Lihat juga

01.04.2025 11:29 AM

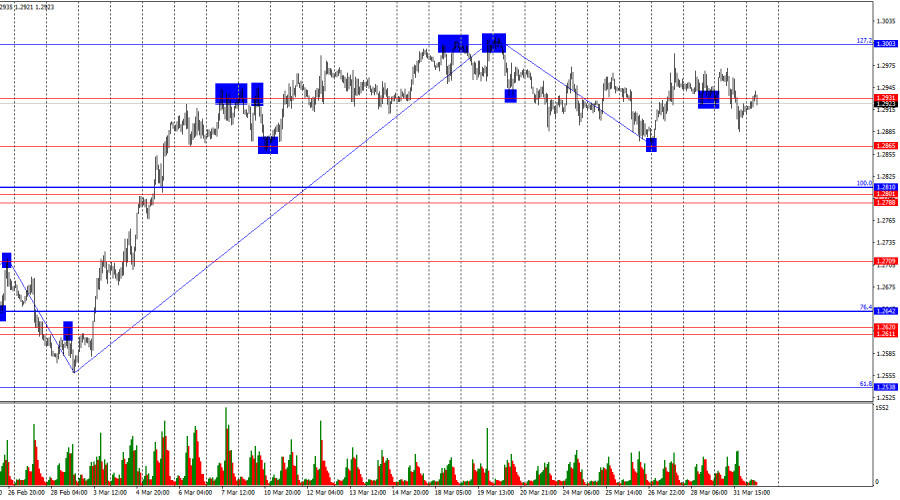

01.04.2025 11:29 AMOn the hourly chart, the GBP/USD pair continued to trade sideways on Monday. Currently, there is no dominance of either bulls or bears in the market. This has been the case for an entire month. The 1.2931 level is not strong, so it's not a point to look for trading opportunities.

The wave situation is completely clear. The last completed downward wave did not break the low of the previous wave, while the last upward wave broke the previous high. Thus, a "bullish" trend is still forming. Most traders still do not want to buy the U.S. dollar regardless of economic data, since Donald Trump continues to introduce new tariffs that are expected to hurt U.S. and global economic growth in the future. For the bullish trend to start transforming into a bearish one, a consolidation below the 1.2865 level is needed.

There was virtually no fundamental background on Monday. While Germany released some reports, the UK had nothing noteworthy. In the U.S., the Chicago Business Activity Index came out better than expected – 47.6 vs. the forecast of 45.2. However, this report provided little support to the bears. Traders are currently hesitant to act because Donald Trump may announce new import tariffs for the U.S. today or tomorrow. No one knows what these tariffs will be, and trying to predict Trump's decisions is like reading tea leaves. Therefore, most traders prefer to wait for the official announcement of new tariff measures before making decisions. Waiting is currently the best strategy. This week, Trump mentioned that he is considering reciprocal tariffs for all countries globally, but he could easily change his stance. The market is on hold.

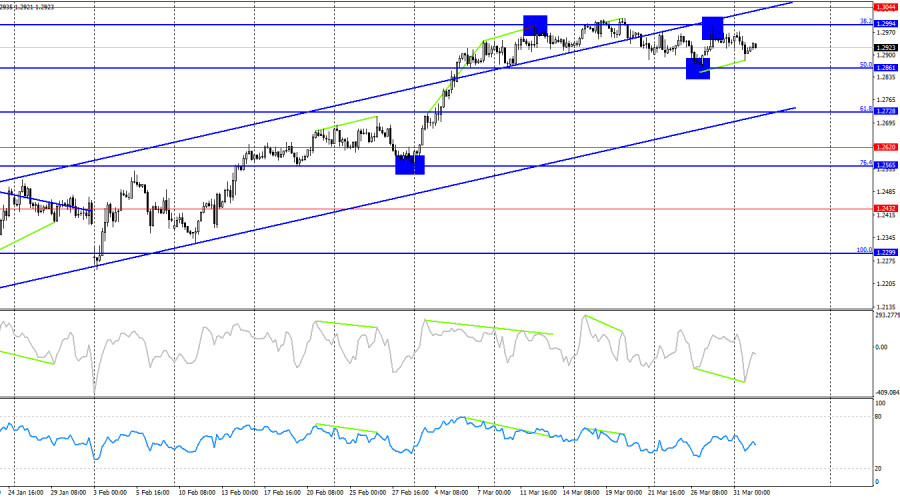

On the 4-hour chart, the pair maintains a bullish trend. A strong drop in the pound is unlikely unless there's a breakout below the ascending channel. A rebound from the 38.2% Fibonacci level at 1.2994 will again work in favor of the dollar and a decline toward the 50.0% corrective level at 1.2861. However, the bullish divergence on the CCI indicator allows for a slight upward movement. On the hourly chart, the pair is clearly range-bound.

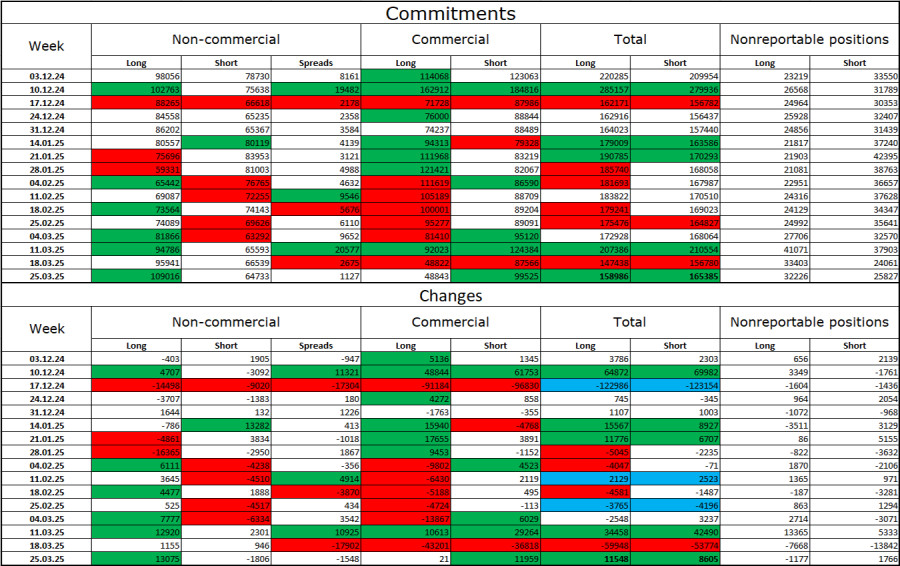

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" trader category became more bullish in the latest reporting week. The number of long positions held by speculators increased by 13,075, while short positions declined by 1,806. Bears have lost their advantage in the market. The gap between long and short positions now stands at nearly 44,000 in favor of the bulls: 109,000 vs. 65,000.

In my view, the pound still has potential for a decline, but recent developments could cause the market to reverse in the long term. Over the past three months, the number of long positions has grown from 98,000 to 109,000, while short positions decreased from 78,000 to 65,000. More importantly, over the last 8 weeks, long positions rose from 59,000 to 109,000, while shorts fell from 81,000 to 65,000.

News Calendar for the U.S. and UK:

On Tuesday, the economic events calendar includes four key releases, each of which could significantly influence market sentiment throughout the day.

GBP/USD Forecast and Trader Tips:

Selling the pair is possible after a new rebound from the 1.3003 level on the hourly chart, with targets at 1.2931 and 1.2865, as the pair remains range-bound. Buying is possible after a rebound from the 1.2865 level, with targets at 1.2931 and 1.3003.

Fibonacci levels are built from 1.2809–1.2100 on the hourly chart and from 1.2299–1.3432 on the 4-hour chart.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dengan munculnya Divergence antara pergerakan harga pasangan mata uang silang EUR/JPY dengan indikator Stochastic Oscillator juga diikuti oleh hadirnya pola Bullish 123 yang diikuti oleh Bullish Ross Hook (RH)

Pada chart 4 jamnya, pasangan mata uang silang GBP/AUD nampak terlihat bergerak dibawah EMA (21)-nya dan indikator Stochastic Oscillator dalam kondisi Crossing SELL, maka dalam waktu dekat berdasarkan kedua info

Rencana trading kami untuk beberapa jam ke depan adalah menjual emas di bawah 3.224, dengan target di 3.203 dan 3.156. Kita harus waspada terhadap setiap rebound teknis, karena prospek tetap

Pada chart 4 jamnya instrument komoditi Minyak Mentah nampak terlihat munculnya pola Inverted Head & Shoulders serta Bullish Pola 123 dan Divergence antara pergerakan harga #CL dengan indikator Stochastic Oscillator

Dengan munculnya Divergence dari indikator Stochastic Oscillator dengan pergerakan harga XPD/USD di chart 4 jamnya serta munculnya pola Bullish 123 yang diikuti oleh pergerakan harganya yang bergerak diatas EMA (21)

Selama sesi Eropa, euro mencapai level tertinggi baru sekitar +2/8 Murray, yang terletak di 1.1473. Pergerakan EUR/USD ini terjadi setelah pengumuman oleh Kementerian Keuangan Tiongkok bahwa Beijing akan menaikkan tarif

Pada awal sesi Amerika, emas mengalami koreksi teknikal yang kuat setelah mencapai level tertinggi baru sekitar 3.237,69 untuk saat ini. Data ekonomi dari Amerika Serikat akan dirilis dalam beberapa

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.