Lihat juga

28.03.2025 09:00 AM

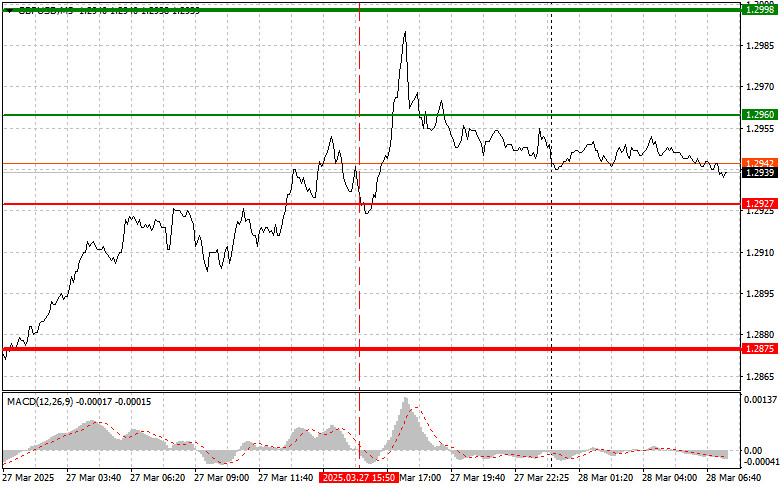

28.03.2025 09:00 AMThe price test at 1.2927 occurred when the MACD indicator started moving down from the zero mark, confirming a valid entry point for selling the pound. However, as you can see on the chart, the decline never materialized, resulting in a loss.

Demonstrating some resilience, the British currency found support in its struggle against the U.S. dollar, even reaching new weekly highs. However, the triumph was short-lived. Under pressure from strong U.S. data, the pound failed to maintain its gains and ceded momentum. The GDP figures were positive and supported the U.S. dollar significantly. Investors, reassured by signs of the U.S. economy's stability, quickly adjusted their portfolios to favor the dollar, weakening the pound's position.

Today may mark a potential return of interest in the GBP/USD pair, but that will require favorable conditions—specifically, the release of robust economic data from the UK. The day will begin with the Nationwide House Price Index, which could set the tone for further trading. Following that, investors will closely watch the retail sales data. The highlight will be the release of the final GDP figures for the previous year's fourth quarter, providing a complete picture of the country's economic activity. If all these indicators exceed economists' expectations, a significant strengthening of the British pound against the U.S. dollar could be expected.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today if the price reaches the entry point near 1.2950 (green line on the chart), aiming for a rise to 1.2987 (thicker green line on the chart). Around 1.2987, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip pullback from the level). A bullish move in the pound can only be expected after strong economic data. Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.2932 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward market reversal. A rise toward the opposite levels of 1.2950 and 1.2987 can be expected.

Scenario #1: I plan to sell the pound today after the 1.2932 level (red line on the chart) is broken, which would lead to a quick drop in the pair. The key target for sellers will be the 1.2904 level, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25-pip rebound from the level). It's better to sell the pound as high as possible. Important! Before selling, make sure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.2950 level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and trigger a reversal to the downside. A decline toward the opposite levels of 1.2932 and 1.2904 can be expected.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji harga pada 143,49 terjadi ketika indikator MACD bergerak jauh di atas garis nol, membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar dan melewatkan pergerakan naik

Pengujian harga di 1,3154 terjadi ketika indikator MACD sudah bergerak jauh di bawah angka nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual pound. Saya tidak

Uji harga di 1.1348 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual pasangan ini dan tidak melihat

Euro dan pound berhasil mempertahankan keunggulan terhadap dolar meskipun terjadi koreksi kuat yang diamati pada aset berisiko selama paruh kedua hari itu. Komentar dari pejabat Federal Reserve kemarin memperkuat dolar

Analisis Trading dan Panduan untuk Trading Yen Jepang Pengujian level 142,69 terjadi ketika MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena

Analisis trading dan panduan untuk trading pound Inggris Uji level 1.3136 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Mengingat tidak

Analisis dan saran trading untuk mata uang euro Uji harga di 1.1397 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Mengingat

Uji harga di 143.28 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar. Akibatnya, pasangan ini naik sebesar

Uji harga di 1,3111 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini pada akhir pekan. Oleh karena itu, saya tidak membeli

Pengujian harga di level 1,1375 terjadi ketika indikator MACD baru saja mulai bergerak naik dari titik nol, mengonfirmasi validitas titik masuk long yang mendukung tren bullish saat ini. Akibatnya, pasangan

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.