Lihat juga

27.03.2025 07:07 PM

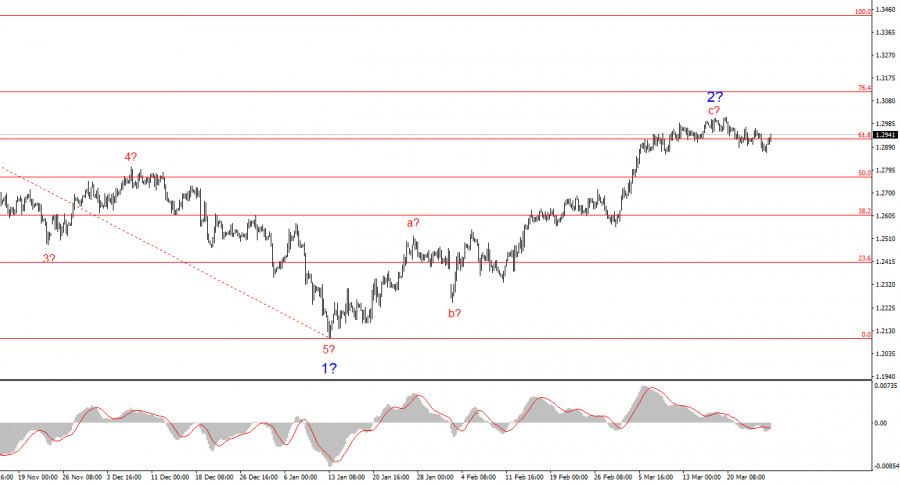

27.03.2025 07:07 PMThe wave pattern for GBP/USD remains somewhat ambiguous, but overall, it is manageable. There is still a high probability of a long-term downward trend developing. Wave 5 has taken a convincing form, so I consider senior wave 1 completed. If this assumption is correct, wave 2 is currently unfolding with targets around the 1.26 and 1.28 figures. The first two subwaves within wave 2 appear to be complete. The third could end at any moment.

Demand for the pound has recently been supported only by the "Trump factor," which remains the main ally of the British currency. However, over a longer horizon than just a few days, the pound still lacks a fundamental basis for growth. The Bank of England and the Fed have both recently shifted positions in favor of the pound, as the BoE has also indicated it is in no rush to cut interest rates. The current wave pattern remains intact, but any further rally in the instrument would raise serious concerns about its validity.

The GBP/USD rate rose by 70 basis points on Thursday and may continue its rise into the end of the day. Let's recall that Trump announced new tariffs overnight. That's when demand for the U.S. dollar began to fall again. However, American traders on U.S. exchanges and broker platforms did not have sufficient time to fully react to this news. Therefore, a decline in the dollar during the U.S. session is to be expected. Not guaranteed, of course—but expected.

The recent shallow decline of the pound is almost laughable. There are indeed factors limiting its fall, but there are also plenty of reasons to expect a stronger dollar. Yet, market participants seem focused only on Trump, his tariffs, the potential recession in the U.S. economy, and the Fed's near-zero interest rates. That's why demand for the U.S. dollar continues to weaken. The wave pattern is now on the verge of being invalidated, and the dollar can only hope that the April 2 tariffs will be the last. If so, persistent dollar selling may stop, and the pair will retain the chance to form wave 3 of the downward trend. Of course, this will now take much longer, as the dollar must regain market trust and its "safe haven" status—something that's hard to do under this president. Still, forming wave 3 remains possible.

The wave pattern for GBP/USD suggests that the downward trend is still developing, as is wave 2 of this movement. At this point, I would advise looking for new short entries, as the current wave pattern still favors a continuation of the downtrend that began last autumn. However, how Trump and his policies will continue to influence market sentiment remains a mystery. The current rise in the pound seems excessive relative to the wave pattern. The BoE and FOMC meetings could have served as the launch point for wave 3, but it appears they did not. And April 2 is still ahead...

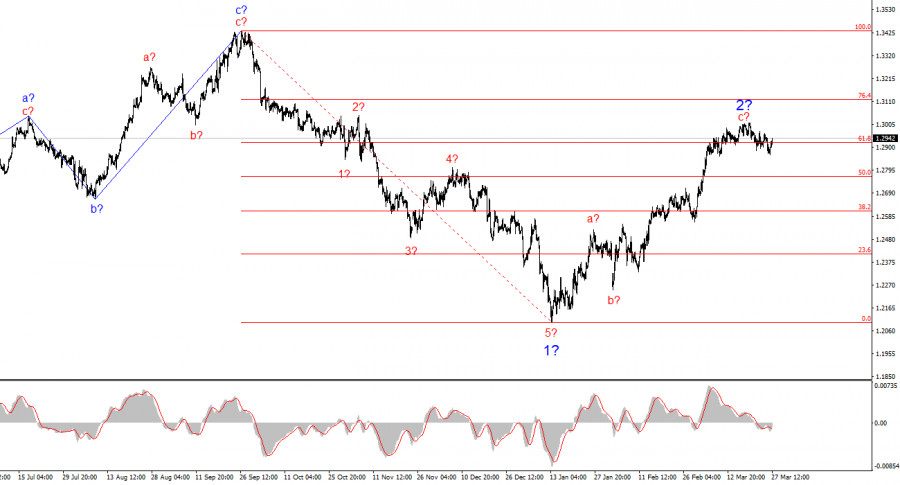

On the larger wave scale, the wave pattern has shifted. Now, we can assume the start of a downward trend, as the previous three-wave upward structure appears to be complete. If this assumption is correct, we should expect corrective wave 2 or b, followed by impulsive wave 3 or c.

Key Principles of My Analysis:

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Struktur gelombang untuk GBP/USD juga telah berubah menjadi corak menaik dan impulsif—disebabkan oleh Donald Trump. Gambaran gelombang hampir serupa dengan EUR/USD. Sehingga 28 Februari, kita dapat melihat pembentukan struktur pembetulan

Pola gelombang untuk GBP/USD juga telah berubah menjadi struktur impulsif kenaikan harga—terima kasih kepada Donald Trump. Gambaran gelombang ini sangat mirip dengan EUR/USD. Sehingga 28 Februari, kita menyaksikan struktur pembetulan

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.