Lihat juga

04.04.2025 07:29 AM

04.04.2025 07:29 AMOnly a few macroeconomic events are scheduled for Friday, but they may trigger a new storm. The market has not yet recovered from Wednesday evening's events when Trump imposed trade tariffs on all countries worldwide. As a result, the dollar's decline may very well continue today on this factor alone. However, in the second half of the day, the U.S. will release the NonFarm Payrolls and unemployment rate reports. It goes without saying how important these reports are—especially if the actual figures deviate from forecasts. At this point, the dollar can only hope for a correction. If the data is weaker than expected, the market will eagerly continue selling off the U.S. currency.

There's no point in discussing anything other than Trump's trade tariffs. The dollar's decline may continue for several more days, and we recommend that traders pay attention to speeches from the leaders of major countries and alliances regarding retaliatory tariffs. Trump said that any response to his measures to "eliminate injustice" would be met harshly with new sanctions and tariffs. So, anyone who assumed that the tariffs introduced on Wednesday were final and their rates fixed is seriously mistaken. Lengthy and complex negotiations are about to begin with all the "sanctioned" countries that will not accept Trump's tariffs. Large players will now start implementing counter-tariffs. Today, we await a speech from Federal Reserve Chair Jerome Powell, who will undoubtedly comment on the updated trade policy.

On the last trading day of the week, both currency pairs may continue to rise, as Trump has once again done everything to push the dollar lower. This is likely far from the last shock to hit the markets in 2025. The global trade architecture is transforming, and many changes in trade flows are expected. Numerous companies and governments will seek new markets, reorient their strategies, and form trade alliances and agreements. This will lead to a significant redistribution of financial and trade flows. And in the currency market, we may see more than one storm ahead.

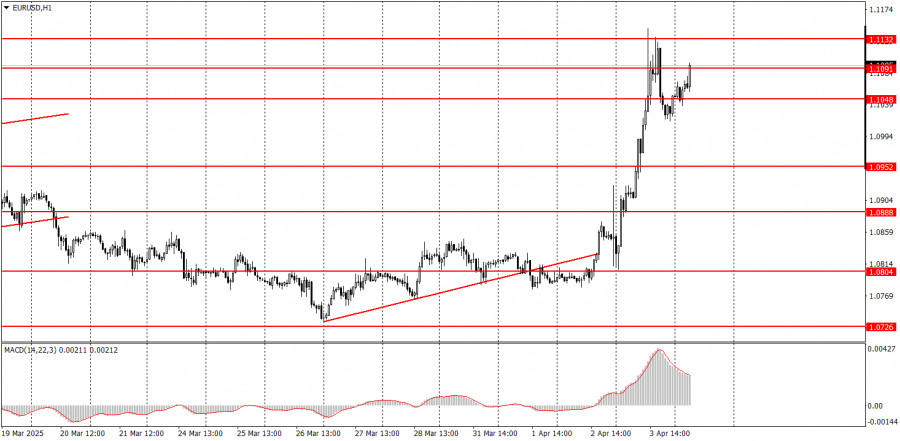

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Minggu mendatang diprediksi akan sepi dari acara besar atau berita dramatis—tidak ada janji baru dari Donald Trump yang mengguncang dunia. Meskipun demikian, masih ada faktor-faktor yang patut diperhatikan yang dapat

Pada hari Senin, sangat sedikit acara makroekonomi yang dijadwalkan. Satu-satunya rilis yang patut diperhatikan adalah estimasi kedua Indeks Harga Konsumen (CPI) untuk bulan April di Zona Euro, yang kurang signifikan

Kalender ekonomi untuk minggu mendatang mencakup beberapa peristiwa fundamental penting untuk pasangan EUR/USD. Namun, tanpa informasi mengenai prospek negosiasi perdagangan, bahkan faktor fundamental "klasik" yang kecil pun mungkin lebih menonjol

Pada hari Jumat, pasangan mata uang GBP/USD terus bergerak menyamping, sebuah tren yang telah berlangsung selama sebulan. Seperti yang terlihat jelas pada grafik 4 jam, harga sebagian besar bergerak menyamping

Pada hari Jumat, pasangan mata uang EUR/USD diperdagangkan dengan sedikit penurunan, dan volatilitas secara keseluruhan telah menurun setelah "April yang mencengangkan". Dolar AS telah menguat selama lebih dari sebulan, meskipun

Seperti yang telah menjadi kebiasaan dalam beberapa bulan terakhir, latar belakang berita ekonomi memberikan pengaruh yang sangat kecil pada instrumen keuangan. Donald Trump dan kebijakan perdagangannya tetap menjadi penggerak utama

USD/JPY. Analisis dan Prakiraan

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.