Veja também

25.02.2025 12:21 AM

25.02.2025 12:21 AMIt has been a while since EUR/USD experienced such a rapid shift from being a strong performer to a weak one. Investors initially believed that Friedrich Merz, who won the elections, would work wonders and pull the German economy out of its recession. As a result, the exchange rate for this key currency pair rose to two-month highs. However, once it became apparent that this optimism was misplaced, the euro fell sharply.

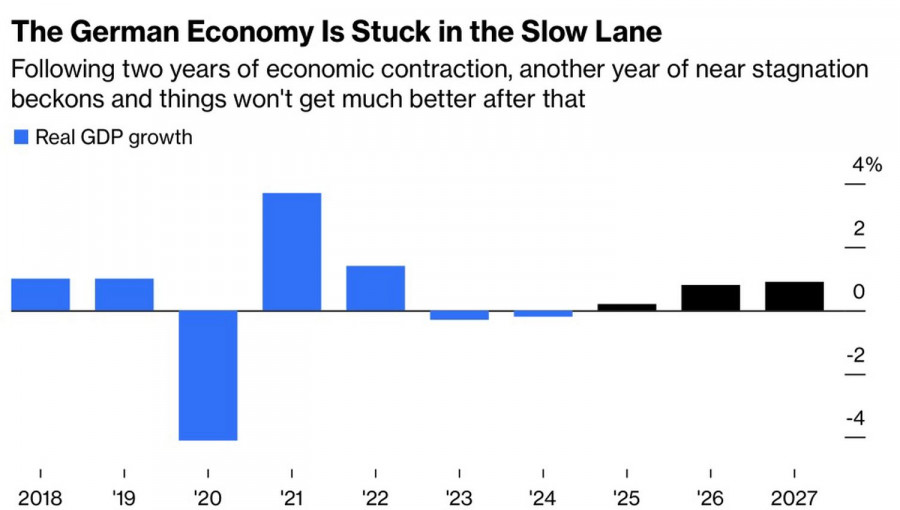

Multiple factors, including the ongoing conflict in Ukraine, the energy crisis, slowing GDP growth in China, and rising protectionism in the U.S., have transformed Germany from the engine of European growth into one of the weakest economies in the region. The recession projected for 2023-2024, along with the failure of GDP to return to pre-pandemic levels, has significant implications. In this context, the poor performance of the ruling party, Olaf Scholz's Social Democrats, which is their worst outcome since World War II, seems almost inevitable.

Investors viewed Friedrich Merz as a strong leader capable of improving the economy and standing up to Donald Trump. However, as the leader of the Christian Democratic Union, he is not a magician. Without the backing of a solid coalition, he cannot effectively implement fiscal measures, and Germany urgently needs to increase its defense spending. The only viable option is to issue more bonds, something Merz has previously criticized.

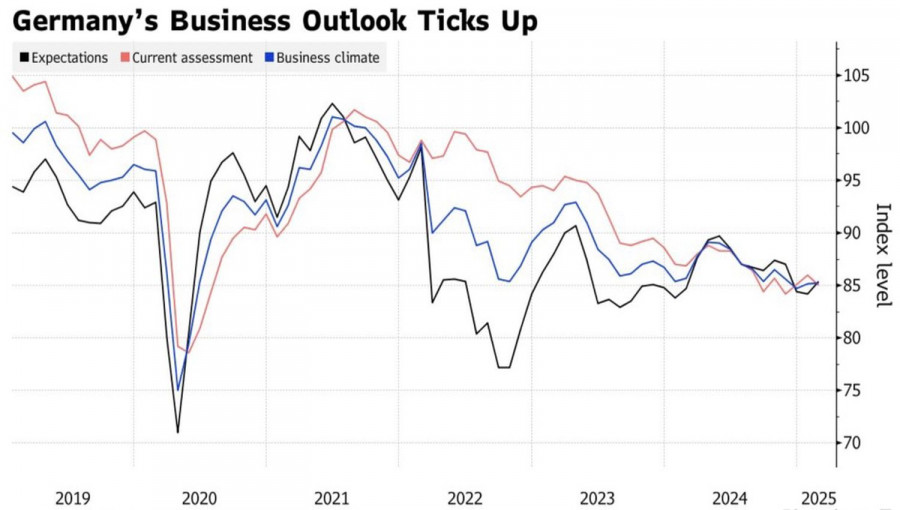

Excessive optimism has made the euro vulnerable. Nevertheless, things started off positively. German business confidence in the economy increased, and business activity surged, allowing the European Purchasing Managers' Index (PMI) to remain stable even as the French index fell to its lowest level in 18 months. Additionally, the expectations index from IFO also showed promising results.

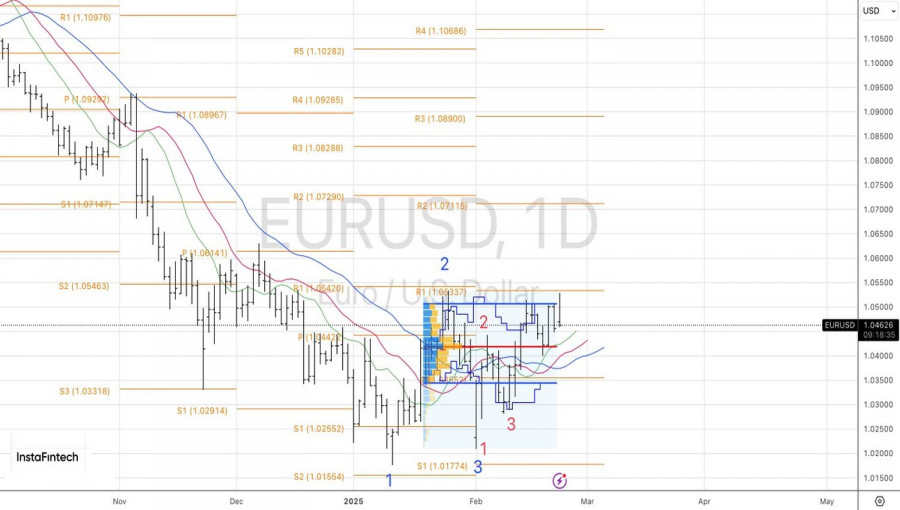

The initial faith in Friedrich Merz was strong, but the excitement surrounding the CDU's success quickly dissipated when it became clear that forming a coalition would not be straightforward. The euro had briefly surged above $1.05 multiple times in the past week, but it ultimately couldn't maintain that level and fell back down. If the market doesn't move in the expected direction, does it tend to shift the opposite way?

The results of the German parliamentary elections helped prevent a collapse of the euro, even amidst the worst daily performance of the S&P 500 since mid-December. Typically, a drop in US stock indices indicates a decline in global risk appetite and tends to bolster a safe haven currency like the US dollar. However, that wasn't the case this time.

What once supported the EUR/USD exchange rate now seems capable of undermining it. Friedrich Merz's struggle to quickly form a coalition contributed to the major currency pair falling to 1.0300.

From a technical perspective, the daily chart of EUR/USD shows a pin bar formation with a long upper shadow. The bulls' inability to generate upward momentum and the pair's return to its fair value range suggest a lack of strength. Furthermore, if the euro falls below $1.0455 and $1.0445, it could signal a selling opportunity.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

ouro queda terceiro consecutivo, por de nas comerciais os e parceiros, que reduzido demanda ativos refúgio, diante indícios desaceleração principais globais. Esses sinais positivos diminuem o apelo do ouro como

Os mercados já estão esgotados pelo caos que se desenrola na mente de Donald Trump e entre seus apoiadores. Tudo continua extremamente incerto, e por isso os participantes do mercado

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.