Vea también

25.03.2025 07:09 PM

25.03.2025 07:09 PMThe USD/JPY pair is retreating from the psychological level of 151.00, reached earlier on Tuesday, though this pullback is not accompanied by significant selling pressure. The Japanese yen is attracting buyers amid hawkish comments from the Bank of Japan, despite disappointing PMI data from Japan.

According to the minutes of the Bank of Japan's January meeting, the need for further monetary tightening remains if positive economic prospects continue. BoJ Governor Kazuo Ueda emphasized that the goal is to achieve stable prices and that the bank is ready to adjust its policy if inflation reaches the 2% target. This fuels expectations that rising wages will impact inflation, supporting the case for higher interest rates.

However, hopes for less damaging U.S. trade tariffs, a peace agreement between Russia and Ukraine, and stimulus measures in China are holding traders back from aggressively betting on a stronger yen. Meanwhile, the U.S. dollar maintains its strength, supported by positive PMI data from the U.S., which also helps keep the USD/JPY pair elevated.

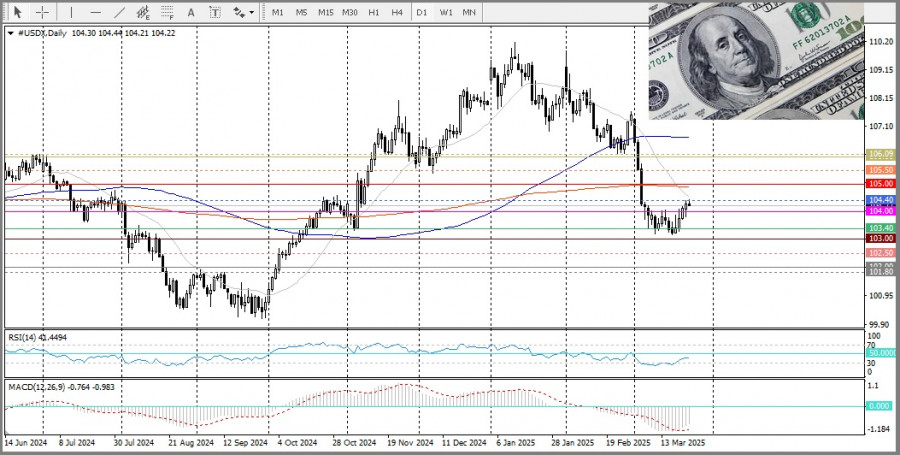

From a technical perspective, the breakout above the 150.00 level — coinciding with the 200-period Simple Moving Average (SMA) on the 4-hour chart — is seen as an important bullish signal.

A positive Relative Strength Index (RSI) on the daily chart supports the outlook for further gains. Pullbacks are likely to be viewed as buying opportunities, remaining limited by the psychological support at 150.00. However, a break below this level could open the path to support zones at 149.30–149.25 and lower. Failure to defend the 148.60 level would shift the short-term bias in favor of the bears.

If bullish traders can hold above 151.00, this may lead to a test of the monthly high around 151.30, followed by a move toward the 200-day SMA near 151.75, and then to the psychological level of 152.00. The rally could extend to intermediate resistance at 152.30 en route to the round level of 153.00.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

El par de divisas GBP/USD continuó su crecimiento el miércoles, que había comenzado el martes. Recordemos que el martes el mercado no tenía ninguna razón de peso para deshacerse masivamente

El par de divisas EUR/USD continuó su recuperación durante el miércoles en un contexto de calendario macroeconómico absolutamente vacío. Ni siquiera destacamos el único informe del día sobre la inflación

El lunes, la moneda estadounidense se fortaleció considerablemente tras el éxito en la primera ronda de negociaciones entre EE. UU. y China, aunque, en esencia, ambas partes solo acordaron

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.