Vea también

21.02.2025 10:52 AM

21.02.2025 10:52 AMWave analysis suggests limited upside potential

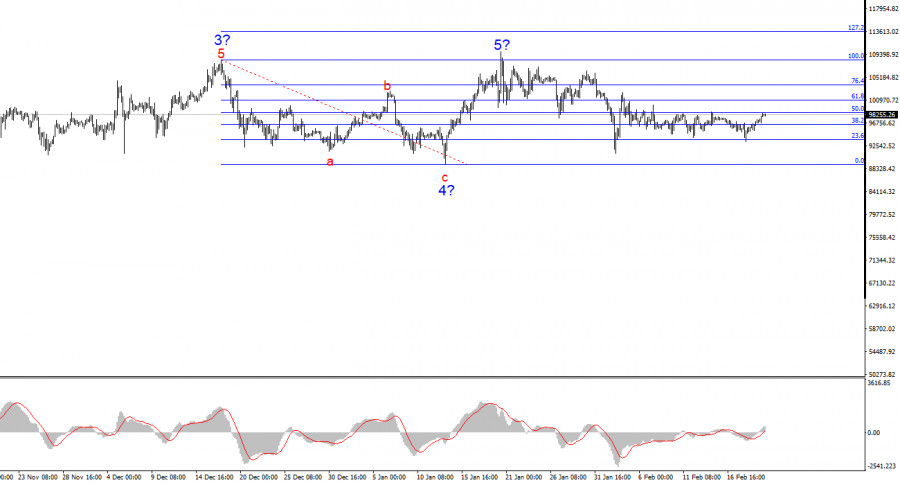

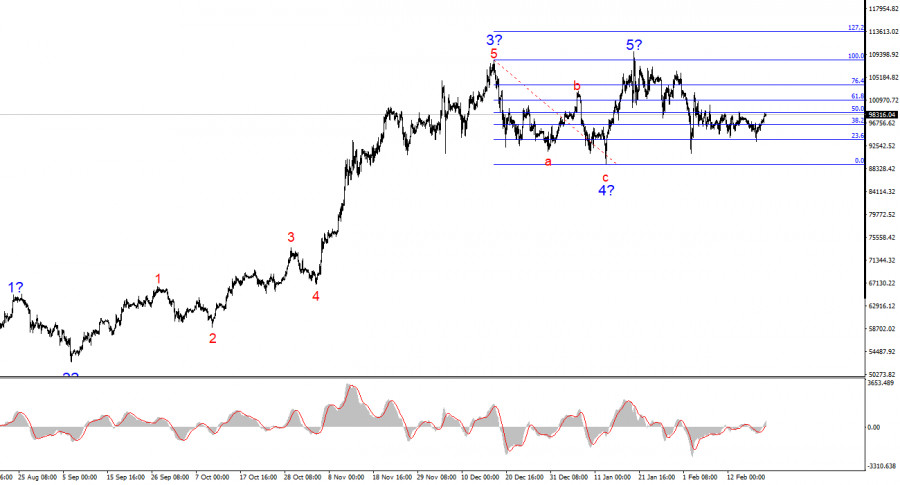

The 4-hour wave structure for BTC/USD appears clear and well-defined. Following a lengthy and complex a-b-c-d-e corrective structure that formed between March 14 and August 5, a new impulsive wave began to take shape, developing into a five-wave pattern. Judging by the size of the first wave, the fifth wave appears to be cropped. Based on this, I do not expect Bitcoin to rise above $110,000–$115,000 in the coming months.

Additionally, wave 4 consists of three elements, confirming the validity of the current wave count. The news cycle has supported Bitcoin's growth, fueled by ongoing institutional investments from hedge funds, governments, and pension funds. However, Trump's policies could prompt investors to exit the market, and trends cannot always be bullish. The wave that started on January 20 does not resemble an initial impulse wave, suggesting we are dealing with a complex corrective structure that could take months to develop in full.

Bitcoin remains trapped in a narrow range

The BTC/USD price has remained nearly stagnant throughout the week. While minor fluctuations are occurring, this is far from the market activity most traders had hoped for. Bitcoin continues its slow decline toward the wave 4 low.

For the past two weeks, BTC has traded within $93,600–$98,600, corresponding to 23.6% and 50.0% Fibonacci retracement levels from wave 4. Since December 17, Bitcoin has been ranging between $91,400 and $108,300, forming two overlapping sideways channels—further emphasizing the need for a pause in Bitcoin trading.

A breakout from the smaller range could trigger a move toward the peak of the presumed Wave 5, but Bitcoin must first escape this horizontal corridor.

Lack of market drivers keeps BTC in consolidation

Currently, the information environment is weak—not only in the forex market but also in crypto. Bitcoin's major movement occurred in the second half of last year, when the Federal Reserve began aggressively easing monetary policy. Now, the market has already priced in that factor, while Donald Trump's foreign policy seems to have little impact on BTC's price.

Although Trump has announced pro-crypto measures, history suggests that their implementation could take a long time—if they materialize at all. The US President continues to make contradictory statements, and the market is wary of taking his words at face value.

As a result, traders are ignoring Trump's promises regarding crypto industry development and the potential creation of a national Bitcoin reserve. Instead, the Republican leader appears more focused on his own cryptocurrency, TRUMP, than on BTC, reserves, or regulations.

Based on my wave analysis of Bitcoin, I conclude that its bullish trend is nearing its end—or has already ended. This may not be a popular opinion, but the fifth wave appears shorter than usual. If this assumption holds, Bitcoin is heading for either a sharp drop or a prolonged correction—with the latter being the more likely scenario.

For this reason, I do not recommend buying Bitcoin at this time. If BTC falls below the wave 4 low, it would confirm the transition into a new downward trend phase.

On a higher time frame, we can observe a completed five-wave bullish structure. This suggests that a corrective downward structure or a new bearish trend may soon begin to take shape.

Key principles of my analysis:

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El Bitcoin no mostró ningún movimiento interesante ni el sábado ni el domingo. Sin embargo, el viernes el precio retiró liquidez del último Lower High. Recordemos que la retirada

El Ethereum apenas logró recuperarse hasta el FVG más cercano y durante dos semanas no pudo seguir subiendo. Sin embargo, el Bitcoin finalmente arrastró hacia arriba a su "hermano menor"

El Bitcoin continuó su movimiento ascendente el martes, lo que generó muchas preguntas. Sin embargo, recordemos que el análisis técnico no puede proporcionar señales con una precisión del 100% todo

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.