Lihat juga

24.01.2025 12:52 PM

24.01.2025 12:52 PMThe ongoing recession in Europe, compounded by the Western conflict with Russia on Ukrainian territory, is likely to force the European Central Bank (ECB) to lower interest rates to mitigate the region's economic damage.

In such a scenario, rate cuts by the ECB, in contrast to potential rate hikes by the Bank of Japan, could lead to a significant decline in the EUR/JPY pair's rate.

The pair may face selling pressure as the euro weakens against the yen, potentially driving the pair lower today, with further downside expected next week following the ECB's decision to cut rates.

Technical picture and trading idea:

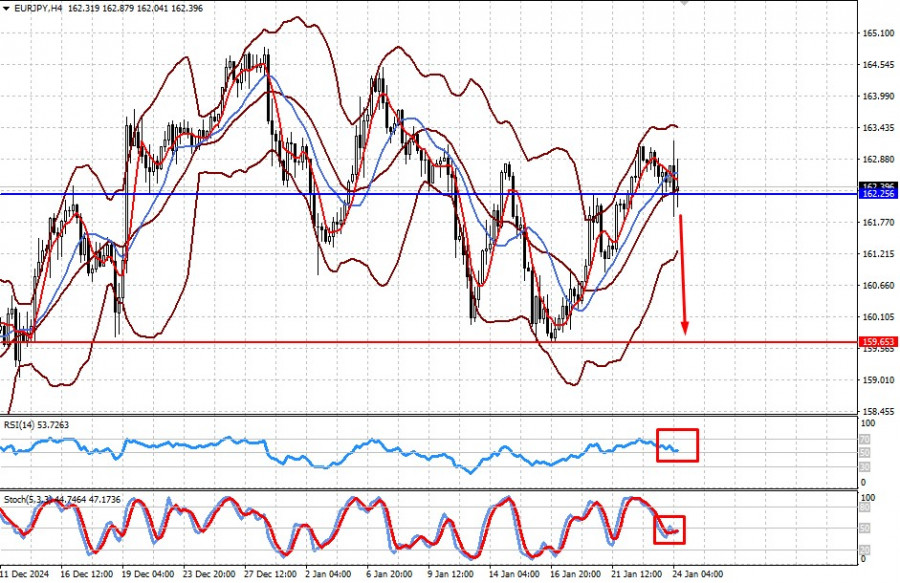

The price is currently at the midline of the Bollinger Bands, below both the 5-period and 14-period SMAs, which are crossing to signal a sell. The RSI remains above the 50% level but is approaching it, with a break below serving as an additional sell signal. Meanwhile, the Stochastic indicator is below 50%, though currently offering limited insight.

A drop below the 162.25 level could lead to a notable decline toward the 159.65 level.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Semalam, seperti yang dijangkakan, ECB menurunkan kadar faedah utama sebanyak suku mata, menjadikan kadar pembiayaan semula kepada 2.15%. Dalam sidang akhbar, Presiden ECB Christine Lagarde menyatakan bahawa kadar telah kembali

Di sebalik sedikit optimisme semalam berikutan keputusan ECB untuk menurunkan kadar faedah dan hampir melengkapkan kitaran pelonggaran, pound hampir mencecah paras sasaran 1.3635. Hari ini bermula secara neutral, nampaknya dalam

Sehingga pagi ini, pasangan USD/JPY berada dalam situasi yang benar-benar maksud berganda — dengan kebarangkalian yang seimbang antara pertumbuhan dan penurunan. Petunjuk yang mencadangkan potensi pertumbuhan termasuk harga yang kekal

Pada awal sesi Eropah, euro didagangkan sekitar paras 1.1440, mengalami pembetulan teknikal selepas mencapai paras psikologi 1.15. Data Senarai Gaji Bukan Ladang AS akan diterbitkan dalam sesi dagangan Amerika

Di sisi lain, emas dijangka akan mengalami pembetulan teknikal. Pada 30 Mei, ia meninggalkan jurang sekitar 3,284, dan jika ia mengukuh di bawah 3,350, ia berkemungkinan besar boleh mencapai sasaran

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.