Lihat juga

03.04.2025 06:28 PM

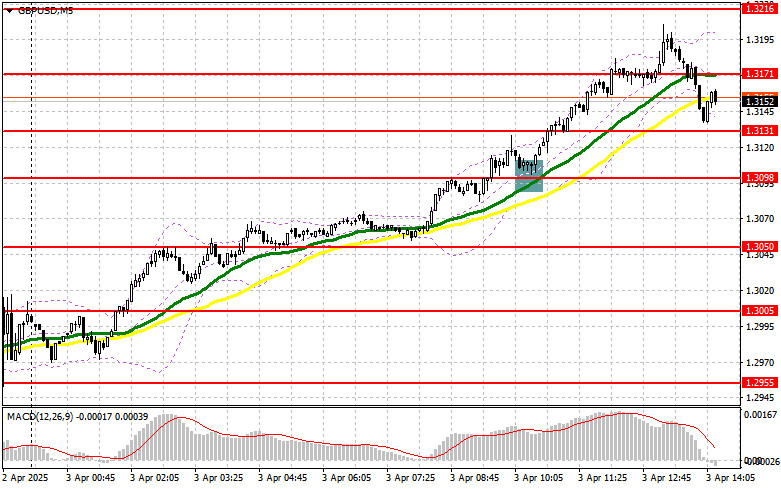

03.04.2025 06:28 PMIn my morning forecast, I highlighted the 1.3098 level and planned to base entry decisions on it. Let's take a look at the 5-minute chart to see what happened. A decline followed by a false breakout at that level created a long entry point, which resulted in a rise of over 100 points for the pair. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD:

Despite rather weak data on the UK services sector, speculation that Trump's new tariffs will primarily harm the U.S. and its economy — and only secondarily the rest of the world — has fueled demand for risk assets, benefiting the British pound.

Today's U.S. statistics are unlikely to provide meaningful support for the dollar. I'm not sure what kind of figures would be required in jobless claims, the trade balance, or the ISM services PMI to help the dollar recover even part of today's losses. Speeches by FOMC members Philip N. Jefferson and Lisa D. Cook also aren't likely to help much.

If the pair declines, I'd prefer to act near the 1.3131 support level. A false breakout there, similar to the one discussed above, will provide a good entry point into long positions with a target at 1.3171. A breakout with a downward retest of this range will offer another long entry point, targeting 1.3202. The furthest target will be 1.3262, where I plan to take profit.

If GBP/USD drops and bulls remain inactive near 1.3131 in the second half of the day, pressure on the pound will increase significantly. In that case, only a false breakout near 1.3098 will justify new long entries. Otherwise, I'll buy GBP/USD on a rebound from the 1.3057 support level, targeting a 30–35 point intraday correction.

To open short positions on GBP/USD:

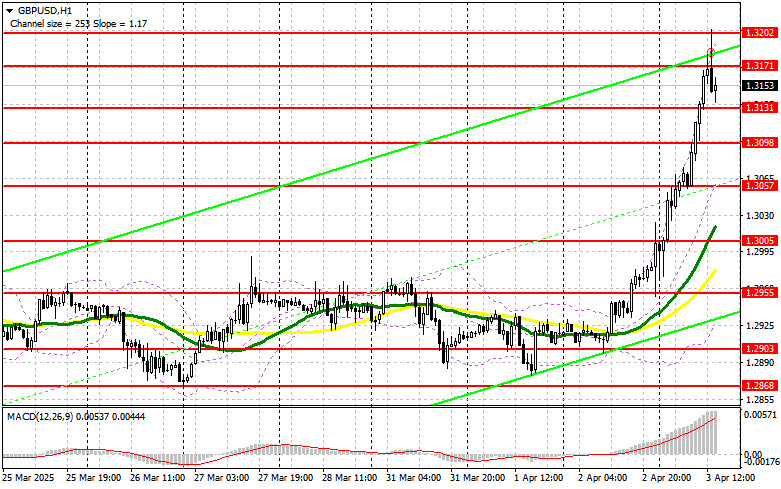

Sellers of the pound don't have much to rely on. Only exceptionally strong U.S. data could trigger a correction in the pair. If GBP/USD continues to rise — which is more likely — I won't rush into selling in such a market.

Only a false breakout near the 1.3202 resistance will provide an entry point for short positions, targeting the newly formed support at 1.3131. A breakout and retest from below would trigger stop-loss orders, opening the path to 1.3098 and hitting buyers hard. The final target will be 1.3057, where I plan to lock in profits. Testing this level may trap the pair within a sideways channel.

If demand for the pound persists in the second half of the day and bears fail to show up at 1.3202, I will postpone selling until a test of the 1.3262 resistance. I'll consider shorting only after a failed breakout. If there's no downward move from that level either, I'll look to open short positions from 1.3301 on a rebound, targeting a 30–35 point correction.

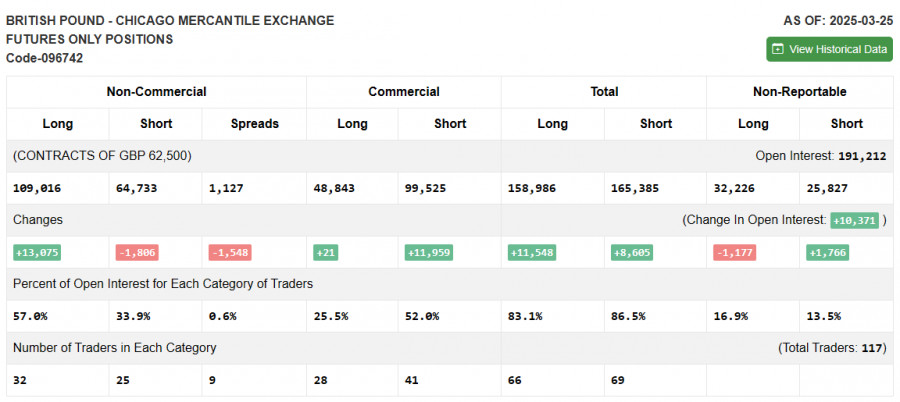

COT Report (Commitment of Traders) – March 25:

The report showed an increase in long positions and a reduction in shorts. Buying interest in the pound continues, which is clearly visible on the chart. While many risk assets have declined, the GBP/USD pair shows stability.

Taking into account the latest inflation figures in the UK and comments from Bank of England officials, the regulator will likely keep its current policy unchanged at the April meeting — a factor that could temporarily support the pound. However, the key issue remains the scale of impact from U.S. tariffs. An increased risk of a global economic slowdown will apply pressure to risk assets, including the pound.

The latest COT report showed non-commercial long positions rising by 13,075 to 109,016, while short positions fell by 1,806 to 64,733. The net position gap narrowed by 1,548.

Indicator Signals:

Moving Averages: Trading is taking place above the 30- and 50-day moving averages, indicating further upside for the pound.

Note: The author uses H1 chart moving averages, which may differ from classic daily MA readings on the D1 chart.

Bollinger Bands: If the pair declines, the lower band near 1.3057 will serve as support.

Indicator Descriptions:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Kamis, pasangan GBP/USD menunjukkan pergerakan naik yang minimal; namun, pada kerangka waktu 5 menit, ini sebagian besar merupakan pergerakan menyamping. Inggris merilis laporan PDB dan produksi industri kemarin

Pada hari Kamis, pasangan mata uang EUR/USD diperdagangkan dalam dua arah. Latar belakang makroekonomi cukup kaya, tetapi tidak memiliki dampak yang menentukan seperti yang kami perkirakan. Banyak laporan saling menutupi

Pada hari Kamis, pasangan mata uang GBP/USD diperdagangkan secara mendatar dengan volatilitas rendah. Meskipun kalender makroekonomi padat, pasar mengabaikan sebagian besar data, seperti yang diperkirakan. Di Inggris, laporan PDB untuk

Pada hari Kamis, pasangan mata uang EUR/USD hanya menunjukkan satu hal—ketidakinginan penuh untuk bergerak. Kami mengamati pergerakan menyamping sepanjang hari meskipun kalender makroekonomi cukup padat. Namun, seperti yang disebutkan dalam

Pada hari Rabu, pasangan GBP/USD melanjutkan pergerakan naiknya, meskipun tidak ada alasan fundamental khusus. Sehari sebelumnya, laporan inflasi AS dirilis di bawah ekspektasi, yang secara formal menunjukkan kemungkinan pelonggaran sikap

Pada hari Rabu, pasangan mata uang EUR/USD mengalami pergerakan naik selama sekitar setengah hari. "Lonjakan" terbaru pada euro ini sangat "mengagumkan," meskipun kemungkinan besar hanya merupakan penurunan lain pada dolar

Pada hari Rabu, pasangan mata uang GBP/USD melanjutkan trading dengan kecenderungan naik untuk beberapa waktu, tetapi kembali mengalami penurunan pada sore hari. Dari sudut pandang kami, dolar AS telah melemah

Pada hari Rabu, pasangan mata uang EUR/USD melanjutkan pergerakan naik, tetapi hanya sebentar. Pada sore hari, euro mulai turun, meskipun tidak ada faktor makroekonomi yang mendukung pergerakan tersebut. Donald Trump

Pada hari Selasa, pasangan GBP/USD mengalami pertumbuhan yang signifikan, meskipun tidak ada pemicu yang jelas di baliknya. Pada hari Senin, dolar naik karena alasan tertentu, tetapi pada hari Selasa turun

Pada hari Selasa, pasangan mata uang EUR/USD hampir sepenuhnya pulih dari penurunan hari Senin. Seperti yang telah terbukti, diperlukan alasan kuat agar dolar AS menguat, seperti kemajuan dalam negosiasi perdagangan

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.