Vea también

07.04.2025 03:23 AM

07.04.2025 03:23 AMThe EUR/USD currency pair lost over 300 pips on Wednesday and Thursday, but Friday brought a strong recovery. No one would have been surprised if the dollar had continued falling on Friday. The market continues to react selectively to news, events and reports favoring the dollar, and Friday's macroeconomic data from the U.S. was somewhat mixed. On the one hand, the number of NonFarm Payrolls was significantly above expectations, but on the other hand, the unemployment rate rose to 4.2%, which no one had forecast.

In general, the market remains in turmoil. Given the abundance of recent events — some highly significant — it's extremely difficult to determine what the market has already priced in, what it's still processing, and what currently matters. Making any forecast at this moment is a challenging and unappreciated task. As expected, Trump introduced new tariffs on April 2, and over the weekend, he added another one — on all imported beer. The U.S. president is not planning to stop. Many experts now say that Trump is going "all in." Either he will radically reshape the global trade system in favor of the U.S., or he will face complete failure — and the blame, he says, will lie with other countries or Jerome Powell.

Speaking of Powell, on Friday, he again stated that the Federal Reserve does not plan to cut rates anytime soon, as it will take considerable time to assess the impact of tariffs on the economy. The Fed Chair also noted that Trump's tariffs will undoubtedly lead to higher inflation (which makes rate cuts even less appropriate) and a rise in unemployment. Powell once again emphasized that the Fed's primary goal is price stability. In our view, this was the strongest possible message to Trump.

Effectively, the Fed Chair clarified that the central bank is not concerned with the president's initiatives. If Trump wants to impose tariffs on the entire world based on his vision of order, he is free to do so. But why should the Fed — an independent body — be responsible for mitigating the consequences of these actions? If the U.S. economy starts slowing sharply, it will be clear who is accountable. If the Fed begins stimulating the economy by cutting rates, inflation will rise even further, and the central bank will fail to achieve its targets. If inflation is high, the Fed gets blamed; if the economy contracts, the president and government are at fault. In this way, Powell once again drew a clear line of responsibility. We'll see how American consumers react to the sharp rise in import prices. Protests against Trump are already being planned across the country.

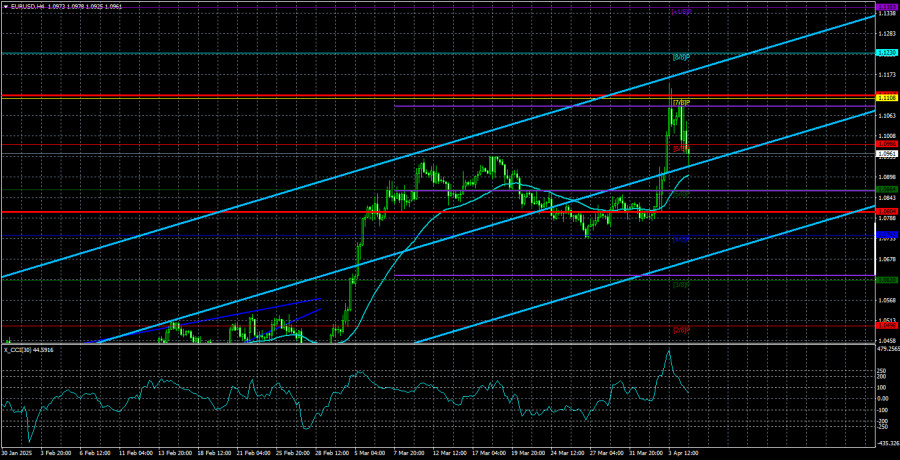

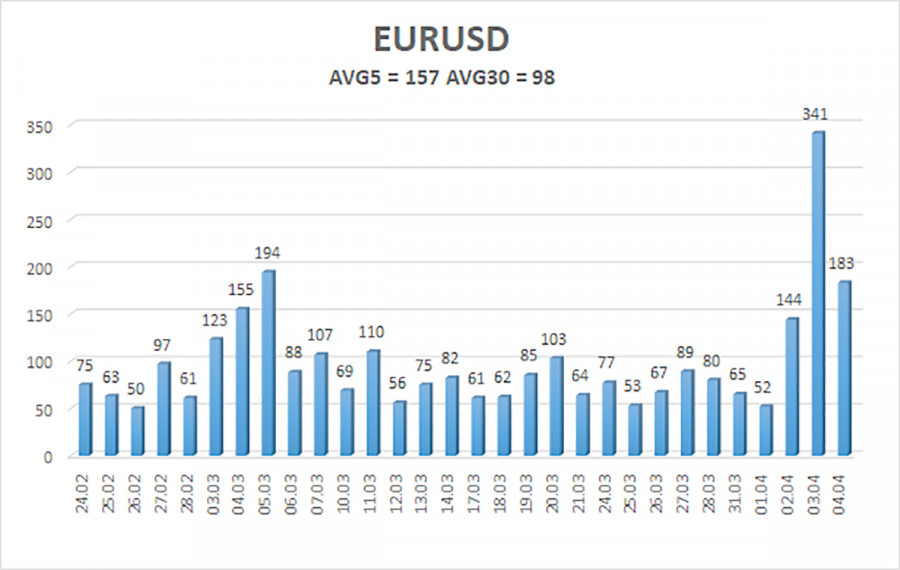

The average volatility of the EUR/USD pair over the past five trading days as of April 7 stands at 157 pips, which is considered "high." We expect the pair to move between the levels of 1.0804 and 1.1118 on Monday. The long-term regression channel is pointing upward, indicating a short-term bullish trend. The CCI indicator entered the overbought zone, signaling a possible correction, but the trend remains bullish for now.

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

EUR/USD continues its upward movement, which is now becoming a trend. For months, we've been saying we expect the euro to decline in the medium term, and so far, that outlook hasn't changed. The dollar still has no reason for a medium-term decline — except for Donald Trump. Yet that single factor continues to drive the dollar into the abyss. This situation is unprecedented and quite rare for the FX market. Short positions remain attractive, with targets at 1.0315 and 1.0254, but it's currently very difficult to predict when the Trump-driven rally will end or how many more tariffs and sanctions the U.S. president will impose. If you trade purely on technicals, long positions can be considered as long as the price remains above the moving average, with targets at 1.1108 and 1.1230.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par GBP/USD se corrigió ligeramente a la baja después de subir el lunes sin motivo aparente. Sin embargo, llamar a este movimiento mínimo hacia abajo un «crecimiento del dólar»

El par de divisas GBP/USD también se negoció el lunes con baja volatilidad y prácticamente en una dirección lateral, aunque la libra esterlina mantiene una ligera inclinación alcista. A pesar

El par de divisas GBP/USD el viernes también se negoció con baja volatilidad y sin ningún entusiasmo. Sin embargo, la libra esterlina todavía mantiene una ligera inclinación alcista

El par de divisas EUR/USD el jueves continuó negociándose de manera bastante tranquila, aunque la volatilidad sigue siendo bastante alta. El dólar estadounidense mostró esta semana al menos alguna recuperación

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.