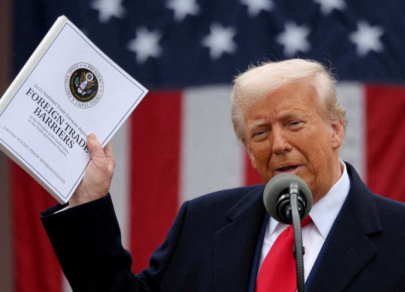

Trump's tariff hammer: countries hit hardest

On April 2, Donald Trump dealt another blow to global trade, unveiling a sweeping new round of tariffs that proved harsher than expected. A baseline tariff of 10% now applies to all exporters to the United States, while more than 60 countries face elevated levies. The biggest hit landed on China, with an additional 34% added to existing tariffs, bringing the total tariff burden on Chinese exports to 50% and in some cases up to 65%. But some nations were hit even harder. Here is a closer look at the countries facing the steepest penalties