entry point around $2,009, aiming a decline to $1,974. Around $1,974, I will exit the sell positions and immediately buy on the dip. Before selling on a breakout, make sure that the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario #2: Ethereum can be sold from the upper border of $2,026 if there is no market reaction to its breakout back to the levels of $2,009 and $1,974.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Bitcoin memperkuat posisinya dengan cukup baik, hampir mencapai level 86.000. Ethereum juga menunjukkan kenaikan, tetapi kehilangan keunggulan tersebut pada akhir sesi perdagangan di AS. Dengan meredanya ketegangan terkait tarif

Selama akhir pekan lalu, Bitcoin dan Ethereum menunjukkan ketahanan yang cukup baik, mempertahankan peluang untuk terus pulih. Meskipun dari sudut pandang teknikal peluang tersebut mungkin tampak agak tipis, trading dalam

Pada pekan trading terakhir, pasar menunjukkan potensi peluang bagi pihak bullish untuk kembali mengendalikan. Apakah potensi ini dapat terwujud sekarang bergantung pada apakah pihak bullish dapat keluar dari area konsolidasi

Bitcoin dan Ethereum anjlok pada penghujung hari kemarin, tetapi kemudian berhasil memulihkan posisi mereka. Untuk saat ini, bear masih memiliki kekuatan lebih dibandingkan pembeli, tetapi ini mungkin hanya sementara, sampai

Dari apa yang terlihat di chart 4 jam dari mata uang kripto Uniswap, nampak terlihat adanya divergence antara pergerakan harga Uniswap dengan indikator Stochastic Oscillator, sehingga berdasarkan hal ini, maka

Dengan munculnya divergence antara pergerakan harga mata uang kripto Polkadot dengan indikator Stochastic Oscillator di chart 4 jamnya, maka selama tidak terjadi koreksi pelemahan yang tembus dan menutup dibawah level

Bitcoin dan Ethereum keduanya melonjak, naik antara 6% dan 10% setelah berita bahwa Trump tiba-tiba berubah pikiran. Gelombang FOMO yang kuat terlihat pada BTC setelah berita tentang penundaan tarif timbal

Bitcoin sedang mengalami penurunan tajam, dana-dana melaporkan kerugian, dan para analis tidak melihat alasan untuk pertumbuhan. Apa yang terjadi dengan pemimpin pasar kripto ini? Apa yang harus dilakukan dalam situasi

Bitcoin dan Ethereum mengalami penurunan tajam pada akhir hari Selasa, melanjutkan aksi jual besar-besaran selama sesi Asia hari ini. Penurunan tajam lainnya di pasar saham AS menarik aset berisiko lainnya

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.