Lihat juga

03.04.2025 06:36 PM

03.04.2025 06:36 PMTrade Breakdown and Trading Tips for the British Pound

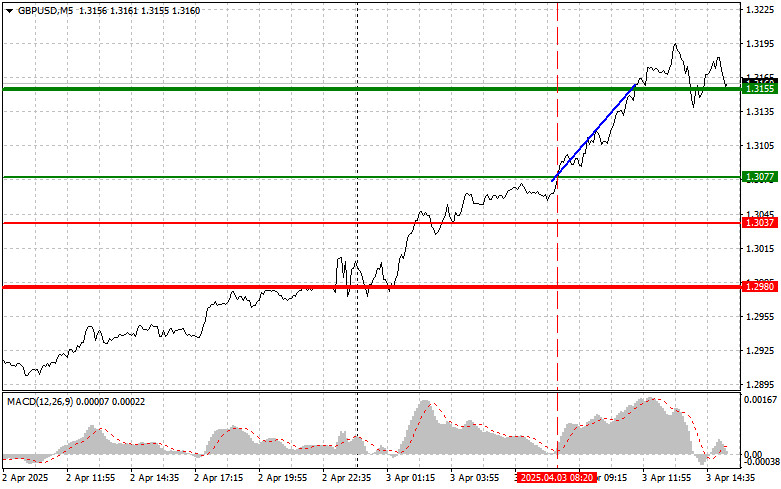

The test of the 1.3077 level coincided with the MACD indicator just beginning to rise from the zero line, confirming a correct entry point for buying the pound. As a result, the pair climbed to the target level of 1.3155.

Despite unimpressive UK Services PMI figures, speculation that Trump's new tariffs would negatively affect the U.S. dollar and economy more than the global economy triggered renewed buying of the pound.

Ahead lies the publication of the ISM Services PMI. Only very strong U.S. macroeconomic indicators might support the dollar—possibly the last of such support, considering Trump's tariff policy. Investors will also be watching public statements from FOMC members. A speech by FOMC member Philip N. Jefferson will provide insight into his assessment of the economy and future monetary policy outlook. His remarks may hint at the Fed's intentions regarding future tightening or easing. FOMC member Lisa D. Cook will also speak, and her views on inflation and employment will help assess the broader discussion trend within the FOMC.

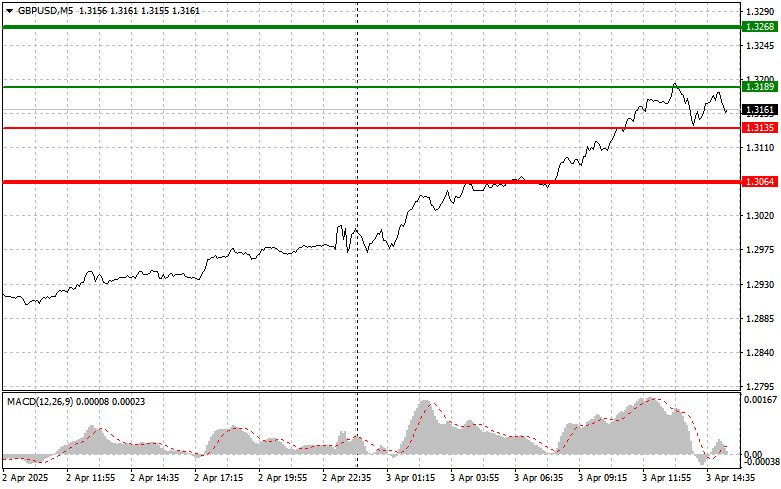

As for the intraday strategy, I will mainly focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound around the entry point at 1.3189 (green line on the chart) with a target of 1.3268 (thicker green line on the chart). Around 1.3268, I will exit long positions and open shorts in the opposite direction, aiming for a 30–35 point pullback. Pound strength today can be expected to continue the trend. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound in case of two consecutive tests of the 1.3135 level, when the MACD indicator is in oversold territory. This will limit the downward potential and likely trigger a market reversal upward. A rise to the opposite levels of 1.3189 and 1.3268 can be expected.

Scenario #1: I plan to sell the pound after breaking below the 1.3135 level (red line on the chart), which would likely trigger a sharp decline. The main target for sellers will be the 1.3064 level, where I will exit shorts and open longs in the opposite direction, targeting a 20–25 point rebound. Sellers may gain momentum if U.S. employment data is strong. Important: Before selling, ensure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the pound if the price tests the 1.3189 level twice in a row while MACD is in overbought territory. This will limit upward potential and may lead to a reversal down toward 1.3135 and 1.3064.

Chart Guide

Important Reminder for Beginners:

Beginner Forex traders should exercise caution when entering the market. It's best to stay out of the market before key fundamental reports to avoid sharp price fluctuations. If you decide to trade during news releases, always set Stop Loss orders to minimize losses. Without Stop Losses, you could quickly lose your entire deposit—especially if you don't use money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one provided above. Making spontaneous trade decisions based on current market conditions is inherently a losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga di 14068 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Uji level harga 1.3356 bertepatan dengan saat indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Akibatnya, pasangan ini turun lebih

Uji level harga 1,1460 pada paruh kedua hari itu bertepatan dengan indikator MACD yang mulai bergerak turun dari garis nol, mengonfirmasi titik entri yang tepat untuk menjual euro. Akibatnya, pasangan

Euro dan pound merosot tajam, bersama dengan beberapa aset sensitif risiko lainnya yang dipasangkan dengan dolar AS—dan ada alasan objektif untuk ini. Kemarin, Donald Trump menyatakan kesiapannya untuk menurunkan tarif

Minyak dan gas terus bermain sesuai aturan politik besar. Setiap pernyataan Trump, setiap keputusan Federal Reserve, dan setiap langkah baru dari Tiongkok seperti kartu baru dalam permainan energi yang kompleks

Analisis Trading dan Tips Trading untuk Yen Jepang Uji pertama level 140.35 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli

Analisis dan Kiat-kiat Trading untuk Pound Inggris Uji level 1,3394 terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk pasar yang valid. Akibatnya, pasangan

Rincian Trading dan Kiat-kiat untuk Trading Euro Pengujian level 1,1521 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk posisi jual

Tidak ada pengujian pada level yang telah saya tandai di paruh kedua hari itu, karena volatilitas yen menurun secara signifikan. Data hari ini menunjukkan bahwa indeks harga konsumen inti Bank

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.