Lihat juga

04.04.2025 06:07 AM

04.04.2025 06:07 AMThe GBP/USD currency pair posted a 300-pip upward move from Wednesday evening through Thursday. Given the current situation, this may not end the dollar's decline. To be honest, the fall of the dollar is actually working in America's favor, as Trump has introduced tariffs of 10% for most countries, while the dollar itself has depreciated by roughly the same 10% during Trump's time in office. The cheaper the dollar is globally, the more attractive U.S. goods and commodities become. However, this argument now seems highly questionable.

We believe the dollar's decline is not due to fears of a U.S. recession or other negative economic outcomes. The dollar's drop in both early March and early April appears to be more of a protest against America and Donald Trump personally. It's important to understand that behind every country are ordinary people. Of course, global consumers won't suddenly stop buying American goods altogether, but even a 30% drop in aggregate demand would harm the U.S. economy.

That said, things are now likely to go badly for everyone. Experts warn that many goods—tariffed or not—will become more expensive. First, many countries are ready to retaliate against Trump with their tariffs. Second, Trump has made it clear that he will respond to any countermeasures with new tariffs of his own. So far, we've seen only the beginning of the trade war, and further escalation is highly likely. Third, if the products of one automaker suddenly rise in price, others may raise their prices as well. In short, the world faces a sharp price spike and a narrowing of available product choices.

As unfortunate as it is, the ones who will pay for this trade war are ordinary consumers. They'll either pay more for the same products or search for cheaper alternatives. Macroeconomic data on Wednesday and Thursday had absolutely no impact on the market. The U.S. will release Nonfarm payroll data and unemployment figures on Friday, and Federal Reserve Chair Jerome Powell is scheduled to speak. But does anyone believe these reports and events will support or help the dollar recover? Trump's actions have essentially shattered the downtrend on the daily timeframe. If the U.S. president continues this path, even the long-term 16-year trend could be broken. Unfortunately, this is one of those times when technical analysis on higher timeframes does not influence price movement. The market is in a state of panic, and traders are aggressively dumping the dollar. This could turn into a prolonged process.

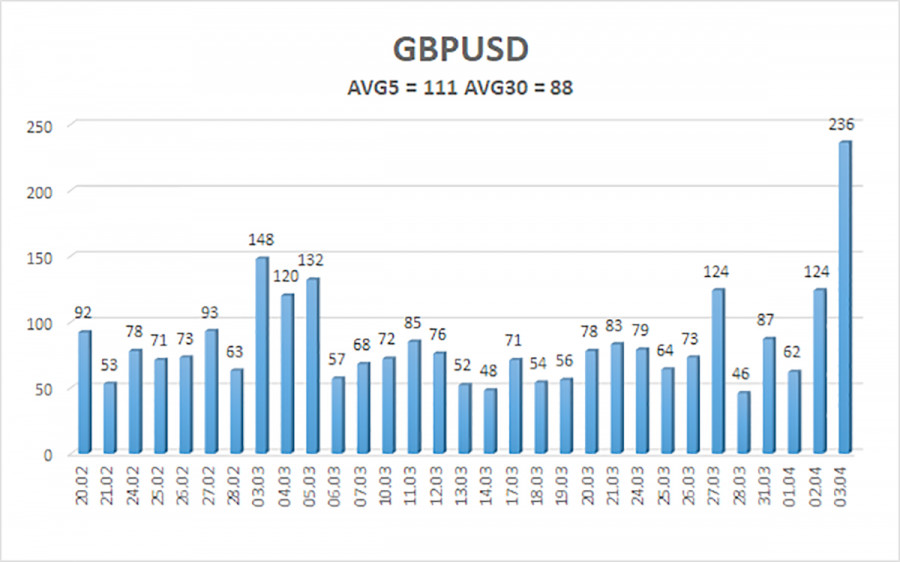

As of April 4, the average volatility of the GBP/USD pair over the past five trading days stands at 111 pips, which is considered high for this pair. On Friday, we expect movement within the range of 1.3000 to 1.3222. The long-term regression channel is pointing upward, indicating short-term strength, but the downtrend on the daily chart remains intact. The CCI indicator recently entered overbought territory, which signaled a downward pullback.

S1 – 1.3062

S2 – 1.2939

S3 – 1.2817

R1 – 1.3184

R2 – 1.3306

R3 – 1.3428

The GBP/USD pair continues its strong upward movement, driven by just one factor—Donald Trump's trade policy. We still do not consider long positions viable, as we view the current rise as a correction on the daily timeframe that has taken on an illogical form. However, if you trade solely on technicals, long positions remain valid with targets of 1.3222 and 1.3306. The pound may continue rising if Trump continues to introduce new tariffs. Short positions remain attractive with targets at 1.2207 and 1.2146 since, sooner or later, the upward correction on the daily chart will end—assuming the previous downtrend hasn't already ended by that time. Even if we're now witnessing the beginning of a new uptrend, a downward correction is necessary, as the pound has been rising almost without any pullbacks.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Seperti yang diantisipasi, ECB memangkas semua suku bunga utama sebesar seperempat poin, menurunkan suku bunga deposito menjadi 2,25%. Pada pertemuan ini, tidak ada proyeksi staf baru yang dirilis, dan mengingat

Gelombang euforia baru telah melanda pasar. Banyak yang percaya ini bukan kebetulan: ambil semuanya dari seseorang dan kemudian berikan mereka sedikit saja, dan mereka akan merasakan kebahagiaan. Jadi, apa yang

Sejumlah besar peristiwa makroekonomi dijadwalkan pada hari Rabu. Semua peristiwa tersebut adalah laporan Indeks Manajer Pembelian (PMI) untuk bulan April di sektor jasa dan manufaktur. Indeks-indeks ini akan dipublikasikan

Pada hari Selasa, pasangan mata uang GBP/USD diperdagangkan dengan lebih tenang, sekali lagi menunjukkan tanda-tanda pola "maxed-out flat". Seperti yang telah disebutkan sebelumnya, dolar AS belakangan ini hanya memiliki

Pada hari Selasa, pasangan mata uang EUR/USD diperdagangkan lebih tenang dibandingkan hari Senin. Dolar AS berhasil menghindari penurunan lebih lanjut, tetapi masih terlalu dini untuk merayakannya. Dolar bisa saja jatuh

Ketakutan dapat melumpuhkan, tetapi tindakan tetap berlanjut. Para investor perlahan-lahan mengatasi kekhawatiran mereka terhadap serangan Donald Trump terhadap independensi Federal Reserve dan mulai mengunci keuntungan pada posisi panjang EUR/USD

Pelan tapi pasti memenangkan perlombaan! Bitcoin diam-diam menembus level tertingginya sejak awal Maret di tengah serangan Donald Trump terhadap Jerome Powell. Ketika independensi Federal Reserve dipertaruhkan dan kepercayaan terhadap dolar

Setelah mencapai rekor tertinggi baru di $3500 dalam kondisi overbought, harga emas mengalami penurunan. Namun, sentimen bullish tetap kuat karena kekhawatiran yang terus-menerus mengenai potensi dampak ekonomi dari kebijakan tarif

Pada hari ini, pasangan EUR/GBP mengalami penurunan setelah dua hari berturut-turut mengalami kenaikan, diperdagangkan mendekati level psikologis 0,8600. Pound mendapatkan dukungan dari optimisme seputar negosiasi perdagangan yang sedang berlangsung antara

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.