USDSGD (US Dollar vs Singapore Dollar). Exchange rate and online charts.

Currency converter

18 Jun 2025 01:58

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

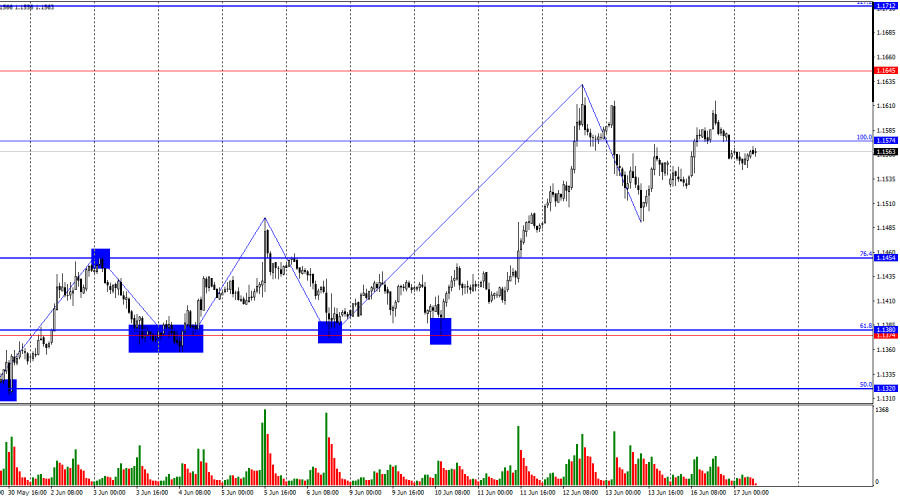

USD/SGD (United States Dollar vs Singapore Dollar)

USD/SGD is involved in active trading on Forex. This currency pair is also called exotic. Rate fluctuations of this trading instrument are not significant. The Singapore dollar is one of the most stable currencies around the world. The economic situation in the country is characterized by very low inflation, robust exports, and huge foreign exchange reserves in the economy.

Singapore is a developed nation with high living standards. Advantageously located at the crossroads of major shipping routes, Singapore has managed to reach such level of development demonstrating an active trading with world's largest economies. At the moment, the country sells abroad home electronics and information technology products, shipbuilding products and financial services. Thus, country's economy and national currency both hinge upon export significantly.

Singapore is listed among the group of so-called "Asian tigers" thanks to the rapid development of its economy. In such a way, the country is approaching to the major Western economies such as the USA, Germany, France, Great Britain, etc.

If you trade USD/SGD, you should pay attention to the dynamics of EUR/USD, GBP/USD, and USD/JPY. These trading instruments are indicators of USD/SGD price movements since they greatly influence the rate of the national currency of Singapore.

If you trade USD/SGD, you should focus on economic indicators of Singapore as well as the global prices for oil and other minerals required to support the Singaporean economy.

See Also

- Technical analysis / Video analytics

Forex forecast 17/06/2025: EUR/USD, USD/JPY, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, USD/JPY, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

10:46 2025-06-17 UTC+2

4573

Bears still can't find supportAuthor: Samir Klishi

12:00 2025-06-17 UTC+2

1603

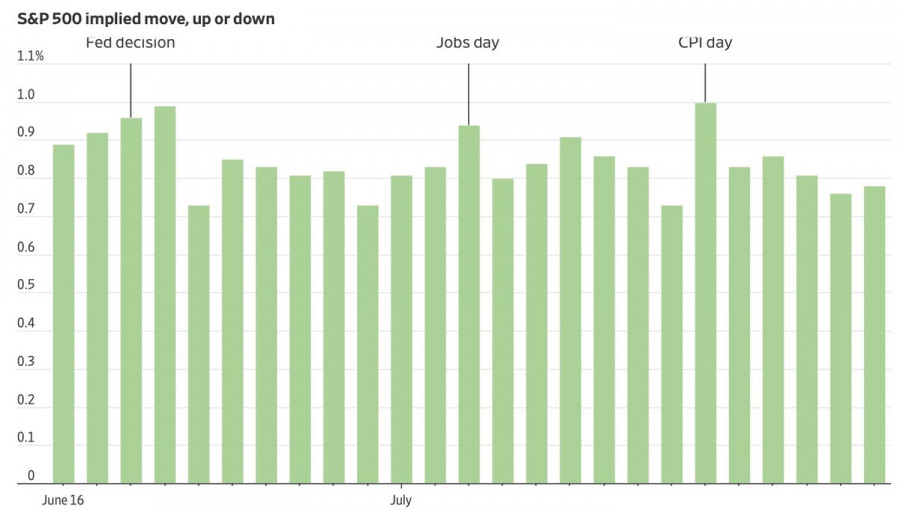

How the US stock market is trading ahead of the Federal Reserve's policy meetingAuthor: Jozef Kovach

10:45 2025-06-17 UTC+2

1438

- The Kiwi Doesn't Give Up Despite New Zealand's Weak Economy

Author: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1333

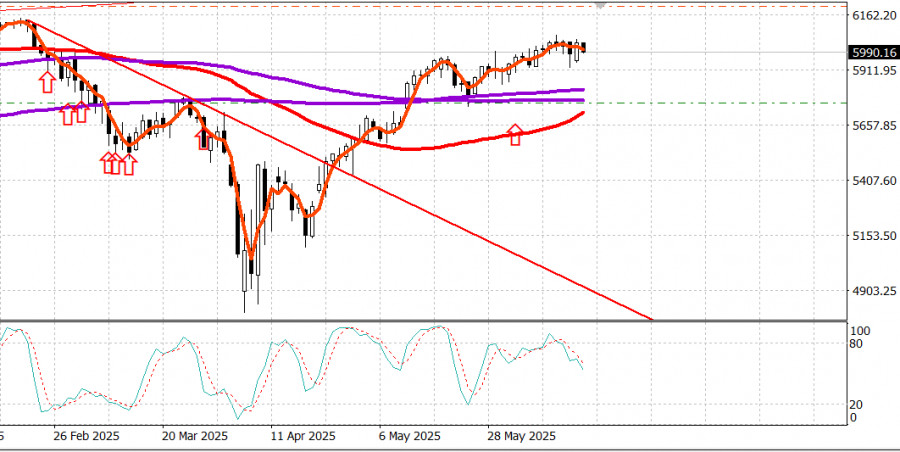

The overconfidence of dip buyers poses serious risks for S&P 500 bullsAuthor: Marek Petkovich

11:07 2025-06-17 UTC+2

1183

The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappointAuthor: Natalya Andreeva

13:27 2025-06-17 UTC+2

1138

- Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500

Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1093

Stock Market on May 17th: S&P 500 and NASDAQAuthor: Jakub Novak

11:56 2025-06-17 UTC+2

1078

JPMorgan Chase & Co. is planning to launch its own stablecoinAuthor: Jakub Novak

11:25 2025-06-17 UTC+2

1063

- Technical analysis / Video analytics

Forex forecast 17/06/2025: EUR/USD, USD/JPY, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, USD/JPY, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

10:46 2025-06-17 UTC+2

4573

- Bears still can't find support

Author: Samir Klishi

12:00 2025-06-17 UTC+2

1603

- How the US stock market is trading ahead of the Federal Reserve's policy meeting

Author: Jozef Kovach

10:45 2025-06-17 UTC+2

1438

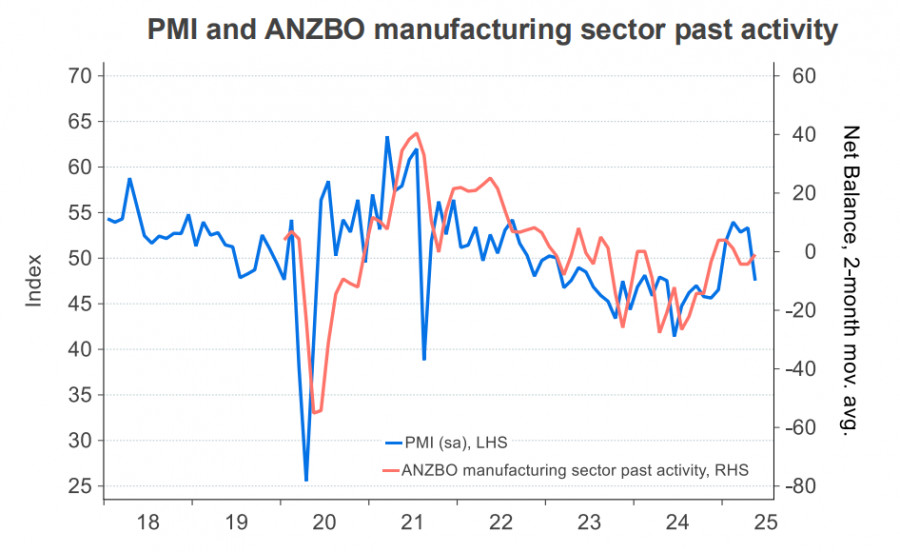

- The Kiwi Doesn't Give Up Despite New Zealand's Weak Economy

Author: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1333

- The overconfidence of dip buyers poses serious risks for S&P 500 bulls

Author: Marek Petkovich

11:07 2025-06-17 UTC+2

1183

- The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappoint

Author: Natalya Andreeva

13:27 2025-06-17 UTC+2

1138

- Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500

Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1093

- Stock Market on May 17th: S&P 500 and NASDAQ

Author: Jakub Novak

11:56 2025-06-17 UTC+2

1078

- JPMorgan Chase & Co. is planning to launch its own stablecoin

Author: Jakub Novak

11:25 2025-06-17 UTC+2

1063