यह भी देखें

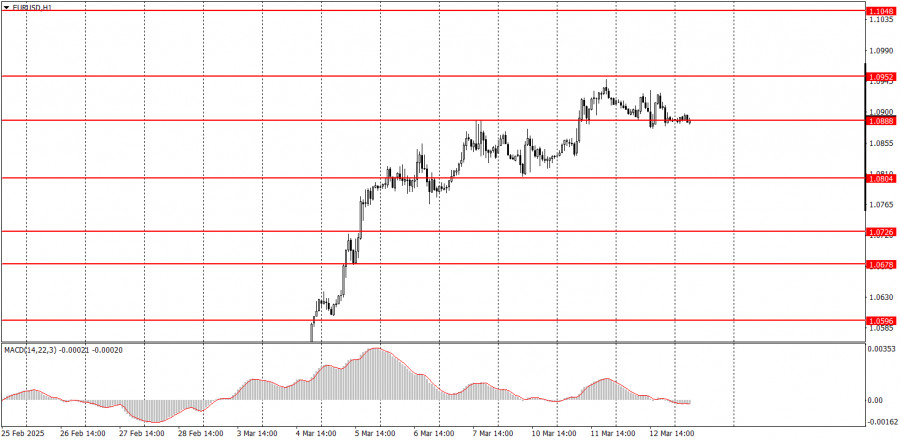

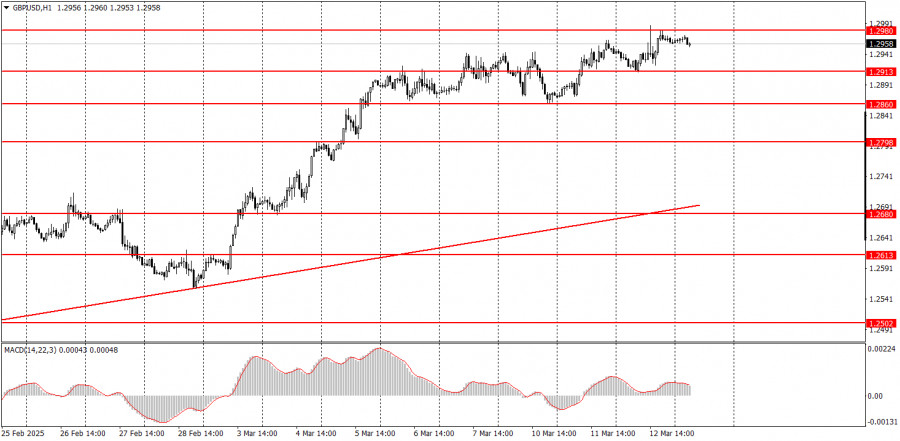

There are few macroeconomic events scheduled for Thursday, and regardless, they are unlikely to hold significant weight for traders. Over the past week and a half, the market has largely ignored events and reports that suggest the strength of the U.S. dollar and economy. Instead, it has reacted strongly to news unfavorable to the U.S. currency, particularly reports about Donald Trump introducing new tariffs. Additionally, a market correction is in the works, which may lead the EUR/USD pair to trend downward, regardless of the macroeconomic context. Meanwhile, the GBP/USD continues its steady growth.

On Thursday, several representatives from the European Central Bank are scheduled to speak. However, the market remains focused primarily on Donald Trump's decisions and statements. Recently, Christine Lagarde delivered a speech addressing inflation, noting that while inflation could see a slight uptick due to U.S. tariffs, a significant rise is unlikely. She also mentioned that inflation might become more stable. Nevertheless, the market showed little interest in this information, as Trump's tariffs and the resolution of the Ukraine conflict remain the prevailing concerns.

On the fourth trading day of the week, both currency pairs may fluctuate in any direction, as the market is currently driven by emotions. Donald Trump is a significant catalyst in this situation. If the U.S. president announces new sanctions or tariffs, the dollar could face pressure. Conversely, if there are no updates from Trump, both currency pairs may experience a slight correction. However, it is worth noting that the pound shows no signs of wanting to correct at all.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

इंस्टाफॉरेक्स

PAMM खाता

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.