Vea también

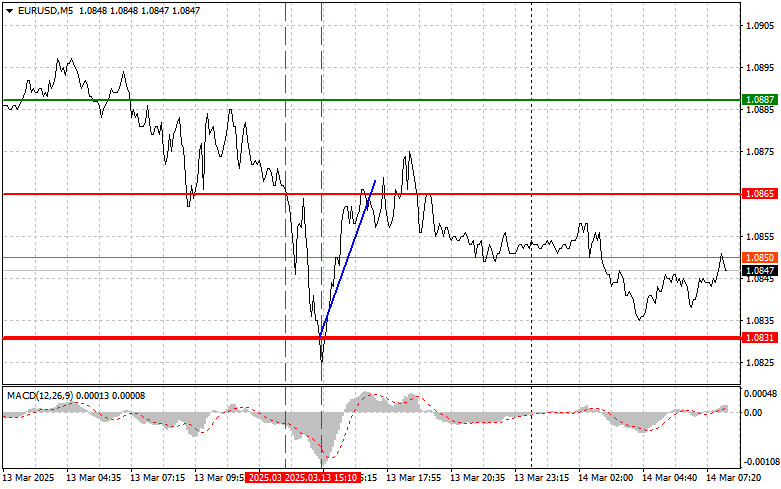

The price test at 1.0865 occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downside potential in my opinion. For this reason, I chose not to sell the euro. After the decline—which I ultimately missed—an excellent buying opportunity emerged at the rebound from 1.0831, as I noted in yesterday's forecast. Consequently, the pair recovered by more than 30 pips.

The U.S. dollar showed little volatility following the release of the producer price index data, which indicated no changes despite expectations of significant growth. The market likely had already priced in expectations of a tighter Federal Reserve policy, so the neutral data did not come as a surprise.

Negative economic trends in key Eurozone countries pose risks to the euro's stability. Today's inflation data from Germany and France, reflected in the consumer price indices, may exceed target levels, increasing pressure on the European Central Bank to tighten monetary policy. At the same time, a decline in industrial production in Italy signals economic weakness, which could have a negative impact on the entire Eurozone. As a result, the ECB faces the challenging task of balancing inflation control with the need to stimulate economic growth.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

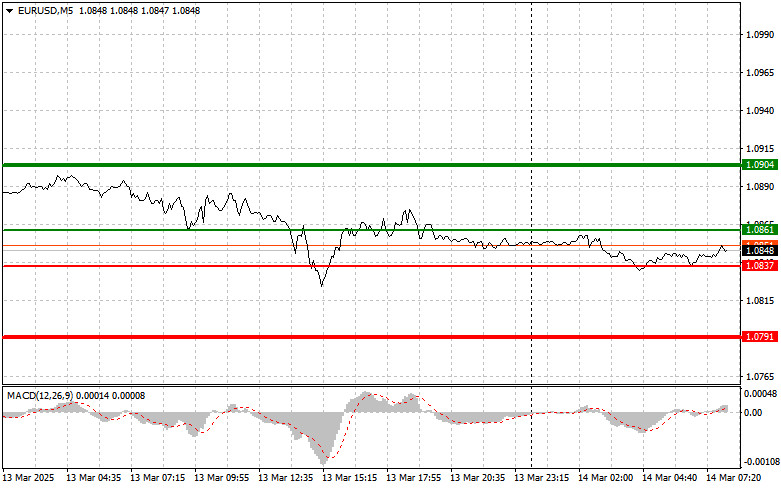

Scenario #1: Buying the euro is possible if the price reaches the 1.0861 level (green line on the chart), with a target of 1.0904. At 1.0904, I plan to exit the market and sell the euro in the opposite direction, aiming for a movement of 30-35 pips from the entry point. Expecting euro growth in the first half of the day is reasonable if positive Eurozone data supports the ongoing upward trend. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro if the price tests 1.0837 twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger a reversal to the upside. Growth toward the 1.0861 and 1.0904 levels can be expected.

Scenario #1: I plan to sell the euro if it reaches the 1.0837 level (red line on the chart), targeting 1.0791. At this level, I will exit the market and buy immediately in the opposite direction, expecting a 20-25-pips move upward. Pressure on the pair will return if Eurozone data disappoints. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro if the price tests 1.0861 twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A decline toward 1.0837 and 1.0791 can be expected.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.