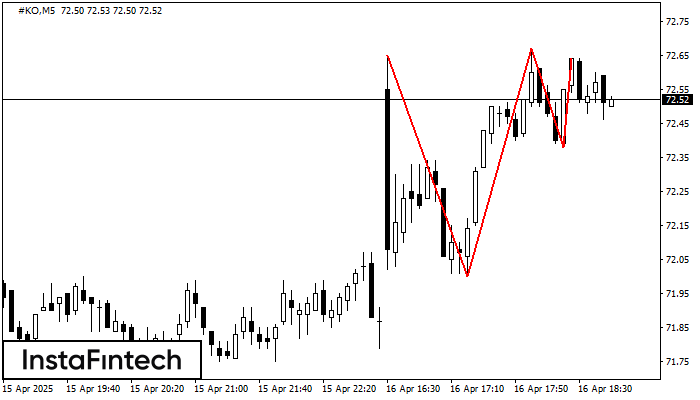

Triple Top

was formed on 16.04 at 17:50:25 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the #KO M5 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level 1, support level -38, and pattern’s width 65. Forecast If the price breaks through the support level 72.00, it is likely to move further down to 72.52.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

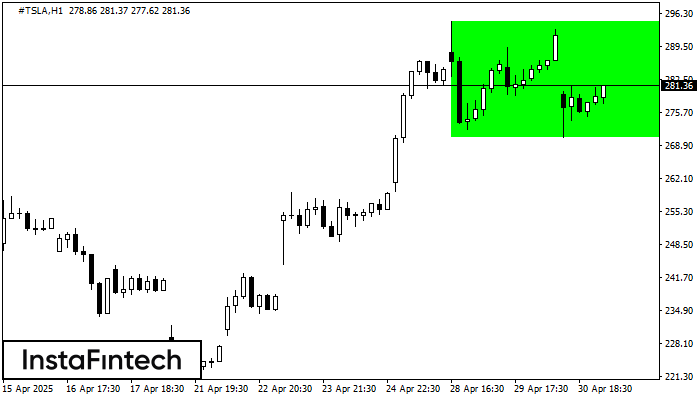

Segi Empat Menaik

was formed on 30.04 at 21:12:49 (UTC+0)

signal strength 4 of 5

Berdasarkan carta H1, #TSLA telah membentuk Segi Empat Menaik. Jenis corak ini menunjukkan kesinambungan aliran. Ia terdiri daripada dua tahap: rintangan 294.59 dan sokongan 270.55. Sekiranya tahap rintangan 294.59

Open chart in a new window

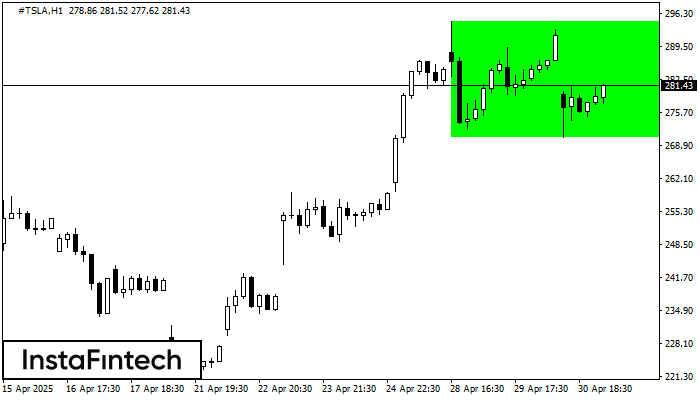

Segi Empat Menaik

was formed on 30.04 at 21:12:27 (UTC+0)

signal strength 4 of 5

Berdasarkan carta H1, #TSLA telah membentuk Segi Empat Menaik. Corak ini menunjukkan kesinambungan aliran. Sempadan atas adalah 294.59, sempadan bawah adalah 270.55. Isyarat bermakna bahawa kedudukan panjang perlu dibuka

Open chart in a new window

Segi Empat Menaik

was formed on 30.04 at 21:12:19 (UTC+0)

signal strength 3 of 5

Berdasarkan carta M30, #TSLA telah membentuk Segi Empat Menaik. Jenis corak ini menunjukkan kesinambungan aliran. Ia terdiri daripada dua tahap: rintangan 294.59 dan sokongan 270.55. Sekiranya tahap rintangan 294.59

Open chart in a new window