Veja também

08.04.2025 12:56 AM

08.04.2025 12:56 AMIf someone strikes your left cheek, there's no need to plead for mercy. Interestingly, more than 50 countries, according to the White House, have done just that. But not China. China is far too proud to ask the U.S. for tariff relief. It can take care of itself. Retaliatory measures are already in place, and markets are increasingly buzzing with talk of yuan devaluation—causing EUR/USD to swing back and forth.

Beijing has imposed 34% tariffs on U.S. imports and restricted exports of rare earth metals. According to Bloomberg sources, the government discusses ways to support its economy, which is targeted by U.S. tariffs. The proposed measures are boosting consumption, encouraging birth rates, subsidizing certain export sectors, and creating a stock market stabilization fund.

However, these steps are unlikely to dispel investor fears. On Forex, there's more and more talk of yuan depreciation to make Chinese exports cheaper. While Mizuho Financial Group forecasts a 3% drop in the yuan against the U.S. dollar, Wells Fargo sees a 15% decline, and Jefferies projects as much as 30%. The more significant the devaluation, the more likely others—including Europe—might follow. These expectations are causing the EUR/USD value to decline, pushing it into negative territory.

Then, the euro rebounds strongly, driven by decreasing investor confidence in the U.S. dollar and increasing expectations of significant monetary expansion from the Fed. Derivatives markets don't believe Jerome Powell's claims that the Fed has no reason to rush. They've only slightly lowered the number of expected rate cuts—from five to four.

At times, it appears that the market has forsaken rational behavior. Investor sentiment seems to be overtaken by Donald Trump's erratic decisions. The Republican urged Powell to "stop playing political games" and cut interest rates. His comments had more impact on EUR/USD than Powell's cautious statements.

Markets are struggling, and investors are uncertain of what to believe, leading to volatile fluctuations in the major currency pair. EUR/USD is increasingly being shaped by geography. During the European session, falling stock indices in the Eurozone weighed on the euro. Then comes the U.S. session, and the S&P 500 plunges, putting pressure on the dollar.

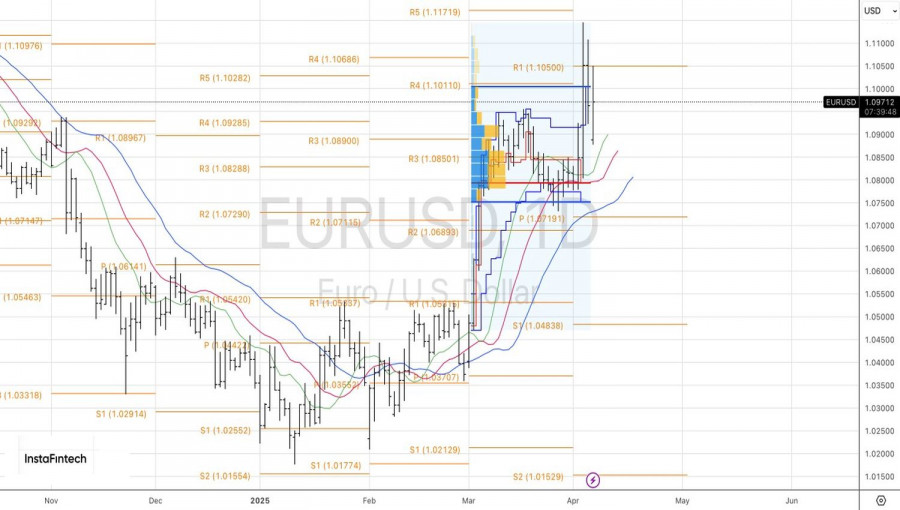

Technically, on the daily chart of EUR/USD, the battle over the upper boundary of the fair value range (1.076–1.100) continues. This level has shifted control multiple times between bullish and bearish investors. Traders might adopt a coyote's strategy: wait and see which lion loses, then side with the winner. A sustained move above $1.100 is a signal to buy—and vice versa.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Embora os mercados continuem focados nas guerras comerciais, principalmente entre os EUA e a China, os dados econômicos mais recentes indicam problemas estruturais persistentes nas economias avançadas da Europa

Poucos eventos macroeconômicos estão programados para esta quinta-feira, mas os acontecimentos de ontem deixaram claro que o mercado continua a ignorar a maioria dos dados divulgados. Apenas alguns relatórios

InstaForex em números

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.